U.S. Steel Corp. shares slipped in late trading after it warned fourth-quarter results will be lower than Wall Street had been expecting.

Earnings before interest, taxes and amortization will be about $1.65 billion, the company said in a statement Thursday. That compares with the $2.13 billion average analysts had been expecting. Shares were down 5.1% as of 6:13 p.m. in New York after regular trading hours.

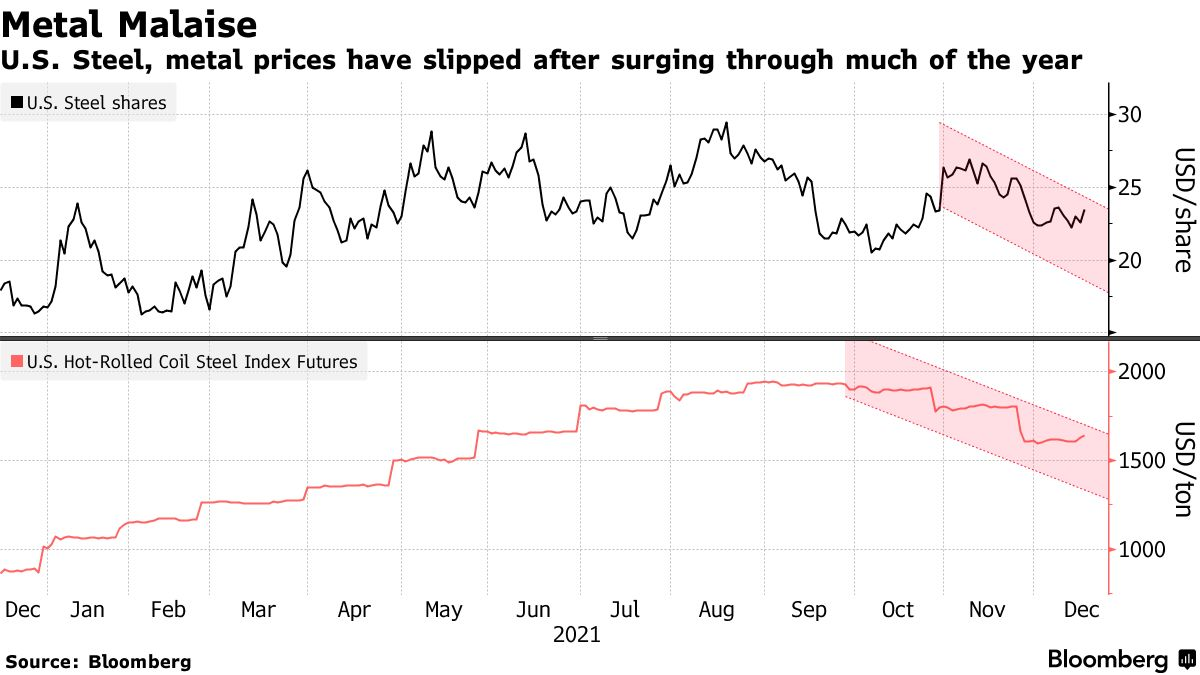

The U.S. steel market has recently started to show some cracks, after surging through much of the year as sales of steel-made products ranging from paper clips to cars rebounded amid vaccine rollouts and reopened economies. The outlook comes a day after rival Nucor Corp., the largest U.S. steel producer, also projected fourth-quarter earnings that were lower than analysts estimated.

“Our fourth quarter guidance indicates another quarter of strong performance yet reflects a temporary slowdown in order entry activity, which we believe is related to typical seasonal year-end buying activity,” U.S. Steel Chief Executive Officer David B. Burritt said in the statement.

U.S. Steel was said earlier this quarter to be seeking buyers to take over abandoned orders of some high-end metal used by automakers.

Benchmark steel prices in the U.S, which touched a record in August, have slipped recently, and shares of Nucor, U.S. Steel, Cleveland-Cliffs Inc. and Steel Dynamics Inc. all posted monthly declines in November.

精彩评论