Another chapter in a long-lasting drama involving Apple(AAPL)and government regulatory bodies is unfolding. The Open App Markets Act,introducedon August 11, would “protect developers’ rights to tell consumers about lower prices and offer competitive pricing”, among other things.

If passed, will the new legislation have a substantial impact on Apple’s App Store and its high-growth, high-margin business? And if so, could this be a negative catalyst pushing Apple stock lower in the foreseeable future?

Some background first

US Republican and Democrat policymakers agree on very little. A notable exception is the belief that Big Tech needs to be better regulated to ensure fairness and open competition in mobile apps, social media, online search, consumer tech services and others.

The history of scrutiny over the tech monopolies and oligopolies is long. Since launching the Apple Maven channel as recently as May 2020, I have witnessed:

- alawsuitbrought against Alphabet (GOOG) over search ads;

- four proposed antitrust billsagainst Amazon and peers;

- a series of investigationsabout the App Store’s controlof the app market in Europe;

- an epic battle between Apple and Epic Gamesover the App Store’s competitive powers.

Now, app stores have taken center stage once again. According to the Senate bill, U.S. consumers spent nearly $33 billion in mobile app stores in 2020 alone. If the app space were controlled by one single company (it is largely controlled by two), it would be a Fortune 100 company by revenue size.

Yes, it matters a lot

To be fair, this Wednesday’s news did not lead to bearishness, as Apple stock managed to top the performance of a struggling Nasdaq index for the day. But make no mistake: any restriction on Apple’s ability to monetize its user base through the App Store can and should be considered a significant risk.

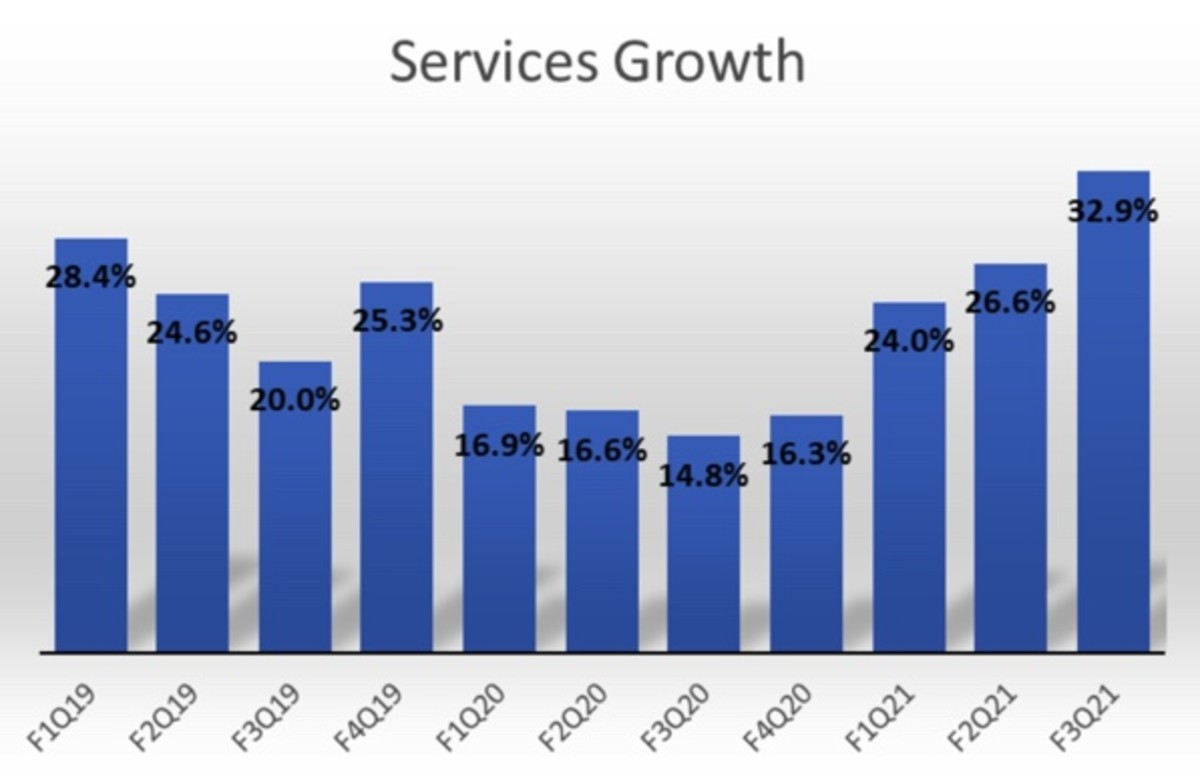

The chart below shows how Apple’s services segment has grown at a healthy average pace of 20% over the past quarters. I estimate that the App Store accounted for about one-third of Apple service revenues in fiscal 2020. Better yet, services carry better margins than Apple’s already high-margin products.

A dent on Apple’s services model could certainly be harmful to the stock. Remember, from myconversation with Wedbush’s Dan Ives, that AAPL’s valuations have expanded substantially in the past decade due, in great part, to this shift toward subscription and recurring revenues.

精彩评论