$VanEck Vectors Morningstar Wide Moat ETF(MOAT)$

As i start to do a portfolio review to look at how my overall investment is doing, and which area or market segment i am currently expose to, I realize i have many overlapping investments. Especially in ETF and Funds. My DCA ETF and funds very much have a 40-50% overlap. Will need to spend my Dec month to review through and reposition some of these investment.

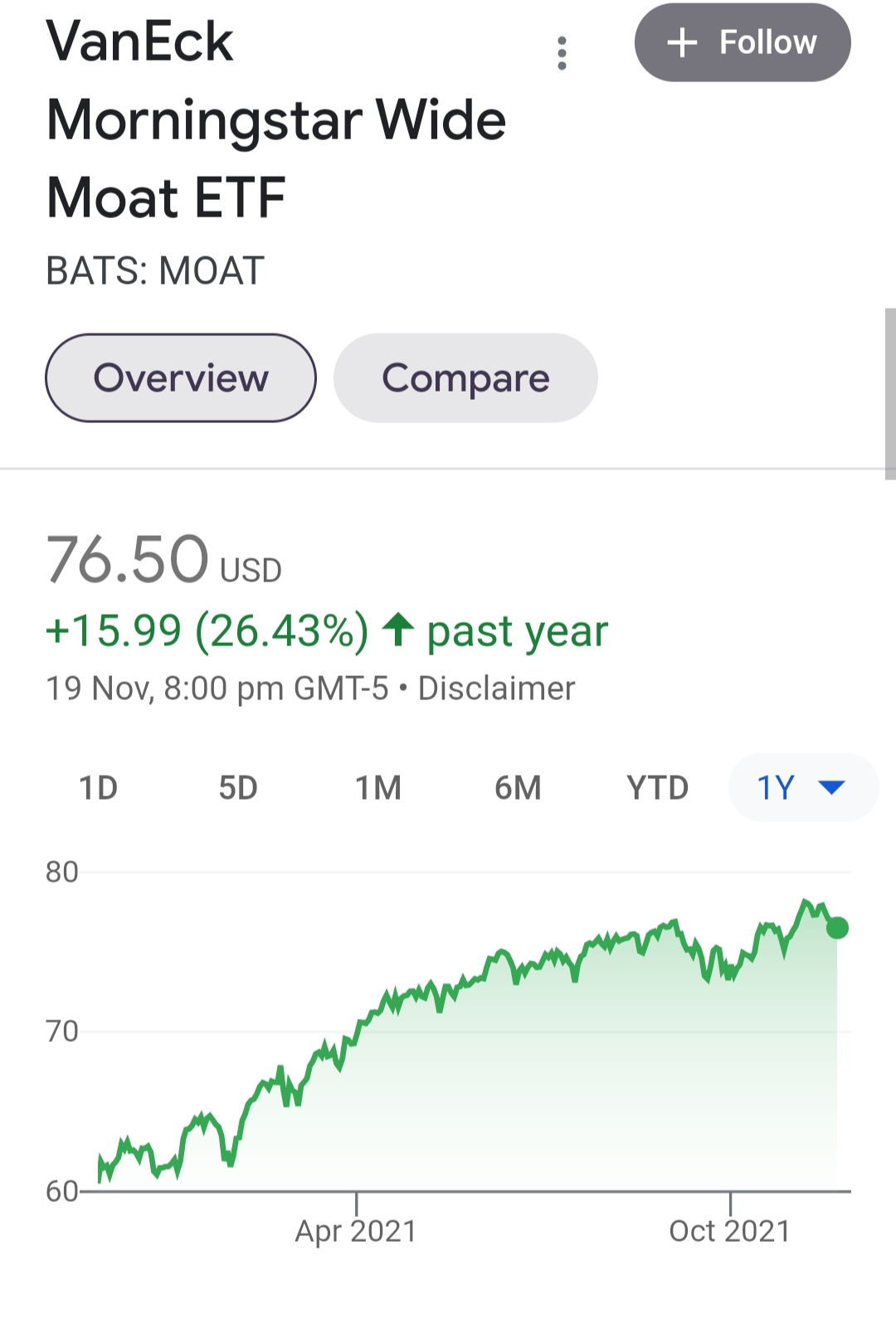

One ETF that I do have in position is the MOAT.

What is MOAT?

An economic moat is a distinct advantage a company has over its competitors which allows it to protect its market share and profitability. It is often an advantage that is difficult to mimic or duplicate (brand identity, patents) and thus creates an effective barrier against competition from other firms.

This is important not only to the company's bottom line but also to potential investors seeking to maximize their portfolios by including companies that will maintain their performance edge. By establishing a defensible competitive advantage a company can fashion a wide enough economic moat that effectively curbs competition within their industry. Essentially, the wider the economic moat, the larger and more sustainable the competitive advantage of a firm.

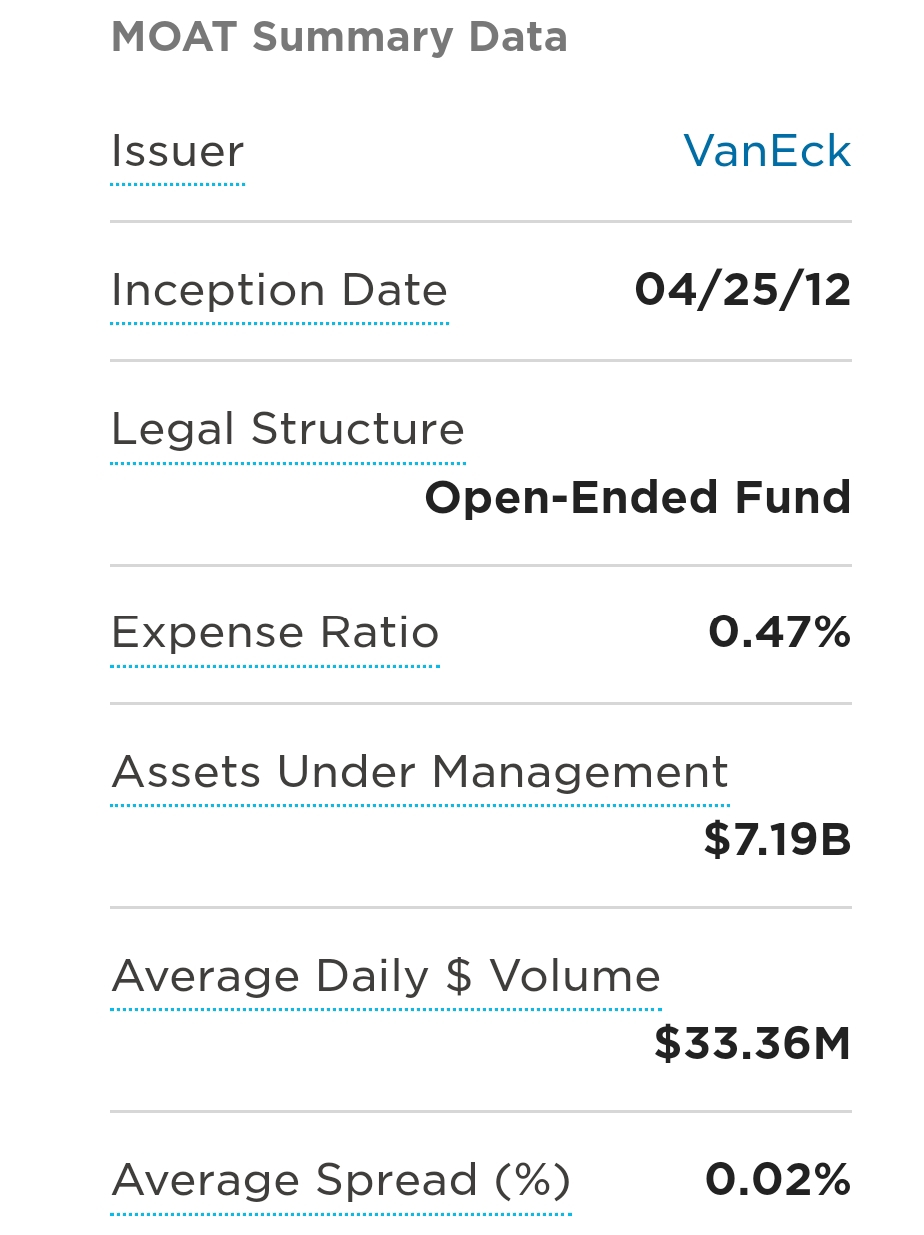

MOAT ETF tracks a staggered, equal-weighted index of 40 US companies that Morningstar determines to have the highest fair value among firms with a sustainable competitive advantage. Meaning, these companies are either clear leader in their own segment or literately close to no competition. Or its cost prohibitive for their customer to switch to another companies.

Sound good to invest in ETF that tracks these company right?

Lets take a look at which companies it actually tracks.

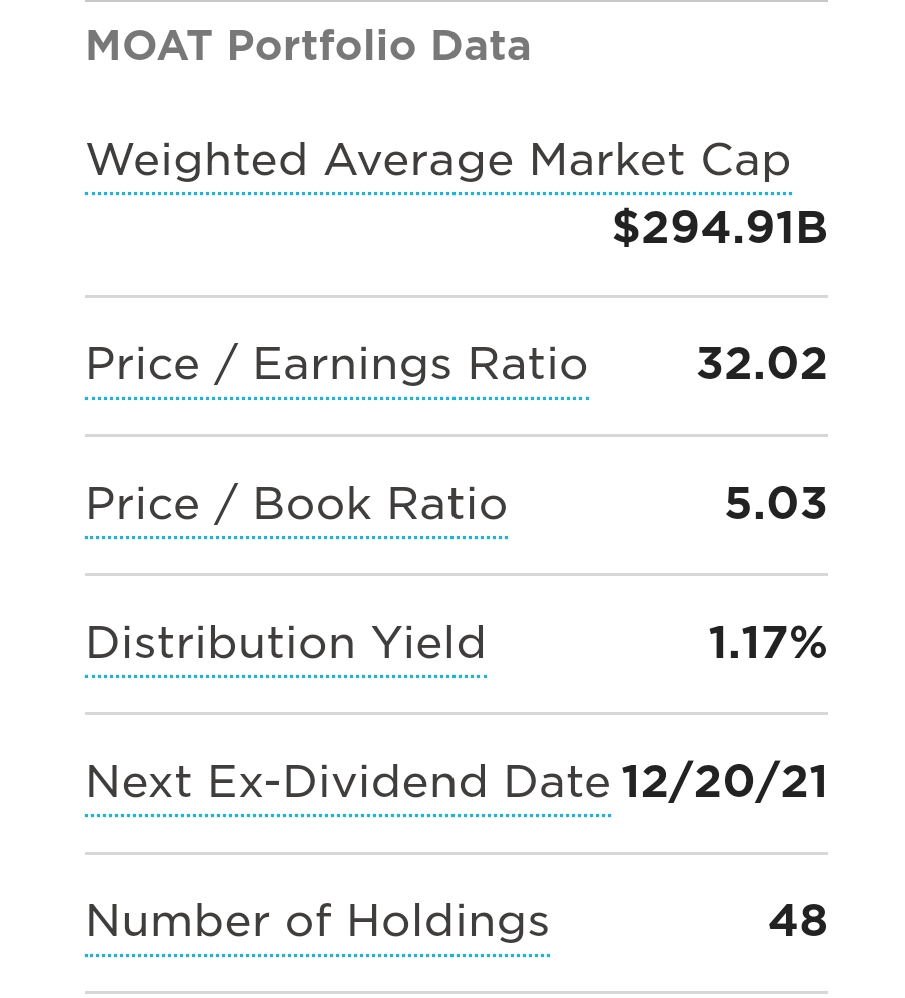

MOAT holds a concentrated portfolio of stocks that are attractively priced and have sustainable competitive advantages (patents, high switching costs, etc.). Morningstar's equity research team determines the fund’s selection by assigning an economic rating and a fair value estimate to the companies in the Morningstar US Market Index. Despite its safe-sounding name, MOAT makes radical departures from market like coverage. The fund favors singlename positions and may have significant sector biases. It follows an equal-weighted index with a staggered rebalance—half the portfolio is reconstituted with equal weights every six months, and the other half follows three months later. MOAT also caps turnover and sector exposure. This results in the fund holding more than 40 names at times.

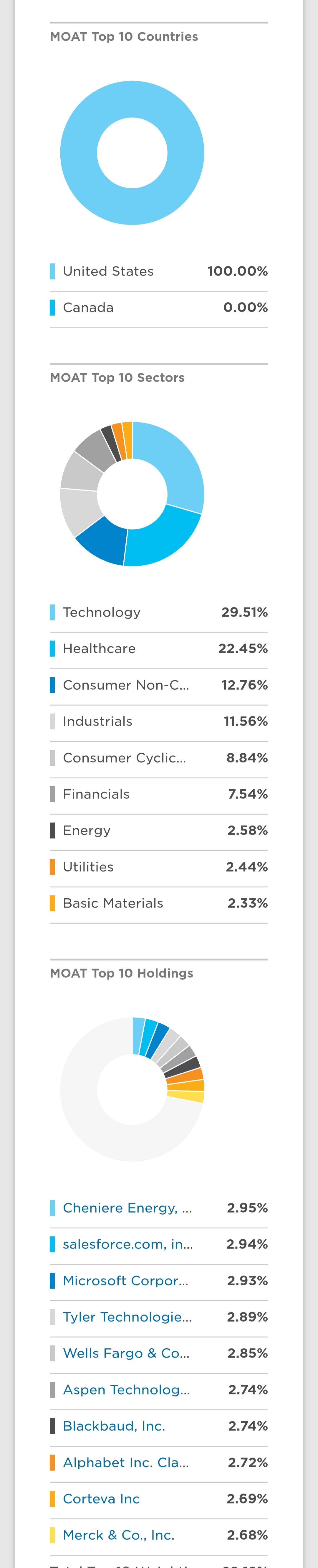

In terms of segment, its holding are diverse, comprises of Technology, Healthcare, Consumer, Industrial, Finance, Energy..etc

Company wise, in top 10, you will see big names like Microsoft,Merck, WellFargo, Salesforce, Alphabet..etc.

Personally, I am a fan of ETF investing. But many of this ETF are tracking very similar companies and and many overlap between these ETF.

And investment in Index ETF itself is already quite diversify, and really no real need and think that we can further diversify by investing in more ETF. But if there is a particular segment that you are bullish and want more exposure, then we can buy into other ETF that tracks that. On the other hand, there is also no harm to buy into multiple ETF. More of feel good, feel safe factor.

Sharing this MOAT with fellow investor.

thank you for reading and happy investing.@Tiger Stars

精彩评论