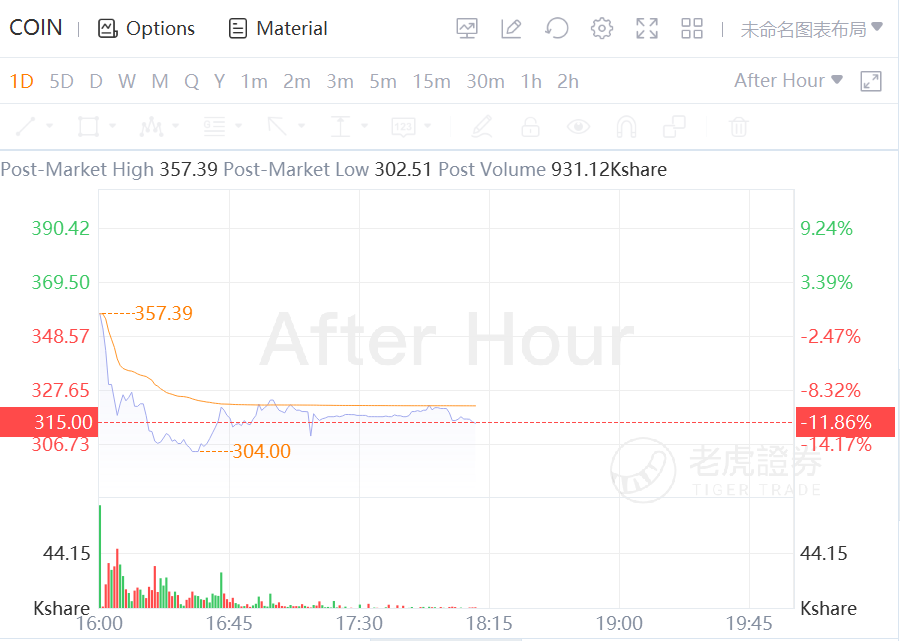

Coinbase (NASDAQ: COIN) shares were trading more than 10% lower after-hours, following the company’s Q3 results, with revenue coming in at $1.31 billion ($1.1 billion in transaction revenue and $145 million in Subscription and services revenue), below the consensus estimate of $1.56 billion. Quarterly EPS of $1.62 was better than the consensus estimate of $1.57. Verified Users grew to 73 million in Q3 and retail Monthly Transacting Users (MTUs) were 7.4 million.

According to the shareholder letter, the company entered Q3 with softer crypto market conditions, driven by low volatility and declining crypto asset prices, but market conditions improved meaningfully later in the quarter which the company has continued to see into early Q4.

The company expects an average retail MTUs of 8.0-8.5 million for the full 2021-year.

Mizuho analyst Dan Dolev said the biggest standout to him was the "dramatic" decline in the retail take rate, which he said is "likely amongst the most dramatic compression in COIN's short history as a public company."

On the positive side, the analyst noted the company benefited from a strong October. However, overall the analyst remains cautious, as take rate pressures appear to be getting worse.

精彩评论