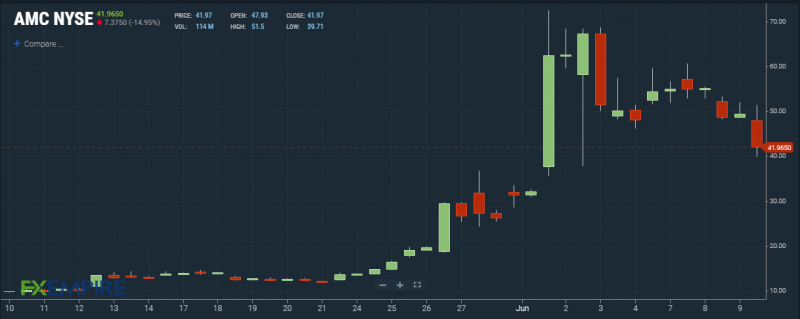

Meme stocks are having a tough day, and AMC Entertainment is among the hardest-hit names. Shares of the movie chain are down nearly 13% amid a sell-off in the entire group today.

After AMC shares traded as high as USD 62.55 in early June, they have since proceeded to give back ground as investors watched 30% get shaved from the stock’s value.

Short Interest Persists

Short selling activity in AMC remains robust , with short interest hovering at 102.3 million shares as of May 28, as per exchange data cited by financial analytics firm Ortex. The short interest surpassed expectations considering that traders have lost billions of dollars to the WallStreetBets movement as retail investors have gained the upper hand.

With the latest exchange data, AMC’s short interest is estimated to be 12.7% of the stock’s free float, according to Ortex. Short interest in AMC has been as high as 18% recently.

Insider Selling

A couple of significant AMC investors have decided to profit from the latest meme stock craze and cash in some of their holdings. Among them, Howard Koch Jr., the producer of popular flicks including Wayne’s World and Primal Fear, has unloaded more than 14,000 shares in recent days, an SEC filing reveals.

After selling shares at an average price of USD 55.34, he saw a payday of more than USD 790K. Koch, who is also known as Hawk, still owns tens of thousands of shares in the movie stock. Before this month, he hadn’t hit the sell button on the stock in half a decade.

In addition, there was some insider selling. AMC HR executive Carla Chavarria parted ways with more than 40,000 shares of her employer’s stock at an average price of USD 62.67. She took home USD 2.5 million.

Meme Stock Meltdown

Selling today isn’t limited to AMC and has spilled over into several meme-stock names, even the newer ones. GameStop shares are down an eye-popping 20% after the company’s earnings report left investors wanting greater transparency on the rest of the year. BlackBerry, Clover Health and Wendy’s are also under pressure today.

As long as the broader stock market remains stuck in its current narrow range, however, the meme stock’s glory days are likely not over yet as investors hunt returns, according to OANDA senior market analyst Edward Moya.

精彩评论