Summary

- Spider-Man: No Way Home was a resounding success, painting a bright picture of the future of moviegoing.

- This quarter is set to be AMC's strongest pandemic-era earnings period.

- With bears still arguing that cinemas are dead, an undeniable reality has emerged.

AMC (AMC) has continued to find ways to defy its bears who continue to scream at the top of their lungs about the impending death of moviegoing. This long-established American pastime has proved to be resilient, defying last year's string of pandemic induced stay-at-home orders to go from strength to strength. Hence, even as news around the new COVID-19 variant spread, the latest Sony-Marvel blockbuster,Spider-Man: No Way Home, pulled in the third highest opening weekend ever. This was just behind pre-pandemic Avengers: Infinity Warwhich had a $257.7 million opening. Without mass Omicron fears in the preceding weeks, Spider-Man would have likely taken this position from Infinity War.

What does this mean for moviegoing in the pandemic era? The continued to be repeated bearish argument that box office is going the way of the horse and buggy look set to be finally being put to rest. Over the weekend, AMC sold seven million tickets for Spider-Man: No Way Home, breaking its pandemic-era records for box office performance. For some context, during the entire first quarter of 2021, the company sold less than seven million tickets. Indeed, while bears would be right that this type of extreme seasonality does not bode well for healthy financials, it still stands that an undeniable reality has come about. As long as the blockbusters keep being created, cinemas will continue to sell tickets. The highly acclaimed Matrix Resurrections is also set for release in a few days, crowning what is expected to be AMC's strongest pandemic-era quarter. This will drive material revenue recognition and place the company on the path to generate positive operational cash flow. Hence, this quarter amounts to giving a shot of adrenaline to a tired runner.

The 2022 Movie Slate Is Strong

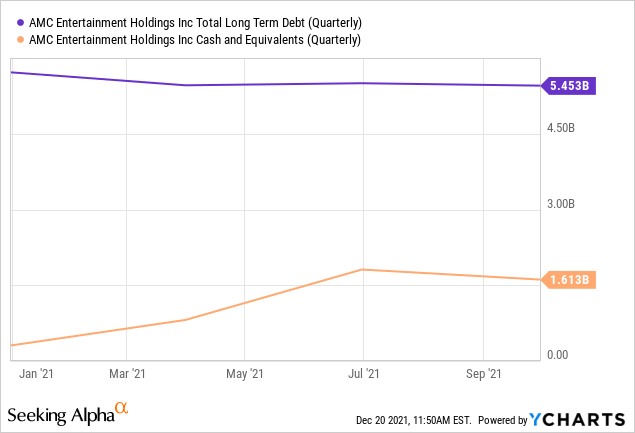

AMC faces headwinds from its large long-term debt balance of $5.45 billion, only partially offset by cash and equivalents of $1.61 billion. This fundamentally restricts the operational flexibility of the underlying business as well as the ability of AMC to chase potential post-pandemic expansion opportunities. The aforementioned seasonality of revenue recognition also heightens the risk of their large debt balance as it increases sensitivity to large periods of zero to negative cash generation from operations.

I think the broader macro picture for cinemas looks healthy as pent up demand for moviegoing throughout last year is released on the back of good movies that households actually want to see. 2022 is likely to see the same phenomena play out as movies likeJohn Wick 4,Thor: Love and Thunder,Avatar 2, and Black Panther: Wakanda Forever,amongst others, are set to be released. These movies are set to build on momentum established by their previous releases.

This bodes well for a company that realized revenue of $763 million for its fiscal 2021 third quarter, a year-over-year growth of 538.7% and a $29.85 million beat on consensus estimates. Adjusted EBITDA was also negative at $5.9 million, albeit a material improvement from the year-ago loss of $334.5 million. This meant the company's free cash flow improved significantly to a loss of $138 million when compared to $385 million in the year-ago quarter. Critically, this $247 million improvement means the company is able to continue to reap expected consumer demand for the moviegoing experience.

Bears would be right to state that the current market capitalization of $14.8 billion is far too much of a premium to pay for the company. Especially as this stands at a significant multiple to its pre-pandemic averages. This beef with the self-proclaimed 'AMC Apes' will likely continue to play out over the next year, leaving capacity for large upward movement in the common shares as the apes look for their own peculiar victory.

Bears On The Backfoot Heading Into 2022

From my purely anecdotal observation watching the latest Spider-Man movie, the audience was filled with a diverse number of people from different age groups. This bodes well for continued demand for moviegoing as it pulls in all subsets of the population. And while AMC does face a high degree of uncertainty, the outlook for moviegoing is not as black and white as suggested by some of the bearish narrative. The company's fourth quarter stands to be extremely hot as a number of strong box office showings aggregate to form record moviegoing demand.

This paints a more vivid picture of AMC's post-pandemic landscape, made cloudy by tales of doom and destruction peddled by bears. The core argument that moviegoing is set to go the way of Blockbuster is likely now dead. As long as good movies exist, there will be cinemas to show them. Does this make AMC a buy? No. The company's financials, although recovering, leave very little room for management error.

This article was written by Leo Imasuen.

精彩评论