China's intensifying regulatory crackdown crushed tech stocks for a second day on Tuesday.

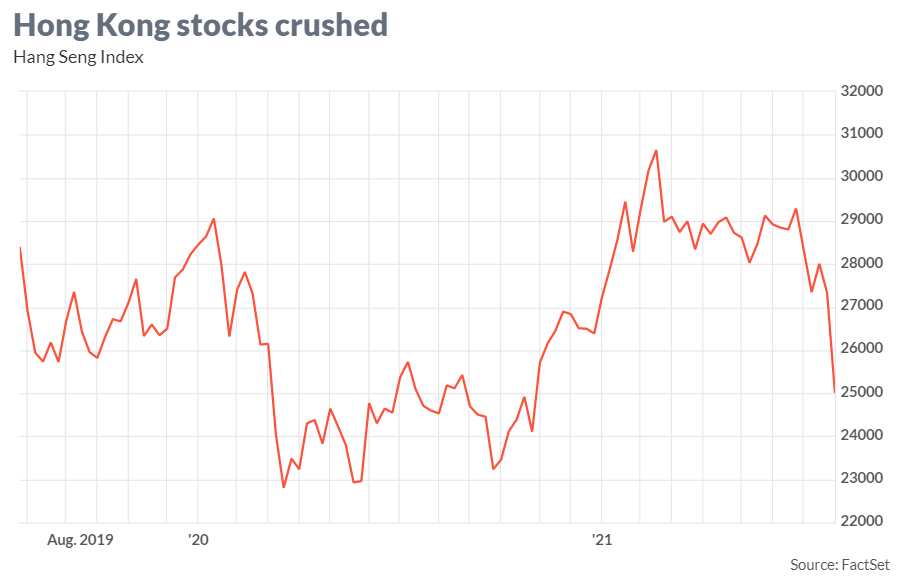

The Hang Seng dropped 4.2% after falling 4.1% on Monday, in what's been the steepest fall for the index since the coronavirus pandemic hit global markets in March 2020. The selling in Hong Kong accelerated toward the end of trading.

China's multi-pronged attack on its high-flying companies extended to Meituan, which fell 18% after new rules were issued requiring online food platforms to ensure their drivers are paid at least the minimum wage.

China's technology giants continued to reel, with Tencent Holdings losing 9% and Alibaba Group losing 8%. Alibaba Health Information Technology dropped 19%.

The late dive for the Hang Seng pressured U.S. stock market futures , which turned negative. Futures on the Nikkei 225 also turned lower after a positive close for the Japanese market .

"A sense of caution is likely to linger across markets as investors adopt a guarded approach due to the Asian volatility and Federal Reserve policy meeting on Wednesday," said Lukman Otunuga, senior research analyst at FXTM.

精彩评论