Sea Limited (NYSE:SE) reported mixed fiscal second-quarter results on Tuesday.

The company’s quarterly revenue increased 38.2% year-on-year (Y/Y) to $5.26 billion, topping the analyst consensus estimate of $4.98 billion. EPS of 65 cents missed the analyst consensus estimate of 74 cents.

“The momentum from our strong start to 2025 has continued into the second quarter. All three of our businesses have delivered robust, healthy growth, giving us greater confidence of delivering another great year,” said Forrest Li, Sea’s Chairman and Chief Executive Officer. “Given the high potential of our markets and the stage we are at in our business now, we will continue to prioritize growth, which will pave the way for us to maximize our long-term profitability. At the same time, our company has reached a stage where we can pursue growth opportunities while improving profitability.”

Sea shares fell 0.1% to trade at $173.88 on Wednesday.

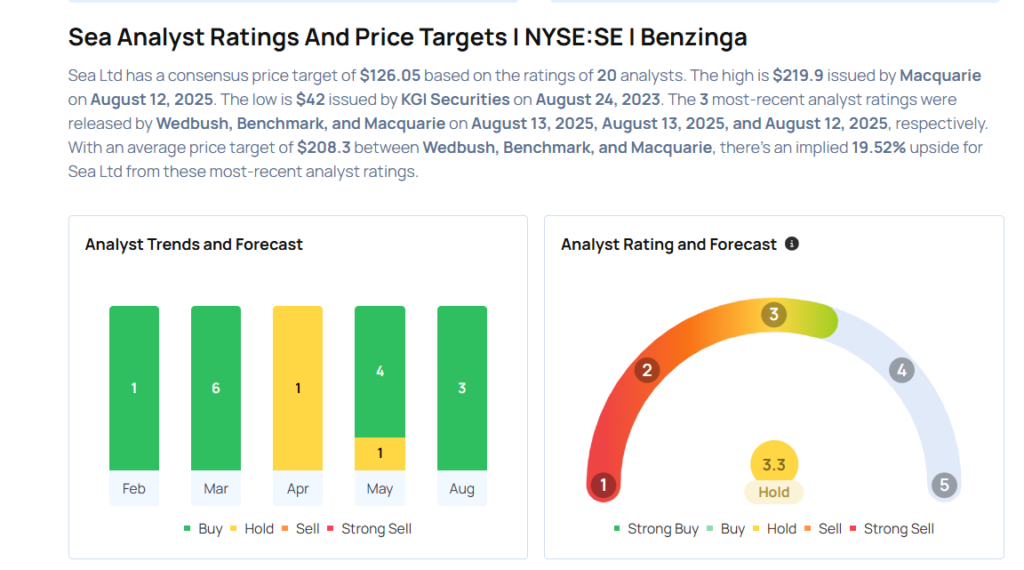

These analysts made changes to their price targets on Sea following earnings announcement.

- Benchmark analyst Fawne Jiang maintained Sea with a Buy and raised the price target from $180 to $205.

- Wedbush analyst Scott Devitt maintained Sea with an Outperform rating and raised the price target from $170 to $200.

Considering buying SE stock? Here’s what analysts think:

Read This Next:

- Top 2 Tech & Telecom Stocks That May Fall Off A Cliff In Q3

Photo via Shutterstock

精彩评论