When a member of the S&P 500 raises its dividend annually for at least 25 straight years, it becomes a Dividend Aristocrat. If it maintains that streak for another 25 years and crosses the half-century mark, it gets crowned a Dividend King.

Fewer than 30 companies made that cut last year. Today, I'll highlight five Dividend Kings that investors can buy and comfortably hold forever for consistent returns.

Image source: Getty Images.

Meet the top five Dividend Kings

My five favorite Dividend Kings are Coca-Cola (NYSE:KO), Procter & Gamble (NYSE:PG), Colgate-Palmolive (NYSE:CL), Johnson & Johnson (NYSE:JNJ), and Hormel (NYSE:HRL).

They all share three common characteristics: They own evergreen brands, they pay higher yields than the 10-year Treasury's yield of 1.6%, and their cash dividend payout ratios remain below 100%.

Company |

Forward Dividend Yield |

Cash Dividend Payout Ratio (Past 12 Months) |

Consecutive Years of Dividend Growth |

|---|---|---|---|

Coca-Cola |

3% |

90% |

59 |

Procter & Gamble |

2.6% |

50% |

64 |

Colgate-Palmolive |

2.1% |

53% |

58 |

Johnson & Johnson |

2.6% |

51% |

59 |

Hormel Foods |

2% |

81% |

55 |

Data source: Company press releases, Yahoo Finance, June 7.

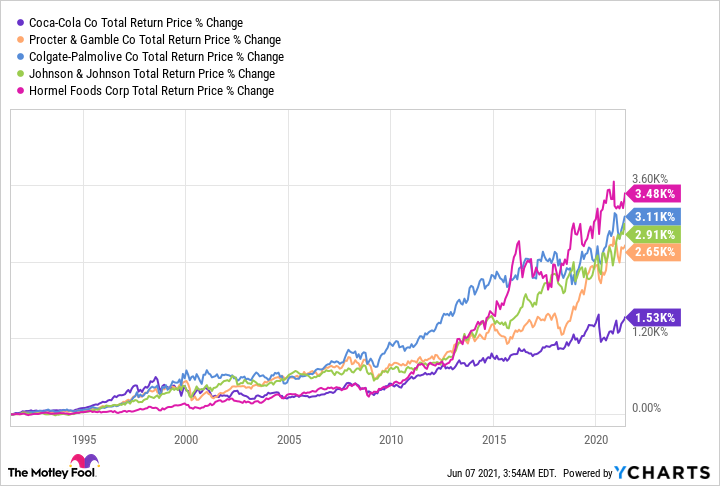

After factoring in reinvested dividends, each of these five companies has generated impressive inflation-beating total returns over the past 30 years.

Source: YCharts

These five companies withstood four major recessions during those three decades while raising their dividends every year. Past performance never guarantees future gains, but that resilience indicates they'll remain great defensive stocks to hold throughout future economic downturns.

Broadly diversified and evolving businesses

These five Dividend Kings all own well-diversified businesses. Coca-Cola has been struggling with declining soda consumption rates, but it's diversified its portfolio with teas, fruit juices, sports drinks, bottled water, and even alcoholic beverages to cushion the blow.

P&G's 65 brands include Bounty, Gillette, Head & Shoulders, Pampers, and Tide; and Colgate-Palmolive sells its namesake products and other well-known cleaning and personal care brands like Softsoap, Irish Spring, and Ajax. Both companies benefited from accelerating shopping trends throughout the pandemic, and they'll likely continue growing after the crisis ends.

J&J's pharmaceutical, consumer healthcare, and medical devices all grow at different rates, but their strengths usually offset their weaknesses. For example, J&J's medical device sales declined last year as patients postponed their surgeries during the pandemic, but the strength of its pharmaceutical and consumer healthcare segments offset that decline.

Hormel experienced robust demand for its packaged meat brands throughout the pandemic, while the popularity of its SPAM and Skippy brands enabled its international business to generate record earnings growth over the past five quarters.

Reliable long-term growth at reasonable valuations

Based on those evergreen strengths, analysts expect all five companies to generate stable earnings growth over the next five years. Their stocks also trade at reasonable forward price-to-earnings ratios.

Company |

Average Annual EPS Growth (Next 5 Years) |

Forward P/E Ratio |

|---|---|---|

Coca-Cola |

9.1% |

24 |

Procter & Gamble |

5.9% |

23 |

Colgate-Palmolive |

7.5% |

24 |

Johnson & Johnson |

7.5% |

16 |

Hormel Foods |

5.9% |

26 |

Yahoo Finance, June 7.

We should take Wall Street's estimates and valuations with a grain of salt, since a lot can happen over the next five years. But I also believe these companies will slowly but steadily grow their earnings, since demand for their products should remain consistent regardless of the macroeconomic challenges.

All five of these stocks could also remain in favor this year as concerns about rising bond yields and inflation spark a rotation from growth to value stocks. Companies like Coca-Cola and J&J, which both faced temporary headwinds during the pandemic, could also benefit from the prioritization of reopening plays over "pandemic stocks".

The key takeaways

These five Dividend Kings aren't ideal stocks for growth-oriented investors with short investment horizons. But they're excellent investments for investors who plan to hold their stocks for decades, reinvest the dividends, and profit from the compounding returns.

精彩评论