Goldman Sachs has prided itself on its bullish stance on the global economy, with its above-consensus takes doing better than many of its banking rivals to forecast just how resilient consumers and businesses have been.

The gross domestic product data released Thursday show the world's largest economy, the U.S., has already surpassed its pre-pandemic peak in the second quarter.

But...

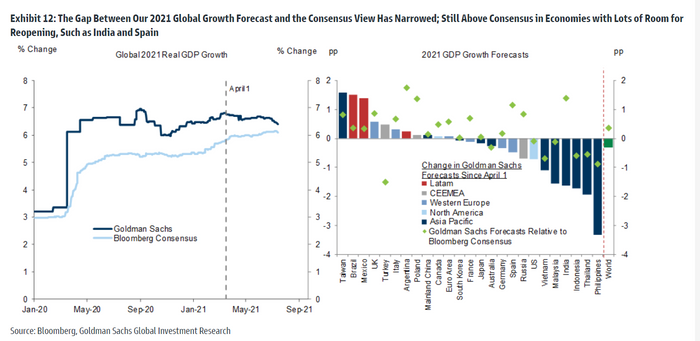

Goldman Sachs economists Daan Struyven and Sid Bhushan explain the bank's economics team has now become less enthusiastic. They've cut economic growth projections for the low-vaccination Asian economies including India and Australia but also the U.S. -- even while upgrading Brazil and Mexico forecasts -- taking their global growth forecast for this year to 6.4%, which is only 0.3% above the Wall Street consensus.

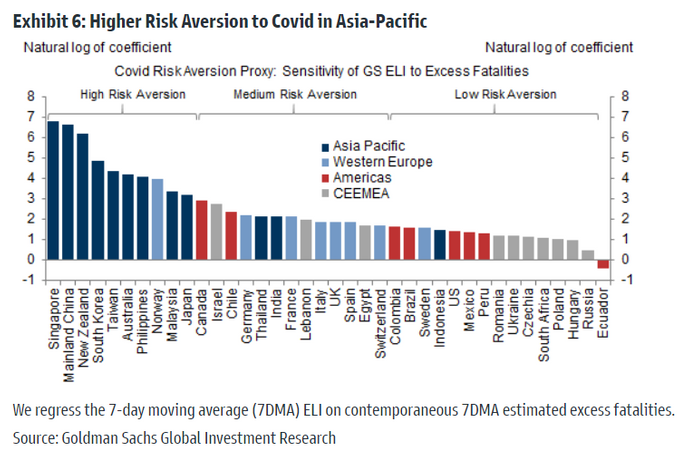

The more transmissible delta strain of coronavirus implies a slower recovery because of renewed outbreaks. The issue isn't just government restrictions, but also the choices of individuals to limit high-contact services.

"The share of Americans reporting to 'always avoid' high-contact activities has decreased, but remains substantial at around 50% for public transportation and large events, and 30% for travel," they said, citing YouGov data. "A further recovery will require not only rising vaccinations and related medical improvements, but also time for individuals to become more comfortable."

And the U.S. is grouped into one of the low-risk aversion countries, based on the restrictions imposed relative to fatalities. "China's high risk aversion could keep quarantines and travel controls in place for longer, and delay the recovery in tourism economies such as Vietnam, Thailand, and Singapore," they say.

The pessimism comes amid a new report from the Centers for Disease Control and Prevention, arguing the delta variant as as transmissible as chickenpox.

精彩评论