In the current stock market correction, tech and growth stocks like Nvidia(NVDA),Microsoft, Apple and Google parent Alphabet have fallen below key moving averages like the 10-week line. Such technical weakness in leading names is troubling, but other sectors, such as banking, are faring better.

Recent action in the Innovator IBD Breakout Opportunities ETF (BOUT) reflects those trends.Banking and oil and gas stocks currently dominate the BOUT ETF, which is rebalanced weekly.

Tesla(TSLA) is one of the few tech and growth stocks currently on theIBD Breakout Stocks Index. Meanwhile,EOG Resources(EOG),Matador Resources, Whiting Petroleum(WLL) and Denbury(DEN) represent just a few of the oil and gas stocks on the index.

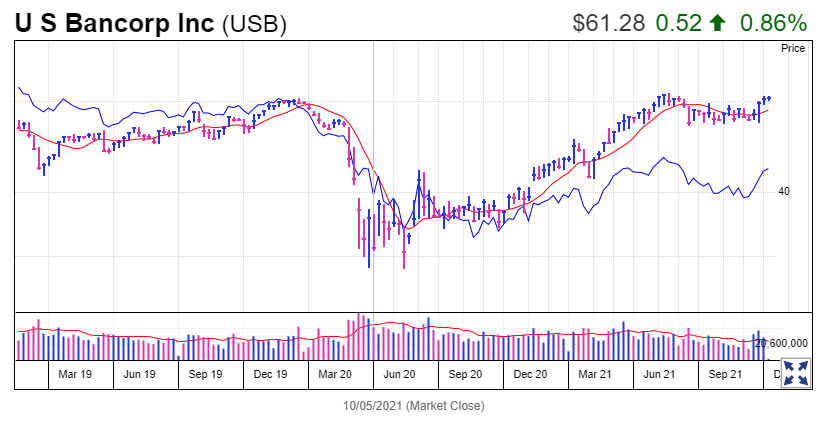

On the financial front, KeyCorp(KEY), U.S. Bancorp(USB), Citizens Financial(CFG) and Truist Financial(TFC) join many fellow banking stocks on the list.

Louisiana-Pacific(LPX), Atkore(ATKR) and Builders FirstSource represent the building sector, while Boyd Gaming andChurchill Downs make showings from the leisure sector.

Stocks Showing Strength In Stock Market Correction

Because the overall trend is against you, it's best to avoid make new buys during a stock market correction. But it's during downtrends that leading growth stocks and companies showing the telltale CAN SLIM traits set upchart patterns that could lead to freshbreakoutswhen the market rebounds.

So now is a good time to build your watchlist and be on the lookout for a follow-through day to emerge and launch a new stock market rally. Following a simple three-step routine helps you do that. You'll spot any changes in the stock market trend withThe Big Picture and Market Pulse. You can find stocks to watch with IBD Stock Lists, and evaluate your potential stock picks with charts and ratings inStock Checkup.

Among other financial plays, bank stocks building new chart patterns and nearing buy points include U.S. Bancorp, KeyCorp and Citizens Financial.

Oil and natural gas stocks have also been drilling for new buy zones. Matador stock is now slightly extended, while EOG stock and Denbury are setting up. Whiting Petroleum is in the top of its buy range after pulling back Tuesday.

In terms of leisure plays, Churchill Downs stock is extended as Boyd Gaming places its bets on a 71.10 buy point in acup-shape pattern. Building sector stocks Atkore, Builders FirstSource and Louisiana-Pacific are all testing their10-week linesas they try to move higher.

精彩评论