Vehicle purchase agreements struck with fleet management companies are not binding orders, according to a regulatory filing submitted by Lordstown Motors (RIDE). The filing came just a day after the company’s President stated it had “pretty binding” preorders to sustain its operations through 2022, reports the Wall Street Journal.

The vehicle purchase agreements are valid for about 3 to 5 years and include Lordstown as the preferred supplier. They also come with down payment terms. According to the embattled electric truck company, the purchase orders only act as an indicator of demand in the market.

Lordstown has seen its prospects turn sour in recent months, having already warned that it does not have sufficient capital to oversee commercial production, let alone operate for another year. Top leaders resigning unexpectedly following inaccuracies on the company’s truck preorders have only continued to arouse concerns.

Amid the uncertainty around Lordstown's long-term prospects, R.F. Lafferty analyst Jaime Perez has downgraded the stock to a Sell from a Hold. Perez commented, "With the level of uncertainty increasing in the future of Lordstown, we find it prudent to lower our rating to Sell. In addition, we reduced our price target by $6 to $3 per share."

The analyst's revised price target implies 70.9% downside potential to current levels.

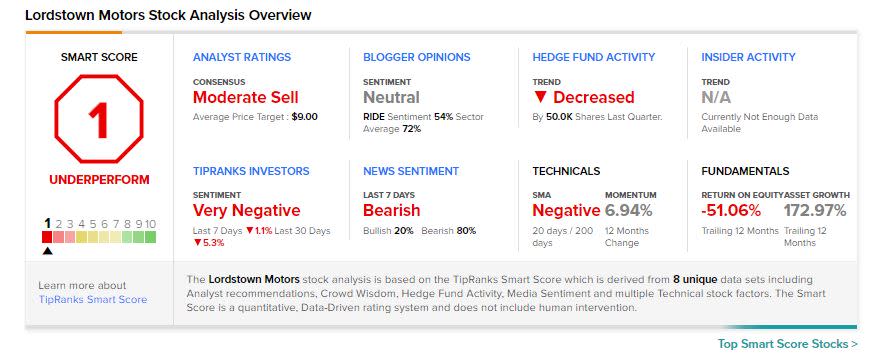

Consensus among analysts is a Moderate Sell based on 1 Buy, 3 Holds, and 4 Sells. The Lordstown average analyst price target of $9 implies 12.71% downside potential to current levels.

RIDE scores a 1 out of 10 on TipRanks’ Smart Score rating system, suggesting that the stock is likely to underperform market averages.

精彩评论