In a recent regulatory filing, The Daily Journal disclosed that it had bought more shares of Chinese giant Alibaba with its corporate cash. The decision was probably the work of Charlie Munger, Warren Buffett's partner and Berkshire Hathaway vice chairman. Munger is also the chairman of The Daily Journal and holds 3.6% of the company's shares.

Although The Daily Journal started off as a legal newspaper and is now transitioning to become a software company to local court systems, it uses its cash holdings to invest in equities, which make up a significant portion of the company's market cap.

While The Daily Journal's concentrated portfolio consists mainly of large U.S. banks, in the first quarter, Munger, a longtime China bull, bought a stake in Alibaba. With that investment having gone south this summer, The Daily Journal's recent disclosure shows Munger nearly doubling down on his bet as Alibaba's share price plummeted.

Image source: Getty Images.

Still believing in BABA

In the filing, The Daily Journal disclosed that its stake in Alibaba had risen from 165,320 shares at the end of the first quarter to 302,060 shares at the end of Q3. That's an 83% increase -- a near doubling of Munger's bet. The company's stake in Alibaba now totals about $45 million -- good for about 20% of the Daily Journal's portfolio.

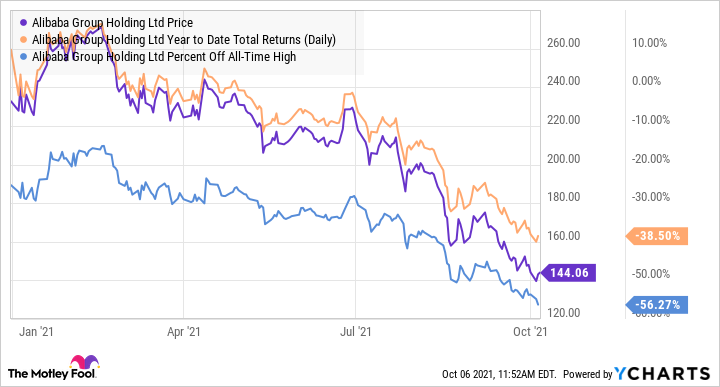

It has been a rough year for Alibaba's stock, as shares are down 38.5% on the year and a whopping 56.3% from all-time highs set back in 2020.

BABA data by YCharts

As Munger is a noted value investor, if he believed Alibaba was a cheap stock back in April, when shares where in the $230-$240 per share range, he probably loves it now, with the stock currently trading in the $140s. It's a prime example of adhering to partner Warren Buffett's famous quote: "Be fearful when others are greedy, and greedy when others are fearful."

But should you follow Munger into Alibaba?

If you're investing your own money, as a general rule, it's usually best not to blindly follow others into an investment, even if they're famous investors. Famous investors can make mistakes, too, and if a trade goes south and you don't know why you own something, you may panic and sell at the wrong time.

Alibaba is a fascinating case, of course, as there are plenty of valid reasons for an investor to be both bullish or bearish at this time of great uncertainty.

Image source: Getty Images.

The bull case on BABA: It looks very cheap

On the bullish side, Alibaba is of course a leading player in Chinese e-commerce, payments and fintech, and the cloud. With an entrenched position in these three high-growth areas, and given that Munger is known to be bullish on the long-term growth prospects of China and its rising middle class, it seems a pretty safe bet that Alibaba should grow in the years ahead.

So when the IPO of Alibaba subsidiary Ant Financial was stopped a year ago and its stock fell, Munger swooped in, buying shares when Alibaba's P/E ratio fell to the high 20s. However, Alibaba also had about $135 billion in net cash and other investments in other companies at that time, so the "core" business was actually much cheaper than that. And Alibaba also has several promising but loss-making subsidiaries, such as its cloud computing platform, which probably has significant positive value but contributes negatively to current earnings.

Over the summer, Alibaba's valuation has fallen all the way to just 17.3 times trailing earnings. That's extremely cheap, especially considering, again, Alibaba's prodigious cash holdings and investments, as well as several loss-making business segments. And even with all the negativity in Alibaba's stock today, analysts still estimate future growth, albeit more muted. Based on 2023 estimates, Alibaba trades at only 13.3 times earnings.

Reasons to be bearish: slowing growth and increased regulations

However, Munger may have misjudged the extent that Alibaba and other Chinese tech companies were to be punished. After a $2.8 billion fine for violating antimonopoly rules in e-commerce back in April, regulators have continued to issue regulations on delivery worker pay as well as restrictions on data collection, which could broadly affect Alibaba's portfolio of businesses.

Ant Financial may be broken up into three separate businesses, effectively knocking down the company's moat against rivals. Even on the core business, recent regulations could open Alibaba's main cash cow e-commerce business to more fierce competition.

In August, its earnings report for the quarter ending in June revealed that it was light on revenue, disappointing some investors. While headline revenue grew 34%, outside of a large acquisition, revenue grew just 22% -- still a solid figure, but a deceleration from Alibaba's past rate. Recent troubles at Evergrande (OTC:EGRN.F), the large Chinese real estate developer, may still spill over into the broader Chinese economy. That could affect the Chinese consumer, which means less buying and lower revenue for Alibaba.

Finally, Alibaba also recently announced a $15.5 billion "social equity" fund to tackle societal challenges such as gig-worker welfare, rural area development, and the growth of small and medium-sized businesses. That fund doesn't necessarily have a financial payoff.

Finally, U.S.-China relations have been frosty to say the least, and further tensions could cause China to take unilateral actions against foreign shareholders of domestic companies. Alibaba is listed in the U.S., but because of Chinese rules, non-Chinese shareholders don't directly own shares, but rather shares of a variable interest entity (VIE) listed in the Cayman Islands, which has a contractual right to part of Alibaba's business. Should things go south between the two countries, it's possible -- a long shot, but still possible -- that China may look to take aim at the VIE structure and contracts.

Factor these things in when looking to buy Alibaba

Munger has long been positive on the growth of China, and it's safe to say he knows an awful lot about the country. However, there are also other smart people with a more pessimistic view of China.

In buying Alibaba, investors need to have confidence the current regulatory campaign will eventually stop or moderate, and that Alibaba will still be able to function as a relatively normal profit-making company -- albeit with more regulations. Obviously, Munger believes that will happen after this period of turbulence, but it's by no means a sure thing.

精彩评论