With all the drama and focus on the inflation story, especially after last week'stransitory hawkish pivot by the Fed, SocGen's Andrew Lapthorne points out that there have been some even more dramatic moves in factor performance in recent weeks.

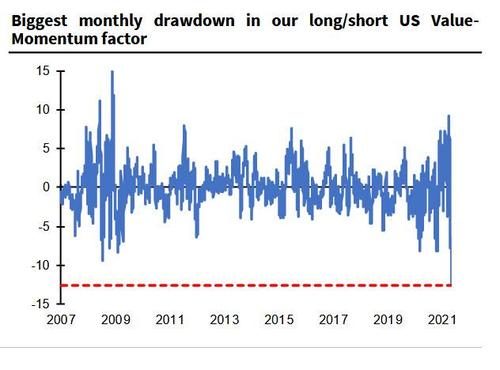

Take long/shortValue-Momentum, arguably one of, if not the, most popular quant strategies, which had been in the ascendancy this year as both Value and Price Momentum factors converged around the cyclical recovery/inflation theme. But in recent weeks, and especially after last week's FOMC, the strategy suffered a historic reversal, posting its worst monthly decline since 2002 according to Lapthorne's calculations,with the 4.3% loss on Thursday ranking as the 14th worst day for our Value-Momentum factor since 1990.

Other quant factors have done better: earnings momentum (bottom-up upgrades and downgrades) remains strong, with 62% of all global estimate changes for 2021 coming through as upgrades and with a high percentage of those upgrades coming through in the reflation sectors (Industrials, Basic Materials, Financial and Energy).

So, while markets have cooled on the reflation theme in recent weeks, the profit momentum story is still aligned, and while the copper price has retracted back to mid-April levels, the oil price is now above pre-pandemic levels. At the same time, Lapthorne concludes, the rate of increase is slowing (it had to at some stage), base effects from last year’s slump will be behind us, and we are entering a period when company reporting is typically quieter. So macro noise looks set to dominate for some time.

精彩评论