Powell testifies, Russia wants to open the taps, and a Bitcoin death cross.

Transitory

Federal Reserve Chair Jerome Powell’swritten remarks prepared for today’s appearancebefore the House Select Subcommittee on the coronavirus crisis show him sticking to the position that the pickup in inflation is transitory.Investors will be watching from 2:00 p.m. Eastern Time as Powell’s answers to questions from lawmakers may shed more light on his view on thepace of the economic rebound. The appearance comes after regional Fed presidents yesterday expressed mixed views on when the central bank should start talking abouttapering asset purchases.

Pump

Brent crude, the international oil benchmark,traded above $75 a barrelfor the first time in two years this morning. The rise in prices is due to trader expectations of further supply tightness in the coming quarters. In the U.S., the spread between the third and fourth month West Texas Intermediate futures contracts, hit the widest in seven years. Russia, however, is considering proposing that OPEC and allies will increase outputat the next meeting on July 1 with the global oil market currently estimated to be have a3 million barrels per daydeficit. That news was enough to cap today’s rally, with Brent slipping to $74.40 and WTI dropping to $73.08 a barrel.

Technical signal

The average price of Bitcoin over the past 50 days has fallen below its average price over the past 200 days — a move called a “death cross” by chartists and analysts. While the original cryptocurrency has formed the pattern before and recovered strongly, there is concern about the coindropping below $30,000, with such a move expected to trigger further selling. Bitcoin fell as much as 4.3% overnight and was trading at $31,550 by 5:50 a.m. Eastern Time.

Markets mixed

Global equities are mostly quiet ahead of Powell’s testimony. Overnight the MSCI Asia Pacific Index gained 0.8% while Japan’s Topix index closed 3.2% higher with the gauge posting its biggest rise in a year after Monday’s selloff. In Europe the Stoxx 600 Index was 0.2% lower at 5:50 a.m. S&P 500 futures were pointing to asmall move into the redat the open, the 10-year Treasury yield was at 1.478% andgold slipped.

Coming up...

U.S. existing home sales data for May and June Richmond Fed Manufacturing are at 10:00 a.m. New York City holdsmayoral primary elections. Cleveland Fed President Loretta Mester and San Francisco Fed President Mary Daly speak at separate events before Powell’s testimony to Congress begins at 2:00 p.m. Plug Power Inc. reports earnings.

What we've been reading

Here's what caught our eye over the last 24 hours.

- The world’s financial centersstruggle back to the office.

- Delta variant gains steam inunder-vaccinated U.S. counties.

- Supreme Court allowsmore compensation for student-athletes.

- Kim’s sister says U.S. has “wrong” views on talks with Pyongyang.

- Tesla unveils supercharging route alongChina’s Silk Road.

- U.K. stilldeeply split on Brexitfive years after referendum.

- Thelithium mine versus the wildflower.

And finally, here’s what Joe’s interested in this morning

The rise of crypto has brought new awareness to fiat currency. It makes sense. The first time in a fish's life where it ever thinks about water is when it's flapping around on a boat deck gasping for oxygen. It's only through the introduction of some seemingly oppositional force that we become aware of the world we're immersed in.

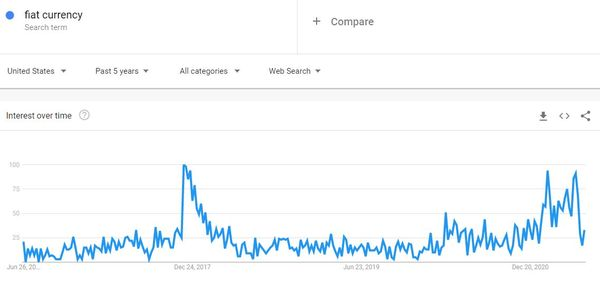

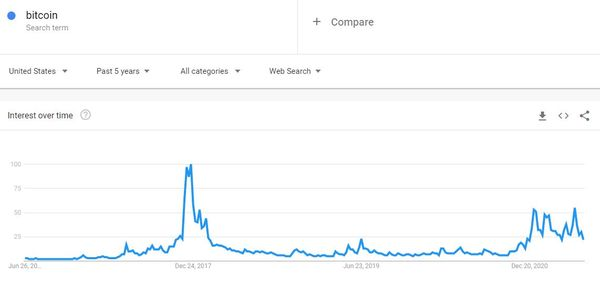

And this isn't just conjecture. You can see it in the data. AGoogle Trendschart for Bitcoin looks almost exactly like the chart for Fiat Currency.

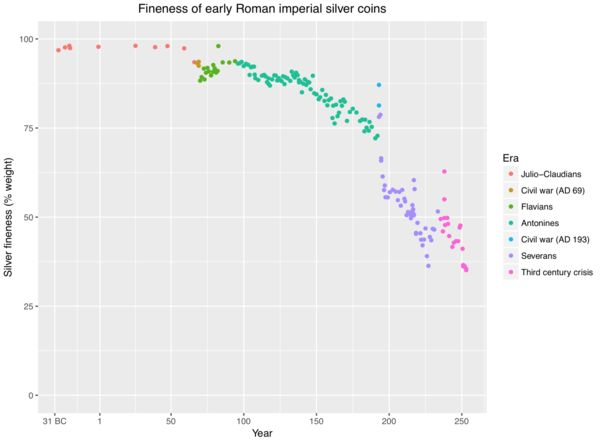

So many people's mental models of money are rooted in gold-standard thinking. People talk all the time, for example, about how we're going to "debase" the currency. But that word makes no sense in the fiat realm, as it logically relates to the concept of making a gold coin less pure bydegrading or adulterating its substance, as if the dollar were old Roman coins thathad less and less silver contentover time.

With any luck the surge in interest in fiat currency -- which again, we have to thank crypto for -- gets us to think more deeply about it and how currencies whose value is rooted in law and public convention have different characteristics than what came before, and what's come after.

精彩评论