- Monday (May 17)

- Tuesday (May 18)

- Wednesday (May 19)

- Thursday (May 20)

- Friday (May 21)

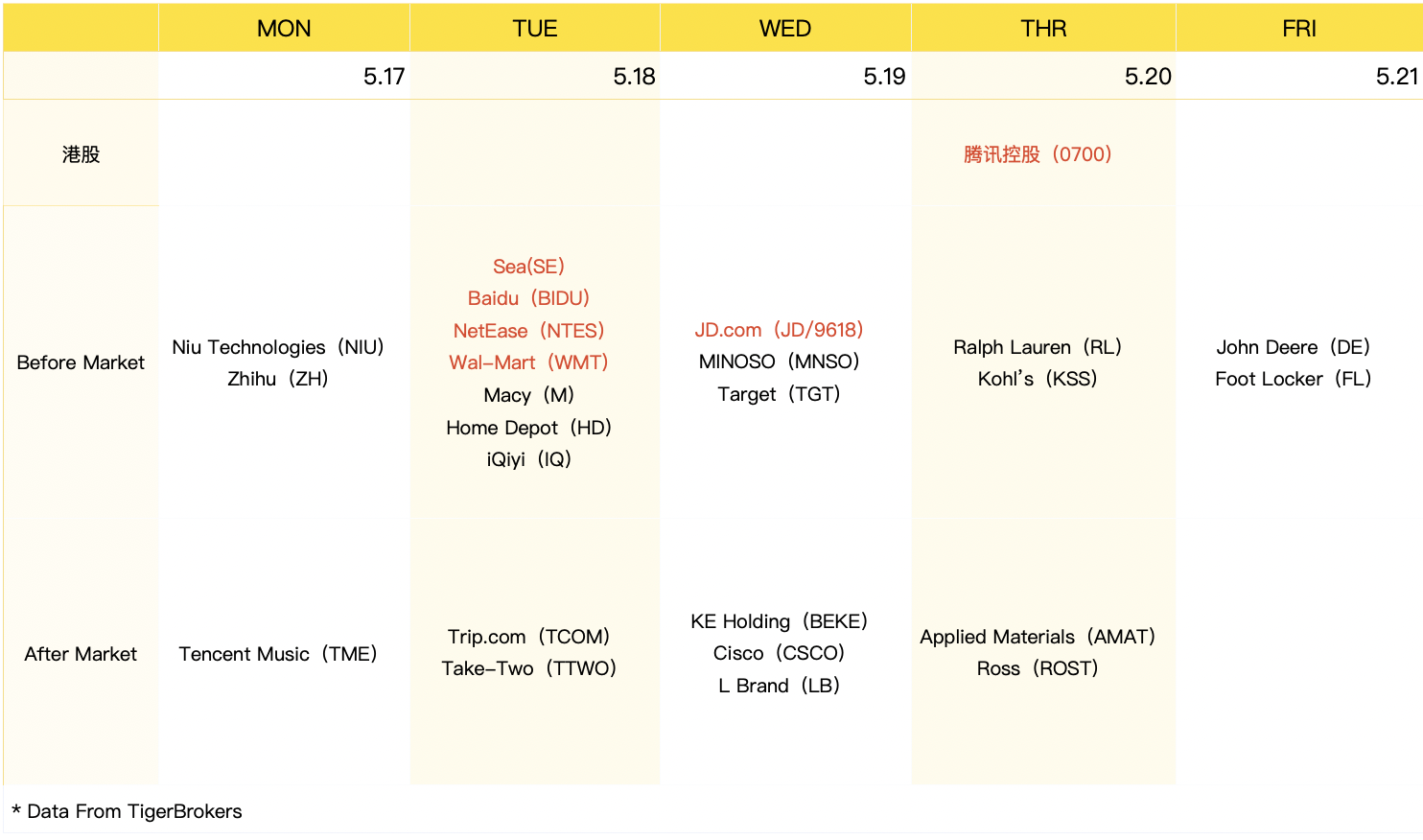

Earnings Calendar For The Week Of May 17

Monday (May 17)

| Ticker | Company | EPS Forecast |

| DM | Dominion Midstream Partners | -$0.10 |

| RYAAY | Ryanair | -$2.04 |

Tuesday (May 18)

IN THE SPOTLIGHT: HOME DEPOT, WALMART

HOME DEPOT: The largest home improvement retailer in the United States is expected to report its first-quarter earnings of $3.06 per share, which represents year-over-year growth of about 47% from $2.08 per share seen in the same period a year ago.

The home improvement retailer would post revenue growth of 21% to $34.2 billion. In the last four quarters, on average, Home Depot has beaten earnings estimates about 2%.

The Atlanta, Georgia-based company’s shares rose over 20% so far this year. Home Depot’s better-than-expected results, which will be announced on Tuesday, could help the stock hit new all-time highs. But the stock’s performance could hinge on margins.

“We expect a 25% to 30% Q1’21 comp as top-line strength likely continued through the quarter. We model gross margin down 40 bps. For context, in Q4 lumber inflation pulled gross margin down ~30 bps and likely worsened sequentially. On SG&A, assuming the per sq ft 2-year stack holds from Q4 (+24%), SG&A should lever 360 to 400 bps,” noted Simeon Gutman, equity analyst at Morgan Stanley.

“In our model, this combination produces EPS of $3.55 to $3.85 vs consensus at $2.95. While a ’21 guide was not provided, if the ’20 top-line exit rate held through ’21, HD would expect a flat to slightly positive comp and an EBIT margin of at least 14%.”

WALMART: The Bentonville, Arkansas-based retailer is expected to report its first-quarter earnings of $1.21 per share, which represents year-over-year growth of about 47% from $1.18 per share seen in the same period a year ago.

However, the multinational retail corporation that operates a chain of hypermarkets’ revenue would decline about 2% to $131.8 billion. In the last four quarters, on average, the retail giant has beaten earnings estimates about 9%.

“We raise 1Q22 EPS estimate to $1.23 from $1.22, on stronger Walmart U.S. comps, more modest SG&A deleverage, offsetting lower International segment revenues on divestitures, and remain above Street’s $1.21. We raise our Walmart U.S. comps to +0.5%, ahead of Street’s +0.3%, and our updated estimates now imply 2-year stack growth of +10.5% Y/Y, in-line with 4Q21,” noted Oliver Chen, equity analyst at Cowen.

“We expect a tailwind from stimulus, and improved apparel and other general merchandise categories, offset by grocery and other essential categories normalizing. Recall in 1Q21 Grocery improved +LDD, Health & Wellness +HSD, and General Merchandise +MSD.”

| Ticker | Company | EPS Forecast |

| HD | Home Depot | $3.06 |

| WMT | Walmart | $1.21 |

| SE | Spectra Energy | -$0.45 |

| NTES | NetEase | $6.35 |

| BZUN | Buzzi Unicem RSP | $0.60 |

| M | Macy’s | -$0.39 |

| DQ | Daqo New Energy | $1.18 |

| BIDU | Baidu | $10.63 |

| KC | Kutcho Copper | -$0.16 |

| STE | Steris | $1.79 |

| TTWO | Take Two Interactive Software | $0.68 |

| TCOM | Trip.com Group Ltd | -$2.05 |

| JHX | James Hardie Industries | $0.29 |

| TTM | Tata Motors | $0.47 |

| MBT | Mobile TeleSystems OJSC | $19.37 |

| AAP | Advance Auto Parts | $3.08 |

| DY | Dycom Industries | $0.13 |

| ASND | Ascendant Resources | -$2.06 |

Wednesday (May 19)

IN THE SPOTLIGHT: TARGET CORP

Target, one of the largest North American retailers offering customers both everyday essentials and fashionables, is expected to report its first-quarter earnings of $2.16 per share, which represents year-over-year growth of over 266% from $0.59 per share seen in the same period a year ago.

In the last four consecutive quarters, on average, the company has delivered an earnings surprise of over 60%. The Minneapolis, Minnesota-based company would post year-over-year revenue growth of over 9% to $21.51 billion.

Target’s better-than-expected results, which will be announced on May 19, would help the stock hit new all-time highs. Target shares rose over 19% so far this year.

“We raise 1Q21 EPS to $2.18E, ahead of Street’s $2.10 as we raise our comps estimate to+11.5%, and tweak margin assumptions. We now model comps +11.5%, yielding 2-year stack growth of +22.3%, accelerating sequentially by +30bps,” noted Oliver Chen, equity analyst at Cowen.

“We are ahead of Street’s+8.2% consensus estimate, and think our estimates could ultimately prove conservative as Target’s (TGT) category portfolio should see the retailer benefit from the stimulus, improving trends in apparel and other re-opening categories, along with continued strength in-home, which will more than offset normalizing food, essentials, and other category comps.”

| Ticker | Company | EPS Forecast |

| VIPS | Vipshop | $2.19 |

| JD | JD.com | $2.29 |

| LOW | Lowe’s Companies | $2.59 |

| CAE | Cae USA | $0.16 |

| ADI | Analog Devices | $1.45 |

| TGT | Target | $2.16 |

| TJX | TJX Companies | $0.30 |

| EXP | Eagle Materials | $1.23 |

| RXN | Rexnord | $0.45 |

| KEYS | Keysight Technologies | $1.33 |

| CSCO | Cisco Systems | $0.82 |

| LB | L Brands | $1.15 |

| SNPS | Synopsys | $1.53 |

| SQM | Sociedad Quimica Y Minera De Chile | $0.25 |

| YY | YY | -$0.39 |

| CPRT | Copart | $0.80 |

| OMVJF | OMV | $0.97 |

Thursday (May 20)

| Ticker | Company | EPS Forecast |

| MNRO | Monro Muffler Brake | $0.29 |

| KSS | Kohl’s | $0.06 |

| BRC | Brady | $0.65 |

| RL | Ralph Lauren | -$0.75 |

| HRL | Hormel Foods | $0.41 |

| BJ | BJs Wholesale Club Holdings Inc | $0.56 |

| PANW | Palo Alto Networks | $1.28 |

| ROST | Ross Stores | $0.88 |

| FLO | Flowers Foods | $0.40 |

| AMAT | Applied Materials | $1.51 |

| DECK | Deckers Outdoor | $0.67 |

| TCEHY | Tencent | $0.54 |

| TBLMY | Tiger Brands Ltd PK | $0.34 |

Friday (May 21)

IN THE SPOTLIGHT: DEERE & COMPANY

Deere & Company, the world’s largest maker of farm equipment, is expected to report its fiscal second-quarter earnings of $4.49 per share, which represents year-over-year growth of over 112% from $2.11 per share seen in the same period a year ago.

In the last four consecutive quarters, on average, the agricultural, construction, and forestry equipment manufacturer has delivered an earnings surprise of over 60%. The Moline, Illinois-based company would post year-over-year revenue growth of over 28% to $10.5 billion.

Deere’s better-than-expected results, which will be announced on Friday, would help the stock hit new all-time highs. Deere shares rose over 42% so far this year.

“Deere & Company (DE) is one of the highest quality, most defensive names within the broader Machinery universe, given an historically lower cyclicality of Ag Equipment and history of strong management execution. FY21 should mark a tangible acceleration in the NA large ag replacement cycle, as commodity tailwinds are complemented by moderating trade headwinds and improving farmer sentiment,” noted Courtney Yakavonis, equity analyst at Morgan Stanley.

“With mgmt continuing to execute against its 15% mid-cycle operating margin target, we see continued momentum in DE’s margin improvement narrative – representing one of the most attractive idiosyncratic margin improvement narratives in the broader Machinery group.”

| Ticker | Company | EPS Forecast |

| ROLL | Rbc Bearings | $1.05 |

| DE | Deere & Company | $4.49 |

| BKE | Buckle | $0.29 |

| BAH | Booz Allen Hamilton | $0.84 |

| VFC | VF | $0.28 |

| FL | Foot Locker | $1.06 |

精彩评论