Summary

- DocuSign has dropped 50% from recent highs after a disastrous earnings report.

- Growth is projected to slow down considerably with significant sequential deceleration.

- The company still maintains solid net retention rates and free cash flow generation.

- I rate shares a buy on account of the lower risk story.

DocuSign (DOCU) has shown investors the importance of factoring in valuation in their analysis. While DOCU benefits from an easy to understand story, strong net retention rates, and solid free cash flow generation, the stock was trading far too richly heading into the latest earnings, and was subsequently punished. The pullback has made the stock much more attractive, and I see upside assuming the stock can once again be rewarded for its lower risk profile in the tech sector. I rate shares a buy with 23% upside over the next 12 months.

DocuSign Stock Price

DOCU joined the ranks of many pandemic winners in becoming post-pandemic losers. The stock collapsed after its latest earnings call.

The stock is now trading at the same levels it did 1.5 years ago, in spite of strong growth during that time.

Why Did DocuSign Stock Drop?

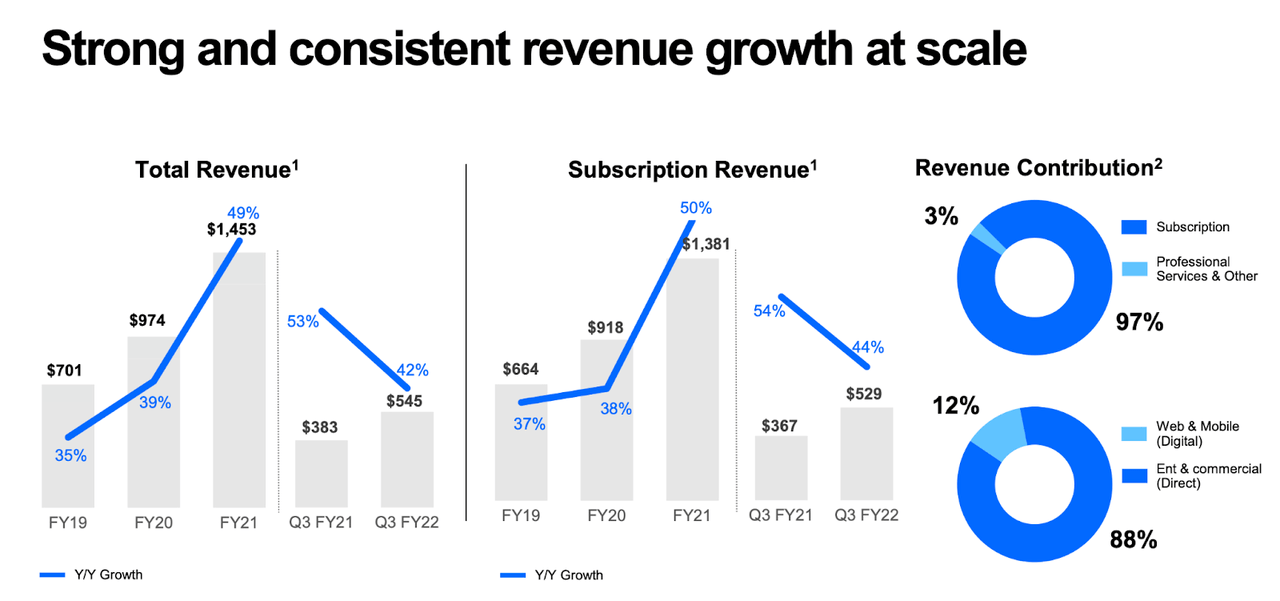

As just stated, DOCU dropped after the latest earnings release. Growth was solid with subscription revenues growing 44%.

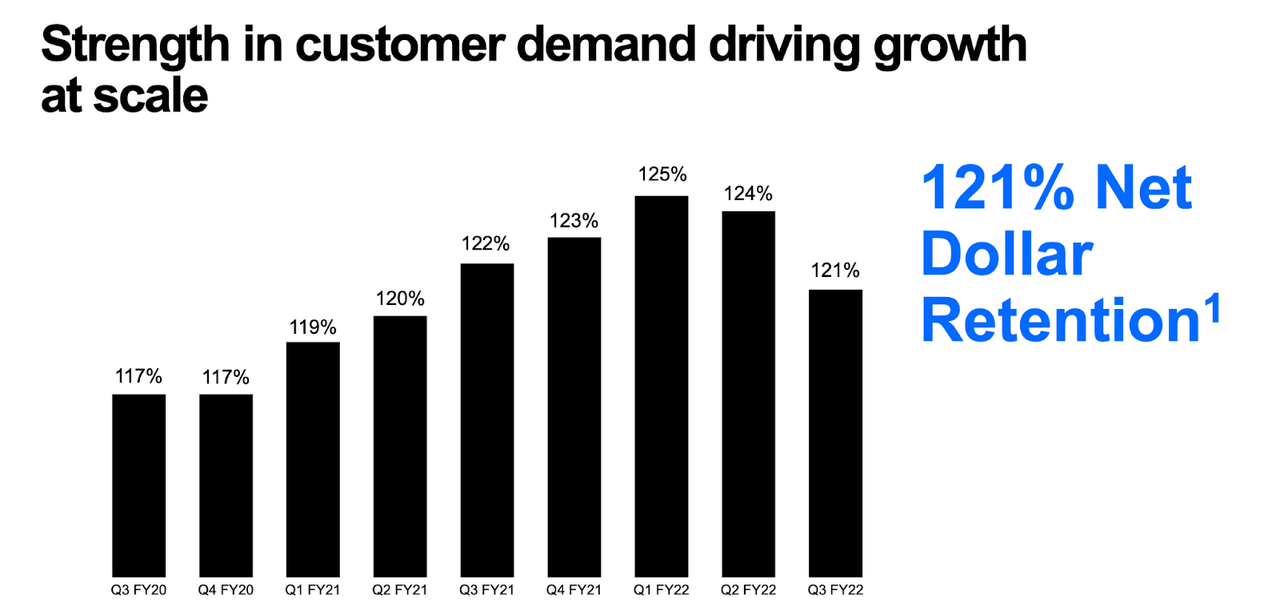

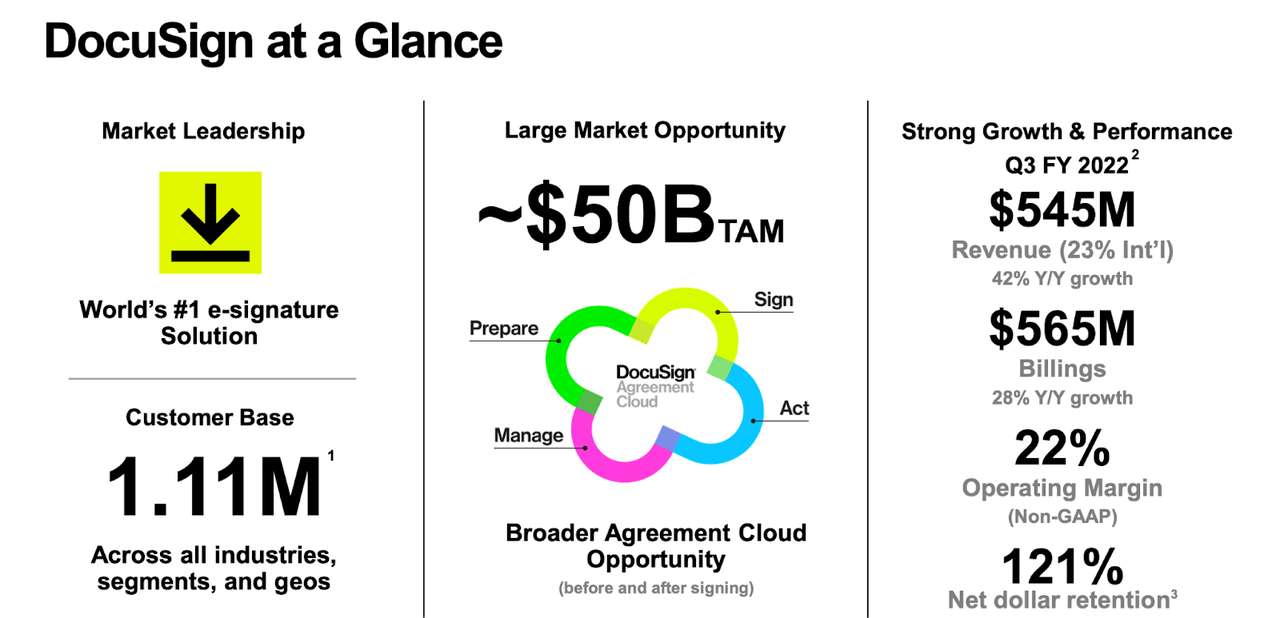

Much of that growth was driven by the strong 121% net dollar retention rate.

These aren’t bad results, even at the prices just before the crash.

The problem was instead the guidance. DOCU guided for the next quarter to see up to $550 million in subscription revenue, representing only 34% year over year growth and only 4% sequential growth. Considering that DOCU was trading near 30x sales prior to the crash, it is not surprising that the stock fell after this projected growth rate, as it would be unusual for a stock to trade at 30x sales with 30% projected growth.

Is DOCU Stock Undervalued?

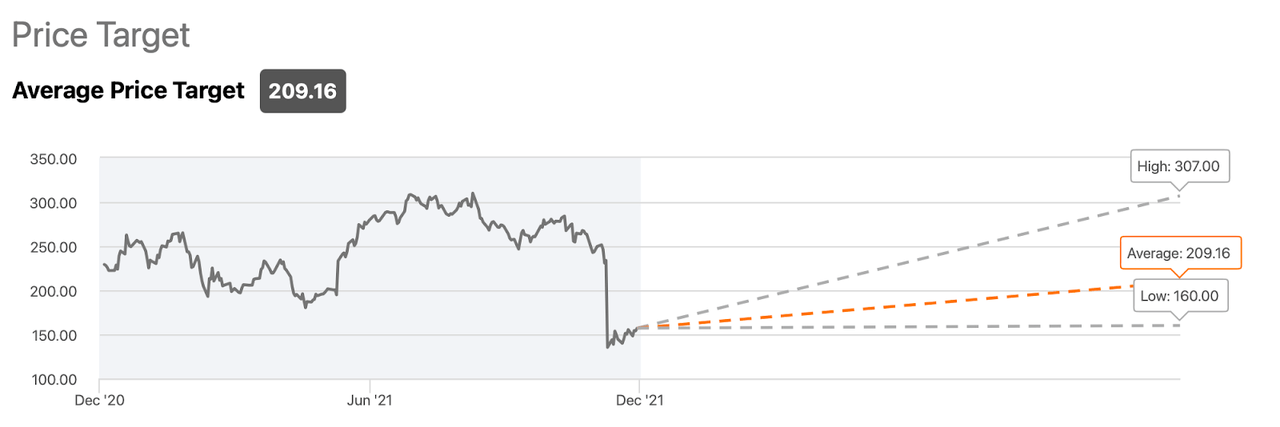

After the fall, Wall Street analysts rushed to cut their target prices. Yet in spite of the price cuts, DOCU remains undervalued relative to the average price target of $209 per share.

Is DOCU Stock Expected To Rise Again?

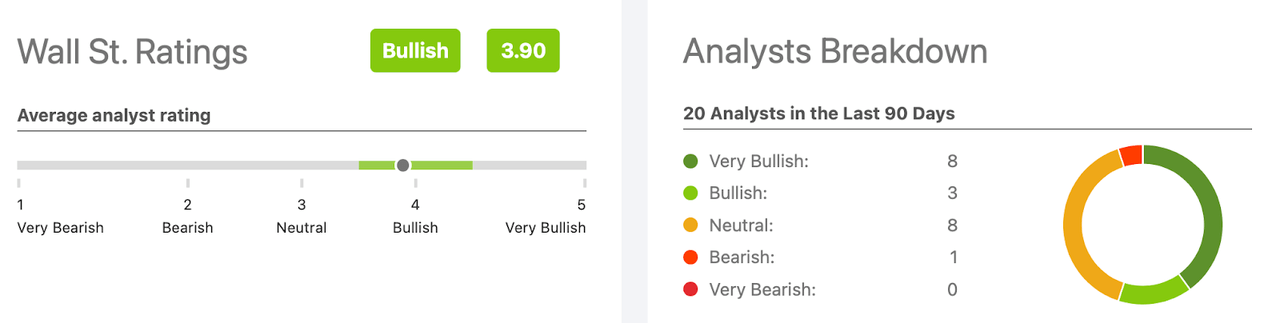

While DOCU lost a lot of its bullish support, analysts in general remain bullish with an average rating of 3.9 out of 5.

Sure, the optimism has waned, but the stock price appears to have priced in the more humble outlook.

What is DocuSign Stock's Outlook?

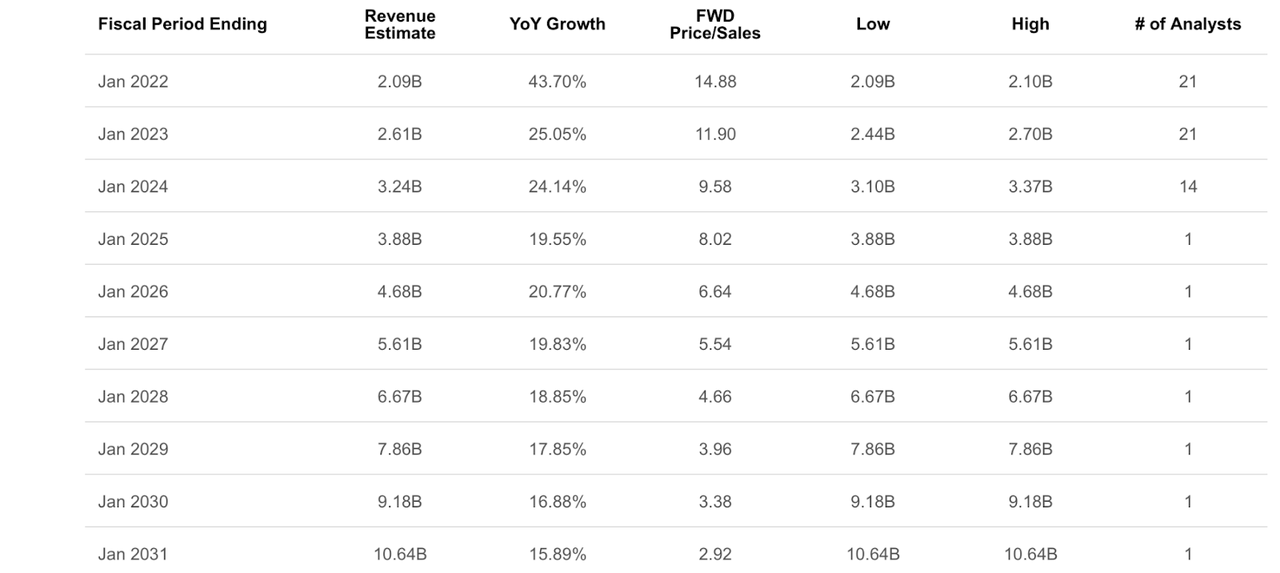

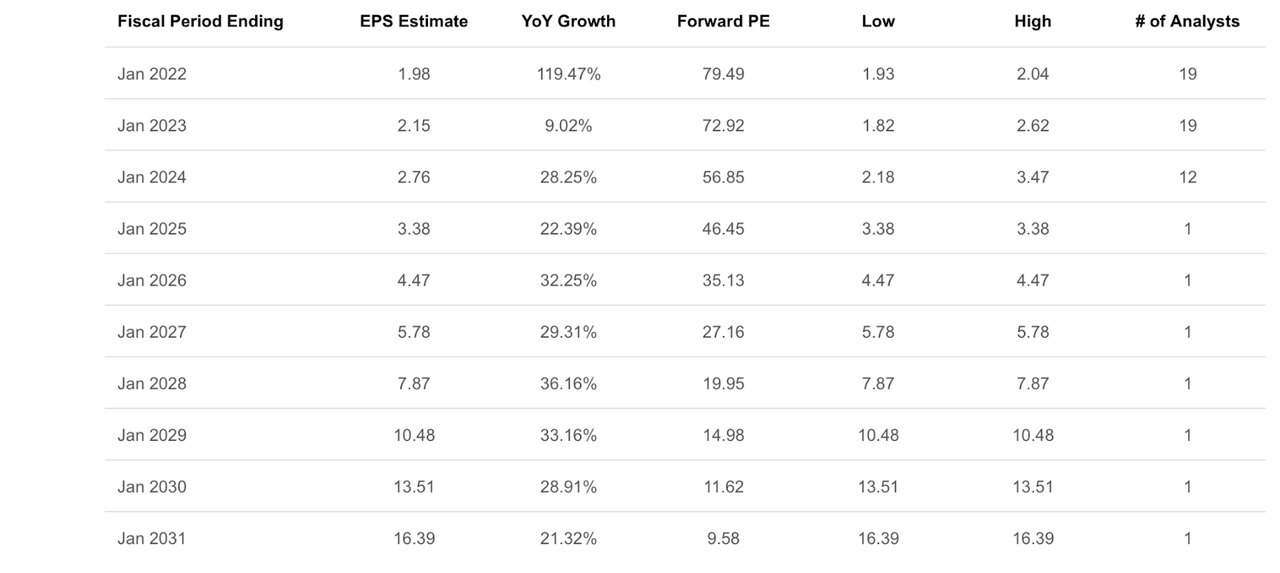

Looking forward, analysts expect growth to decelerate to 25% next year before hovering around 20% for the rest of the decade.

That kind of growth rate looks reasonable considering the inevitable thesis of e-signatures. Analysts expect DOCU to achieve a 30% net margin in a decade, as operating leverage takes hold.

Is DOCU Stock A Buy, Sell, or Hold?

At current prices, DOCU trades at 79x earnings and 15x sales. Are these multiples reasonable? It is important to remember that DOCU is the leader in the e-signature market, which has a $50 billion estimated total addressable market.

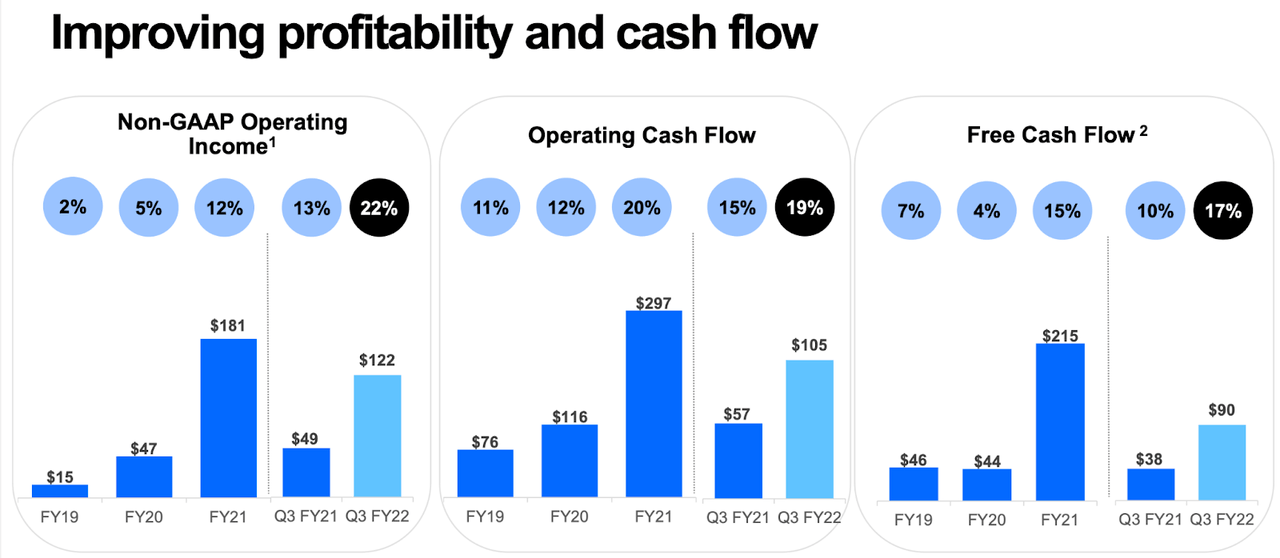

DOCU has penetrated around 4% of that market, suggesting much more room to grow. In discussing valuation, we must also note that DOCU has historically generated strong profitability, with non-GAAP operating margin at 22% and free cash flow margin at 17% as of the latest quarter.

Sure, these metrics exclude stock-based compensation, which might not impact cash flow but does dilute shareholders. At the same time, strong non-GAAP profitability may be an indication of strong GAAP profitability in the future. For this reason, the stock deserves to trade at some premium to peers of similar growth rates. I typically would want to see a valuation of around 10x price to sales for a company growing at a 25% clip, but DOCU has earned the premium due to the strong net retention rate, solid profitability, and easy to understand growth story.

If I assume long term net margins of 40%, then the stock is currently trading at a 0.5x price to earnings growth ratio (‘PEG’) based on 2030 estimates. I view a 2x PEG ratio to be more appropriate due to the lower risk story. That suggests 4x upside over the next nine years, for an annualized return of 16%. Incidentally, this would leave DOCU trading at 38x earnings in 2030, which appears reasonable for the projected growth rate.

Risks to the thesis include competition, as I admit that it is not obviously clear how important price competition is in the e-signature market. Perhaps DOCU can achieve benefits from the network effect, similar to that seen as PayPal (PYPL) or Shopify (SHOP), but my personal experience with DOCU (as a signer) has not shown this to be the case.

DOCU’s strong profit margins should enable it to invest more aggressively than competitors, but investors should watch out for deterioration in the net retention rate. While DOCU might not offer as much upside as alternatives in the sector, the lower risk profile makes it an attractive risk-reward proposition in its own right. I rate shares a buy with 23% upside to a 1.5x PEG ratio.

精彩评论