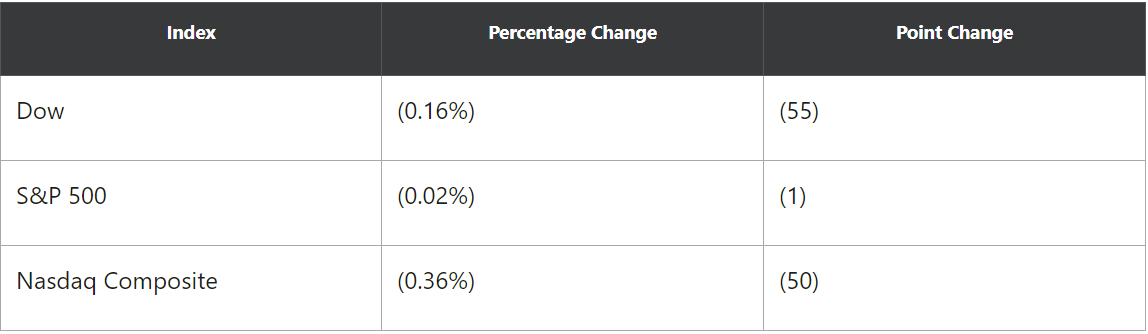

The stock market was slightly lower to start the week.

Investors came into the new week on a downbeat note, consolidating substantial gains from last week that sent the Dow Jones Industrial Average (DJINDICES:^DJI) and the S&P 500 (SNPINDEX:^GSPC)to new record heights. The Dow, S&P, and Nasdaq Composite (NASDAQINDEX:^IXIC)all gave up ground on Monday, albeit with only minimal declines.

Aphria's revenue rose just 6% during the quarter, and gross profit was also up just mid-single-digit percentages even before taking into account fair value adjustments on inventory and biological assets. Meanwhile, a big boost in share-based compensation caused operating expenses to nearly double from year-ago levels.

It's easy to forget as coronavirus vaccine rollouts continue, but much of Aphria's market in Canada and Germany was subject to COVID-19 lockdown measures throughout quarter. The resulting supply glut also weighed on pricing, which hurt gross margin levels.

Collateral damage across the marijuana sector

The bad news from Aphria hurt therest of the pot stock industryas well.Tilray (NASDAQ:TLRY), which is just about set to complete its merger with Aphria, saw its stock drop 13%. Other major players in the field also took hits, including Aurora Cannabis (NYSE:ACB)and its 9% decline, an 8% drop for Cronos Group (NASDAQ:CRON), and the 5% fall in shares of Canopy Growth (NASDAQ:CGC).

Marijuana ETFs also felt the brunt of selling pressure. Both ETFMG Alternative Harvest (NYSEMKT:MJ) and AdvisorShares Pure Cannabis (NYSEMKT:YOLO) posted losses of nearly 5% on Monday.

It's unclear just how long the problems for pot stocks could continue. The rollout of vaccines in Canada has gone more slowly than in the U.S., and Canada has seen significant incidence of more easily transmissible strains of the coronavirus. If vaccinations take longer than hoped, then the spike in COVID-19 cases could put a strain on the cannabis industry throughout the middle of 2021.

Dodging the bullet

However, not all cannabis-related stocks were lower. In the U.S., marijuana real estate play Innovative Industrial Properties (NYSE:IIPR) posted a 1% gain, as it continued to offer a pick-and-shovel entry point for would-be cannabis investors. The company specializes in procuring properties for cannabis operators, sometimes engaging in sale-and-leaseback transactions with cultivators to free up capital for them and generate rental income for itself.

For now, U.S. investors don't seem concerned about potential negative impacts on cannabis from the pandemic. Indeed, with more favorable attitudes toward pot in Washington, U.S.-focused cannabis stocks could well keep seeing gains even if major Canadian producers stay under pressure.

精彩评论