Summary

- Nvidia Corp. pays a paltry but growing dividend quarterly since 2012.

- With the sharp share price appreciation in the past few weeks, NVDA stock is trading above its consensus price target, making it prone to a pullback.

- Nvidia's management track record and consistent financial performance bodes well for its dividend growth.

- However, the upside potential is arguably limited here, with a potential for a price correction. This leaves the prospects of investing in Nvidia for its dividend very bleak, for now.

Does Nvidia Pay A Dividend? If So, What Is Nvidia's Recent Dividend Yield?

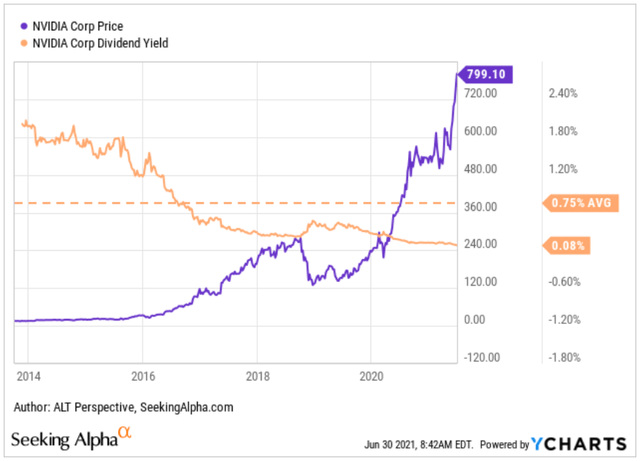

Nvidia Corporation (NVDA) pays a non-trivial $0.16 dividend per quarter, amounting to $0.64 per year. However, thanks to its share price spurt, you may be forgiven for thinking NVDA does not pay any dividend, as the dividend yield has shrunk to a mere 0.08 percent. This is way lower than its long-term average of 0.75 percent.

One would need to own 50 shares worth around $40,000 to collect enough dividend to buy a Big Breakfast meal from McDonald's (MCD) in New York,every three months. If you are a retiree, banking entirely on Nvidia's dividends to get by, you would need to own loads and loads of NVDA shares to avoid going hungry.

Is Nvidia A Good Dividend Stock?

Since my commentaryNvidia: Highly Anticipated Stock Split Is A Shot In The Armwas published on May 24, NVDA stock has climbed over 30 percent. The huge jump in share price in just over a month has some calling it a "crowded trade".

This is especially because Nvidia Corporation is not a small-cap company. Its market capitalization is around $500 billion. This means Nvidia is 16.7 times larger than AMC Entertainment Holdings, Inc. (AMC) by market cap, and that's after the latter's over 2,500 percent year-to-date gain. Similarly, Nvidia's market cap is more than 30 times higher than another meme stock GameStop Corp. (GME) despite the latter's over 4,700 percent appreciation over the past year.

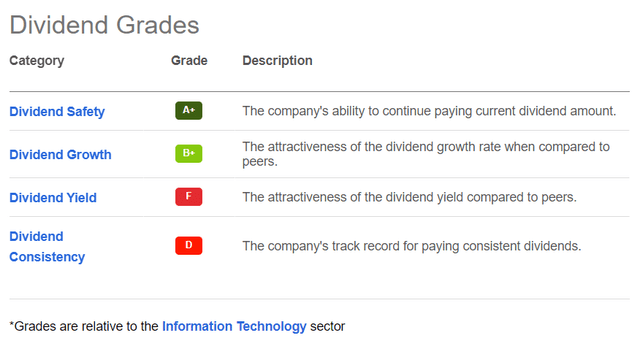

The resulting puny dividend yield unsurprisingly caused Nvidia to get an F grade in Seeking Alpha'sDividend Scorecard. That's particularly embarrassing considering the grades are relative to the Information Technology sector which provides it with low bars to clear.

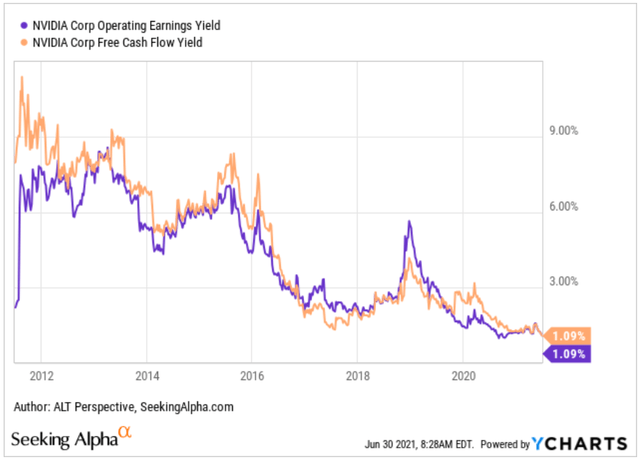

For instance, the Information Technology sector has a median dividend yield of 1.2 percent, as compared with the Materials sector's 1.7 percent. Nvidia also scored poorly on other metrics like operating earnings yield and free cash flow yield. This is understandable given that these are near the lowest levels Nvidia has ever experienced since it started its dividend scheme in 2012. The operating earnings yield is derived by taking the operating income and dividing it by the market capitalization.

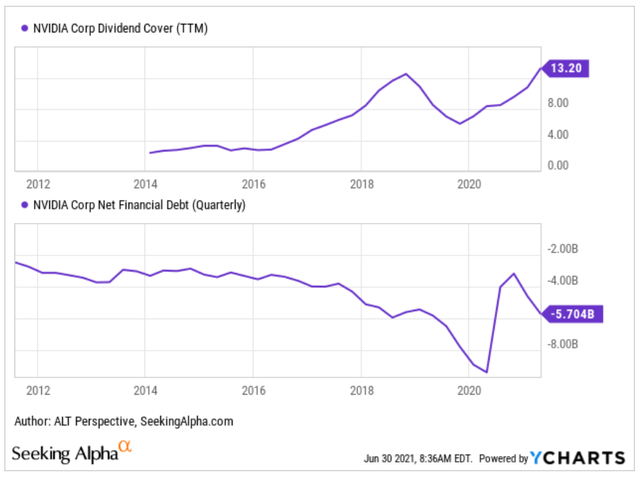

Nvidia Corporation fared better in the other three categories - dividend safety, dividend growth, and dividend consistency. In terms of dividend safety, NVDA stock scored an A+, though that's as much due to its strong financials as its conservative dividend payout.

Nvidia's payout ratio is 7.4 percent, against the sector median of 32 percent. This means that the chipmaker is giving out less of its earnings as dividends compared with its sectorial peers. Its cash dividend payout ratio is slightly better at 7.2 percent, against the sector median of 22.5 percent. The cash dividend payout ratio is a preferred metric as it uses cash flow rather than earnings that can be manipulated.

Nvidia's dividend cover on a trailing-twelve-month basis is at its highest historically at 13.2 times, surpassing the previous peak in 2018. It is also in a healthy net cash position, after digesting the $7 billionacquisitionof Mellanox Technologies, Ltd. that closed in April last year. The Mellanox deal saw Nvidia issuing $5 billion of notes.

Will The Arm Deal Derail Nvidia's Dividend Payout?

The proposedacquisitionof Arm Limited from SoftBank Group Corp. (OTCPK:SFTBY)(OTCPK:SFTBF) and the SoftBank Vision Fund was announced in September. The transaction is valued at $40 billion or 5.7 times larger than the Mellanox deal. Inevitably, the concern is whether the large purchase will impact the ability of Nvidia to continue its dividend program.

The worry may be unfounded as the bulk of the $40 billion - $21.5 billion - will be satisfied by the issuance of Nvidia shares. Another $5 billion, out of the $40 billion, that SoftBank could receive under an earn-out construct, subject to satisfaction of specific financial performance targets by Arm, may be satisfied in cash or common stock. Nvidia will also issue $1.5 billion in equity to Arm employees.

This leaves a payment of $12 billion in cash, which includes $2 billion payable at signing. The company stated that it planned to finance the cash portion of the transaction with balance sheet cash. Based on the May 2021 quarterly report, Nvidia has enough to pay with some change. It has $12.7 billion in combined cash and equivalents as well as short-term investments.

Furthermore, Nvidia still has months to build up that cash before the clearance by antitrust regulators around the world to conclude the deal. Most importantly, the press release stated that theArm dealwill be "immediately accretive to NVIDIA’s non-GAAP gross margin and EPS."

Will Nvidia's Dividend Grow? Is Nvidia A Good Dividend Stock For Long-term Investors?

Nvidia Corporation became a dividend-paying company more than eight years ago with a quarterly dividend of $0.075 declared on 8 November 2012. The dividend amount has since doubled to $0.16, beginning from 15 November 2018.

Wall Street analysts are not expecting Nvidia to change its dividend amount until 2023 when the consensus forecast is for the dividend to increase to $0.68 on an annual basis. That would bump the dividend yield slightly to 0.09 percent if the share price remains the same.

Although we don't have dividend visibility beyond 2023, we can get some clues from the EPS estimates. Analysts are projecting Nvidia's EPS to more than triple in a decade, as compared to the year ending January 2021. In general, we should be expecting that the dividend grows along with the EPS. Otherwise, we can count on activist shareholders hounding the management to do so.

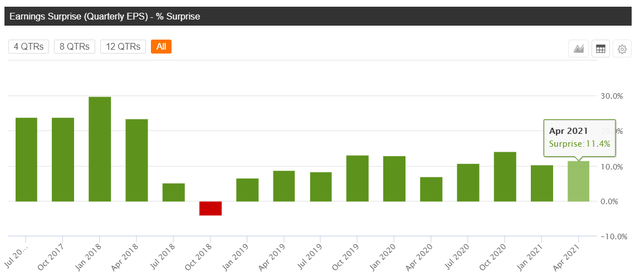

The icing on the cake would be a better-than-expected EPS, which corresponds to higher dividend expectation as well. Nvidia has delivered rather consistent, decent-sized, earnings surprises in the past few years, boding well for its future performance.

Is NVDA Stock A Buy Now?

With Nvidia scoring an A in momentum based on Seeking Alpha's quant rating, the stock is arguably for momentum traders. For the others, the rapid rise in the share price has left the market wondering if there will be a pullback as the stock catches a breather.

The price target upside for Nvidia is a negative 8.4 percent. This means that the stock has run ahead of the analysts' consensus price target. While having a negative price target upside is not uncommon for Nvidia, it is still a strong indication that investors need to strongly consider whether the potential for appreciation remains attractive. This is especially as analysts have already made sharp upwards revisions to their price targets in the past weeks.

The company's involvement in data centers, autonomous driving, gaming, and artificial intelligence applications are exciting developments. However, investors would need to consider if these catalysts are already priced into the stock. Investors who had been "burned" by the sharp falls in the so-called growth stocks in the previous quarter would advise against chasing Nvidia's share price climb.

精彩评论