Singapore's latest six-month Treasury bill (T-bill) saw its cut-off yield dip to 2.05%, according to auction results released by the Monetary Authority of Singapore (MAS) on June 5. With yields trending lower, investors need to find alternatives for better returns.

Refer to news on The Business Times here https://www.businesstimes.com.sg/companies-markets/latest-singapore-six-month-t-bill-cut-yield-sinks-2-05?utm_medium=social-organic

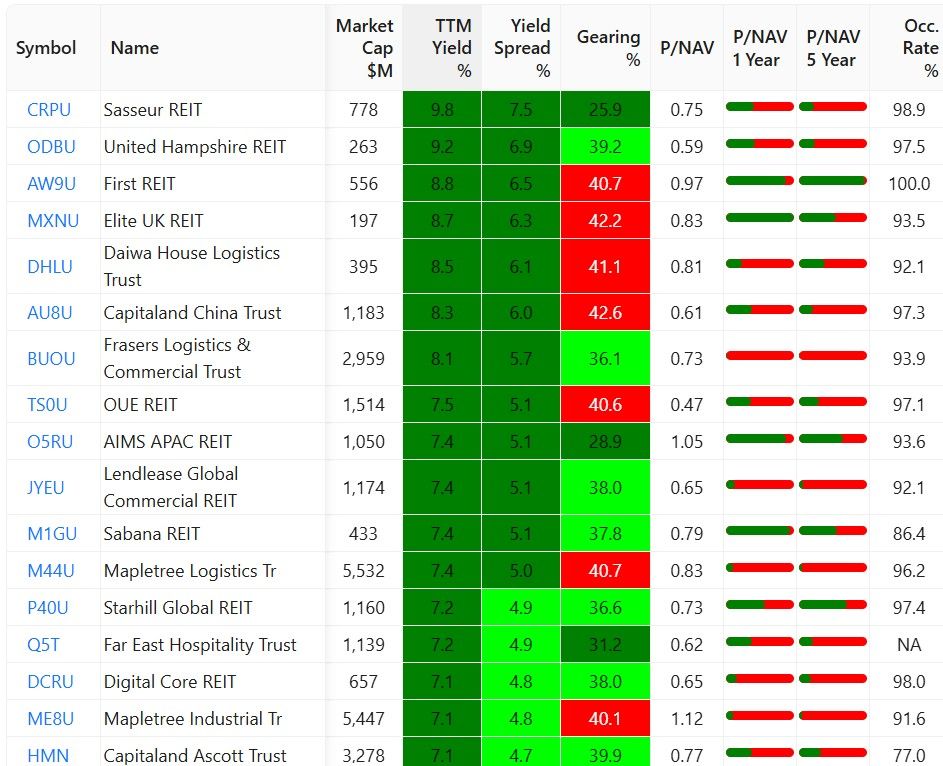

Singapore REITs could be a compelling option, offering trailing twelve-month (TTM) distribution per unit (DPU) yields of up to nearly 10%, along with attractive discounts to net asset value (NAV).

Ready to explore your options? Check out the Singapore REITs Screener here: https://reitsavvy.com/

hashtag#SingaporeREITs hashtag#alternativeinvestment hashtag#DividendStocks hashtag#HighYield

hashtag#Investing hashtag#YieldHunting

Sasseur REIT United Hampshire US REIT First REIT Elite UK REIT OUE REIT Digital Core REIT

精彩评论