One of the more important developments in the retail sector during August was the spotlight thrown on consumer spending trends with Delta COVID variant headlines disrupting the presumed story of a huge summer spending surge at malls, off-price retailers, big box retailers and specialty retailers. For the most part, retailers continue to report strong sales even as inflation pressures start to become more painful and threaten back-half profit expectations.

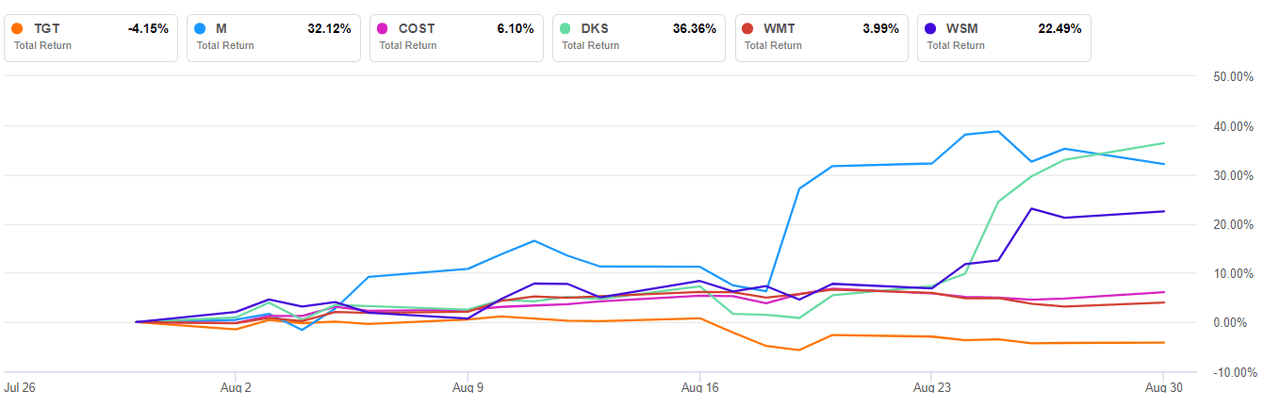

The biggest August gainers in the retail store sector were Dick's Sporting Goods(NYSE:DKS) +36%, Macy's(NYSE:M) +32%, Express(NYSE:EXPR) +26%, Signet Jewelers(NYSE:SIG) +24% and Williams-Sonoma(NYSE:WSM) +22%. Victoria's Secret(NYSE:VSCO)burst on the scene with a 40% rally during August, while Gap(NYSE:GPS)was a mall sector disappointment with an 8.3% drop for the month. Walmart(NYSE:WMT) +3.6% and Costco(NASDAQ:COST) +6.2% were August winners, while Target(NYSE:TGT)gave back some its huge YTD gain with a 4.2% decline. There were also monthly losses for Dollar Tree(NASDAQ:DLTR) -8.9%, Dollar General(NYSE:DG) -3.1% and Big Lots(NYSE:BIG) -11.0% as stimulus faded and inflation cut into margins on lower-priced items. Interestingly, the increased bets by investors on strong back-to-school and back-to-work spending did not slow momentum for online retailers like Wayfair(NYSE:W) +21% and Etsy(NASDAQ:ETSY) +18%.

The SPDR S&P Retail ETF(NYSEARCA:XRT)scratched out a 1.1% gain for the month.

Looking ahead to September, Wells Fargo warns that the drumbeat of supply chain challenges is getting louder, which creates a tricky setup for the retail sector. Other research firms are also warning that freights and labor costs could increase again this month for major retail chains.

Higher freight costs were called out on a number of Q2 earnings calls (Dollar Tree transcript,Burlington Stores transcript,Big Lots transcript) with a warning that Q3 could see more of the same.

Looking for a sector sleeper? There is amall stock with a Seeking Alpha Quant Rating above the retail pack and in the top 5% of all stocks tracked.

精彩评论