Hello, everyone!

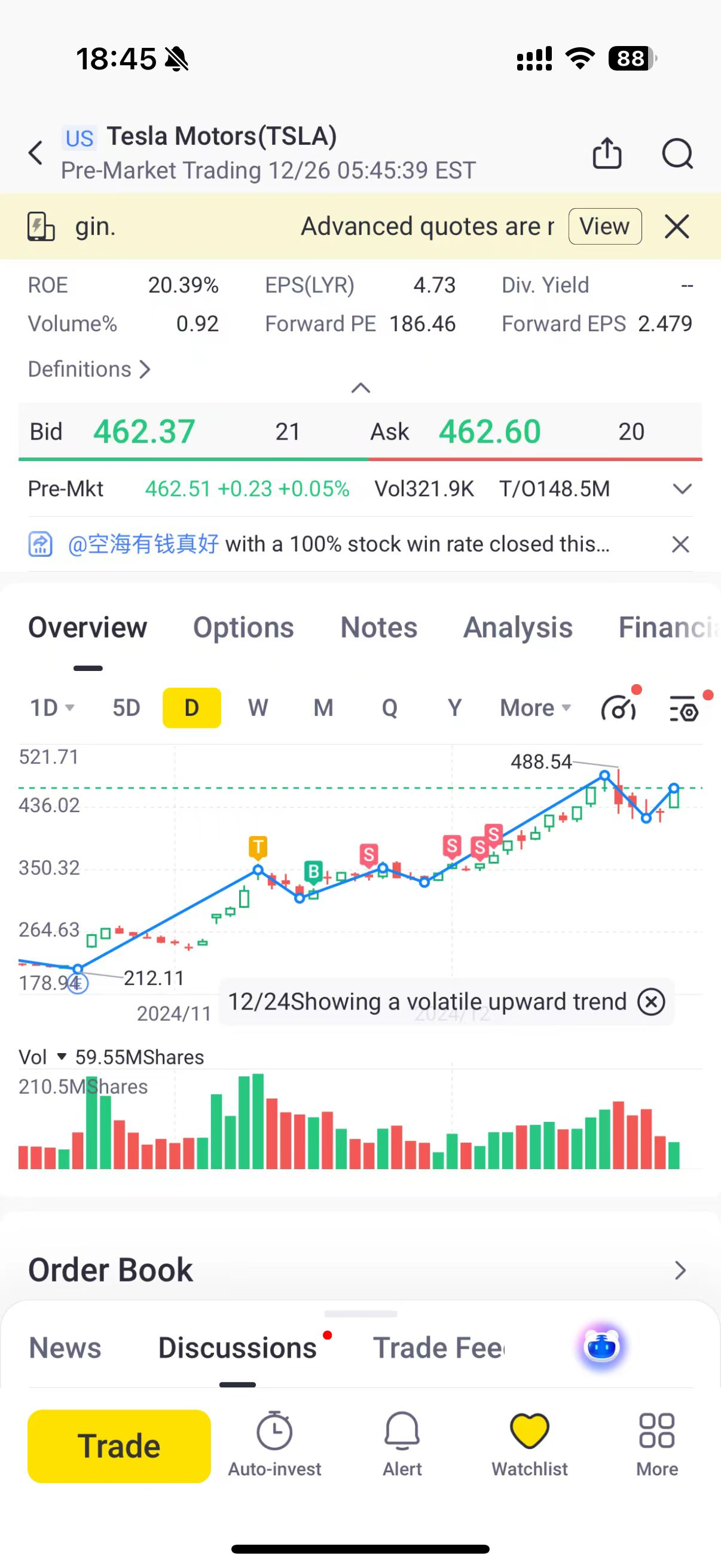

Recently, Tesla’s stock performance can truly be described as soaring to the skies. From $280 before Trump’s election, it has skyrocketed all the way to $470, a whopping 67% increase. I once made a short-term trade on Tesla when it was at $350, but unfortunately, I lacked the vision to hold on. I sold it at $370, and then the stock took off even further.

Reflecting on the pain, while Tesla's current trend looks impressive, is it still a good idea to jump in at these high levels?

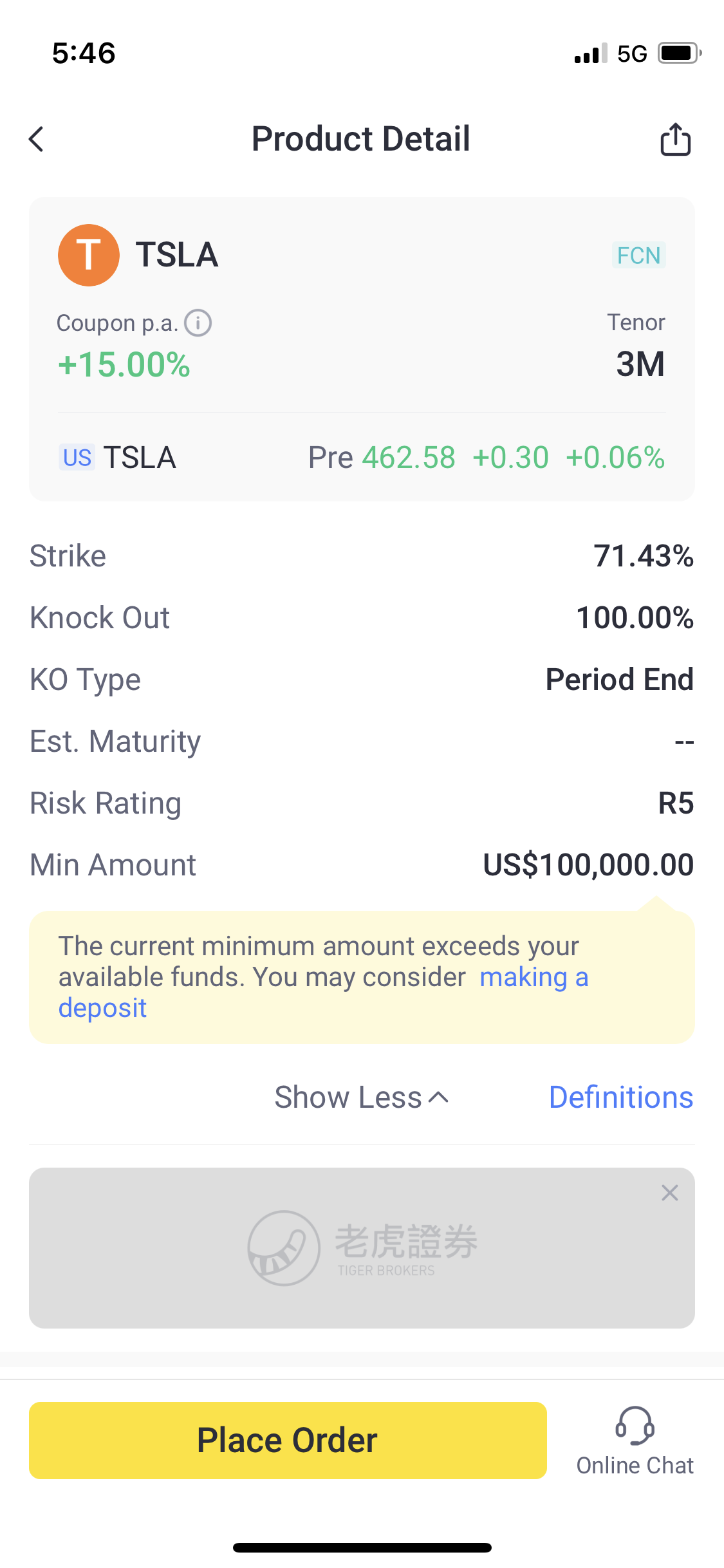

Tiger academy believes that even though Tesla has a promising future, the mindset of someone who got in at the $300 range is entirely different from someone getting in now. So, even though it was sold too early, i still don’t dare to chase it at these highs. Instead, a more balanced offensive and defensive strategy has been adopted—introducing Tesla's FCN in this issue of Yield Hunting.

Let’s look at the parameters:

Annualized Coupon Rate: 15%

Strike Price Ratio: 70%

If we look solely at the coupon rate, it doesn’t seem particularly high compared to high-volatility stocks like MSTR, where rates can easily reach 40%.

However, what really stands out is the 70% strike price ratio under this coupon rate—it’s undeniably attractive. Based on Tesla's current stock price, a 70% strike price ratio means a potential entry price of around $323 ($462 × 70%). Considering Tesla's current momentum and future prospects, $323 might just be a dream entry price for many investors.

In comparison, a sell-put strategy with similar parameters offers an annualized return of 11.34%, while this 15% annualized return not only provides safety but also offers excellent value.

悬赏200虎币

悬赏200虎币

精彩评论