Pineapple giant Dole Plc filed paperwork with regulators Friday for an initial public offering in the U.S., seeking to pay down debt and cover merger costs.

The Dublin-based company, created through a merger between Dole Food Co. and its Irish peer Total Produce Plc, didn’t disclose how many shares it plans to sell or at what price.

Davy, Deutsche Bank Securities and Goldman Sachs are the lead underwriters for the offering. The company plans to trade on the New York Stock Exchange under the symbol DOLE.

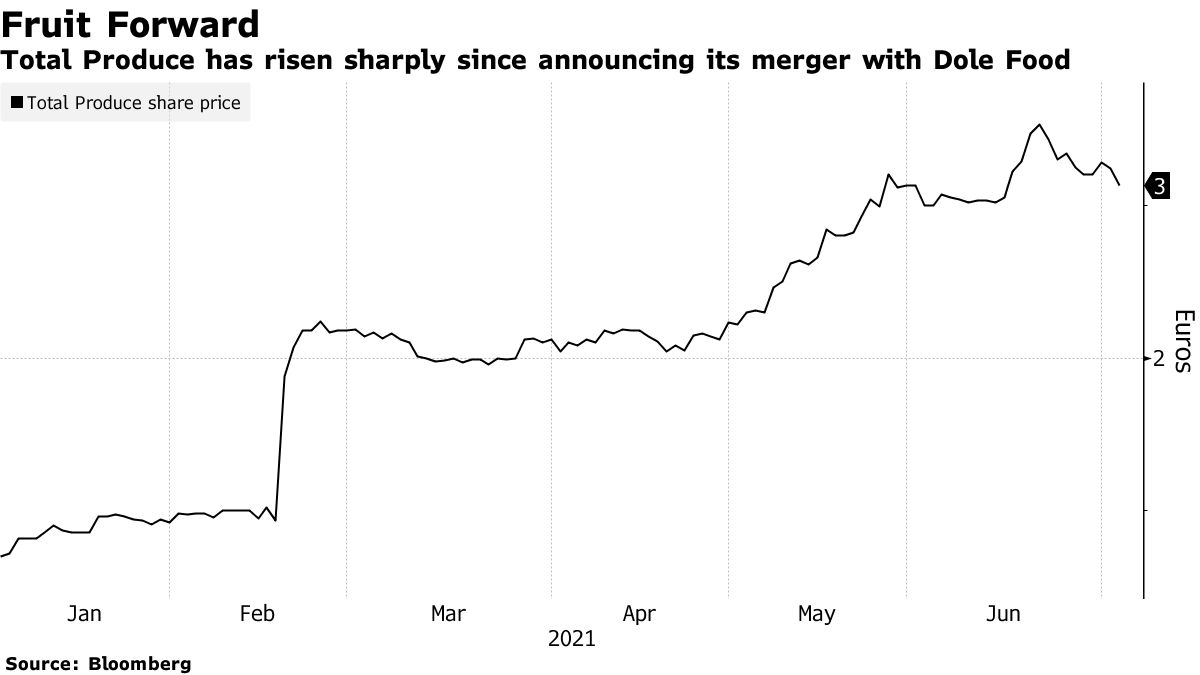

Total Produce agreed to buy Dole Food in February in a deal that placed both companies’ capital into a newly created firm.

Under the merger, Total Produce investors will receive 82.5% of Dole Plc shares. Investment firm Castle & Cooke Inc., which owns 55% of Dole Food parent DFC Holdings, is to receive the rest. The distribution is conditioned on a U.S. IPO.

The pineapple producer said it generated net income of $101 million in 2020 on revenue of $8.97 billion, of which 72% came from fruit. Europe and North America contributed 45% and 49% of revenue, respectively.

精彩评论