Datadog, Inc (NASDAQ:DDOG) reported better-than-expected first-quarter results on Tuesday.

The software-as-a-service (SaaS) platform's fiscal first-quarter revenue increased 25% year over year to $761.55 million, beating the analyst consensus estimate of $741.52 million. Adjusted EPS of 46 cents beat the analyst consensus estimate of 43 cents.

“Datadog executed solidly in the first quarter, with 25% year-over-year revenue growth, $272 million in operating cash flow, and $244 million in free cash flow,” said Olivier Pomel, co-founder and CEO of Datadog.

For the second quarter, Datadog expects revenue of $787 million–$791 million above the consensus estimate of $772.13 million. It projects an adjusted EPS of $0.40–$0.42 compared to the analyst consensus of $0.41.

Datadog raised its fiscal 2025 revenue outlook to $3.215 billion-$3.235 billion (prior $3.175 billion-$3.195 billion), above the consensus estimate of $3.200 billion. It projects an adjusted EPS of $1.67-$1.71 (prior $1.65–$1.70), below the analyst consensus of $1.75.

Datadog shares gained 0.5% to trade at $106.63 on Wednesday.

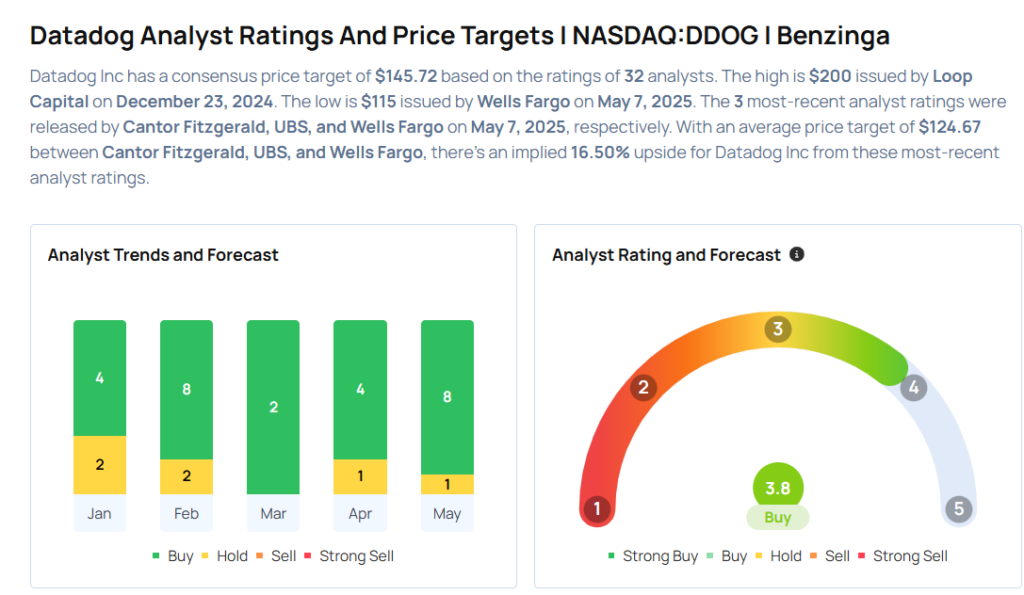

These analysts made changes to their price targets on Datadog following earnings announcement.

- Needham analyst Mike Cikos maintained Datadog with a Buy and lowered the price target from $160 to $130.

- Canaccord Genuity analyst Kingsley Crane maintained the stock with a Buy and lowered the price target from $150 to $145.

- Wells Fargo analyst Andrew Nowinski maintained Datadog with an Equal-Weight rating and lowered the price target from $140 to $115.

- UBS analyst Karl Keirstead maintained the stock with a Buy and raised the price target from $120 to $125.

Considering buying DDOG stock? Here’s what analysts think:

Read This Next:

- Top 3 Financial Stocks That May Plunge In May

Photo via Shutterstock

精彩评论