Try justifying GameStop’s valuation

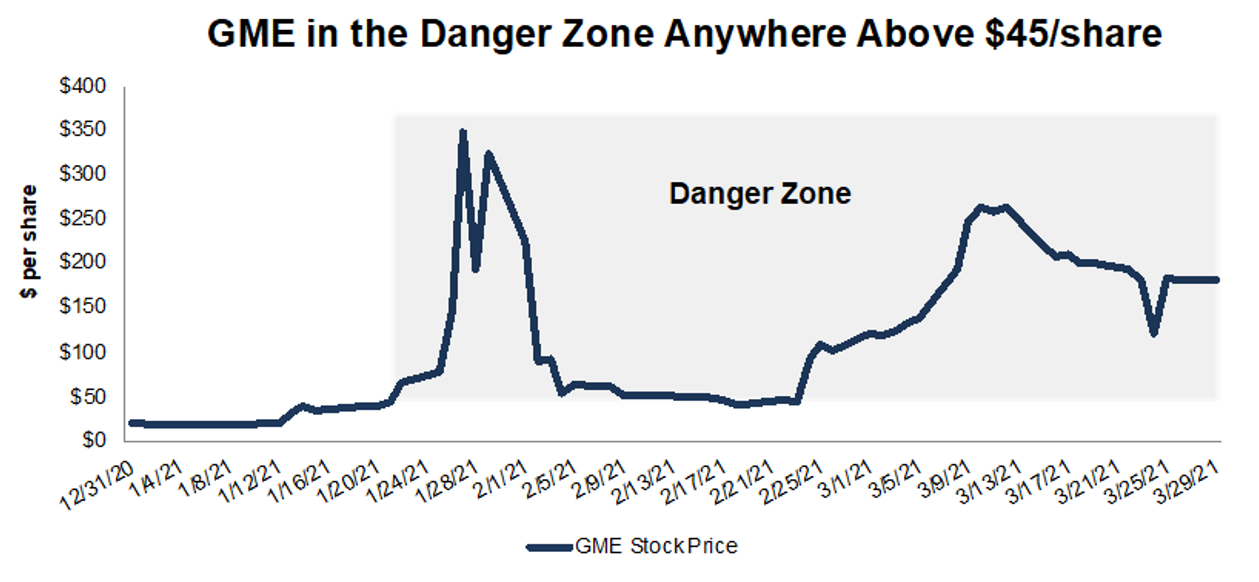

GameStop was not worth owning anywhere above $45 a share, given the company’s fundamentals, as explained when we closed our Focus List: Long positionin the stock in late January.

Nevertheless, the stock went on to climb as high as $347, even higher intraday, before taking a roller coaster path back to around $185.

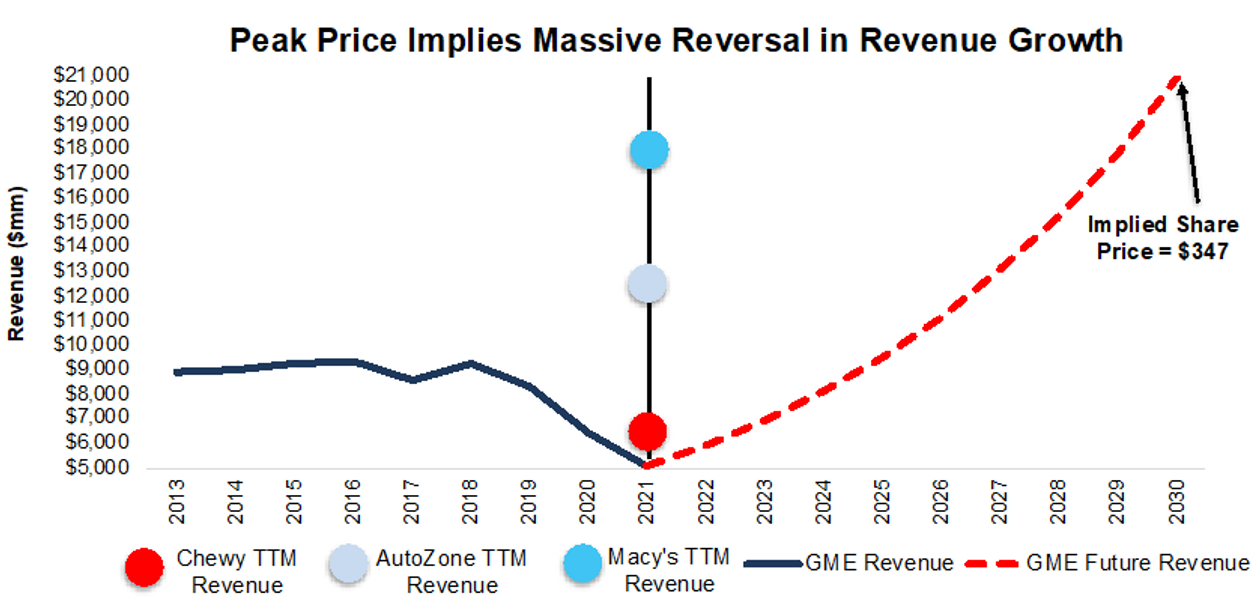

To give readers a sense of just how crazy overvalued the stock was at its peak, we do the math and show how the business would have to perform to justify a share price of $347.

undefined Crazy” at $347 explained: It implies more revenue than Macy’s

To justify $347 a share, our reverse discounted cash flow (DCF) model shows that GameStop must:

- improve its profit margin to 5.5% (10-year average from 2010-19 is 3.9% and the all-time high was 4.8% in 2008) and

- grow revenue by 17% compounded annually through 2030 (above the projected video game industry CAGR of 13% through 2027)

In this scenario, GameStop earns nearly $21 billion in revenue in 2030 or more than the trailing-12-months (TTM) revenue of Macy’s,AutoZone and Chewy.

GameStop’s historical revenue vs. DCF implied revenue: Scenario 1

For reference, GameStop’s revenue fell by 3% compounded annually from 2009 to 2019.

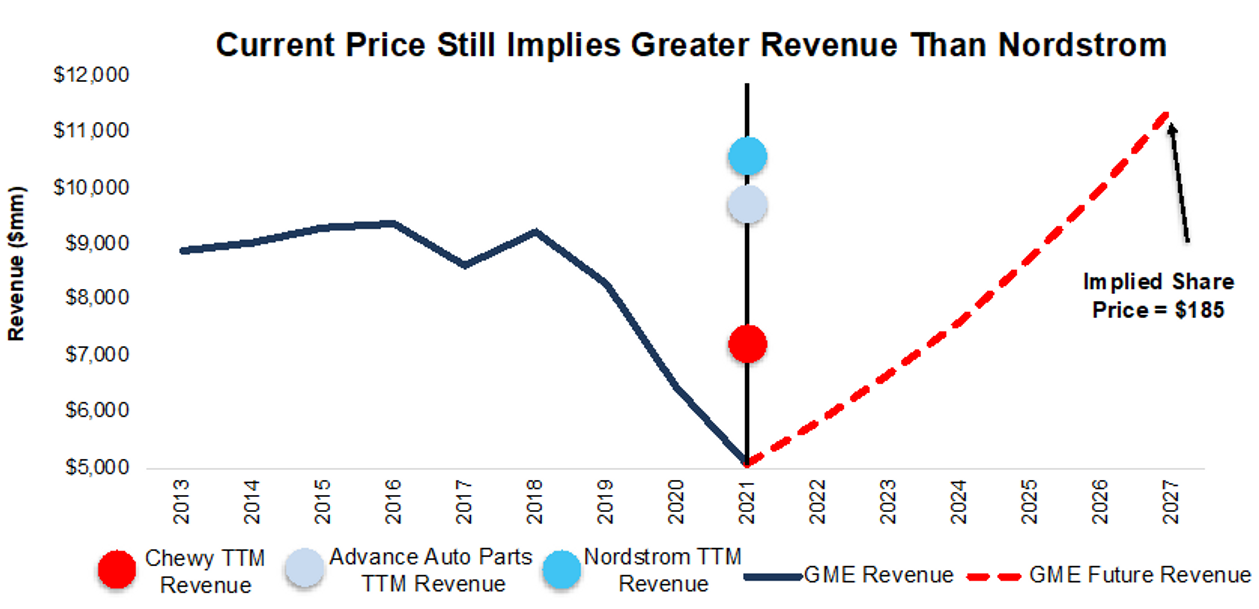

Still Crazy at $185

For perspective on the current price, we run the same analysis to show what the company must do to justify $185 a share:

- immediately improve its profit margin to 4.8% (all-time high in 2008 compared with 0.7% in 2019) and

- grow revenue by 15% compounded annually through 2027 (above projected videogame industry CAGR of 13% through 2027)

In this scenario, GameStop earns over $11 billion in revenue in 2027, which is 19% higher than GameStop’s record revenue of $9.6 billion in 2012 and the TTM revenue of Nordstrom,Advance Auto Parts and Chewy.

GameStop’s historical revenue vs. DCF implied revenue: Scenario 2

Sure, stock prices can be irrational

We are not saying that fundamentals should be 100% of your investing process. We only aim to add insight into the fundamental risk of owning stocks at different prices.

We’re not saying that you will not make lots of money trading stocks. You might. Our aim is to provide some fundamental perspective to inform and complement other investment strategies. In other words, if you have 10 great technical ideas, you might like to overweight those with the best fundamentals and underweight those with weaker fundamentals.

With a better grasp on fundamentals, investors have a better sense of when to buy and sell – and – know how much risk they take when they own a stock at certain levels.

精彩评论