Critical information for the trading day

The big talk not just in markets but in politics is whether the new round of stimulus will overheat the economy.

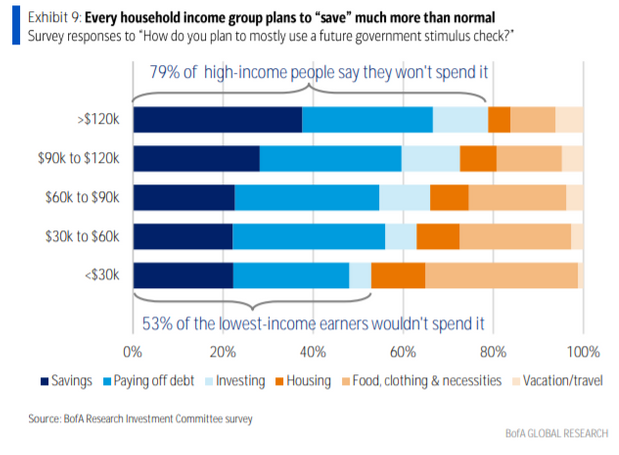

Bank of America’s research investment committee say it won’t, and brings some new data to the table. First, itcited data from the Census Bureaushowing that of the households who received a $600 stimulus check in the first half of February, 73% saved or paid down debt.Consumer credit also unexpectedly fellin January.

Bank of America also surveyed more than 3,000 people to ask how they would spend the new stimulus check. Even in the lowest-income category, 53% say they plan to either save, pay off debts or invest.

So what does that mean for investors? Bank of America says don’t count on anything more than a temporary inflation rebound. Supply disruptions will be relieved as the labor force returns to work, plus progress on artificial intelligence and automation could mean fewer industrial jobs to return to. If wage growth does accelerate, companies can afford to accelerate research and development.

The research investment committee recommends what it calls prudent yield for bond allocations — high-yield corporate and municipal bonds, leveraged loans, preferred stock and convertible bonds have all outperformed the overall bond market. For stocks, it says buy small-cap growth when it dips, and the Nasdaq CompositeCOMP,+3.69%at 11,600 (which is 12% below Tuesday’s close).

Financials are its favorite sector since it can win either way. If Bank of America’s inflation analysis is wrong, banks would benefit from a steeper yield curve and more housing and loan activity. If it is right, banks would be attractive, given higher stock buybacks and attractive yields.

The buzz

The House of Representatives is due to vote on the $1.9 trillion stimulus plan already approved by the U.S. Senate, at which point it will head to the White House for President Joe Biden’s signature. TheCongressional Budget Office estimates $1.1 trillion will be spent in 2021.

U.S. consumer price data for February will be the focus of a market suddenly obsessed with the prospect of inflation breaking out.

Maryland become thelatest state to relax many of its COVID-19 restrictions.

The U.S. and China are discussing sending their top diplomats to Alaska in a bid to reset relations for the Biden administration,according to the South China Morning Post.

PfizerPFE,+0.29%and BioNTechBNTX,+6.86%agreed to provide 4 million extra coroanvirus vaccine doses to the European Union.

Roblox Corp.scored a reference price of $45 a share from the New York Stock Exchange as the tween-centric gaming platform prepares to go public through a direct listing on Wednesday.

Luxury home builder Toll BrothersTOL,-0.43%reported a 70% jump in its first-quarter profit.

The market

After Tuesday’s big surge in technology stocks and bonds, it was looking calmer in the early going. U.S. stock futuresES00,-0.06%NQ00,-0.40%dipped slightly, and the yield on the 10-year TreasuryTMUBMUSD10Y,1.562%edged up to 1.56%.

Bitcoin futuresBTC.1,+2.42%climbed over $55,000.

The chart

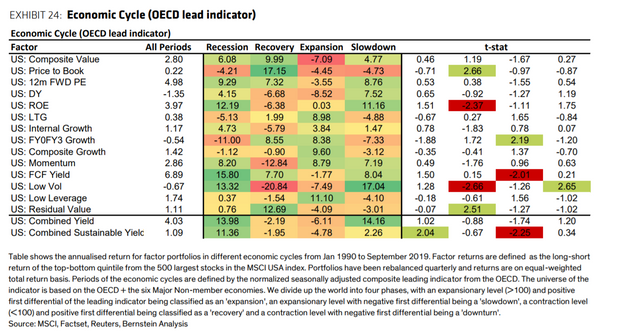

Portfolio strategists at Bernstein Research carved the economic cycle into four different parts and tested how well different investment style factors fared. Value stocks did best in the current “recovery” part of the economic cycle.

精彩评论