If you're looking for a multi-bagger, there's a few things to keep an eye out for. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. So when we looked at Norfolk Southern and its trend of ROCE, we really liked what we saw.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Norfolk Southern, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = US$4.1b ÷ (US$39b - US$2.8b) (Based on the trailing twelve months to June 2021).

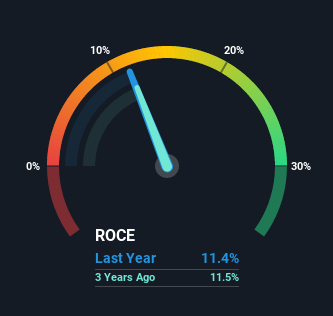

Therefore, Norfolk Southern has an ROCE of 11%. That's a pretty standard return and it's in line with the industry average of 11%.

Check out our latest analysis for Norfolk Southern

In the above chart, we have measured Norfolk Southern's prior ROCE against its prior performance, but the future is arguably more important.

The Trend Of ROCE

Norfolk Southern's ROCE growth is quite impressive. More specifically, while the company has kept capital employed relatively flat over the last five years, the ROCE has climbed 22% in that same time. So our take on this is that the business has increased efficiencies to generate these higher returns, all the while not needing to make any additional investments. On that front, things are looking good so it's worth exploring what management has said about growth plans going forward.

In Conclusion...

To bring it all together, Norfolk Southern has done well to increase the returns it's generating from its capital employed. And with the stock having performed exceptionally well over the last five years, these patterns are being accounted for by investors. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

One more thing to note, we've identified 2 warning signs with Norfolk Southern and understanding them should be part of your investment process.

精彩评论