It was a rough few months, but Ark Investment Management’s Cathie Wood is back.

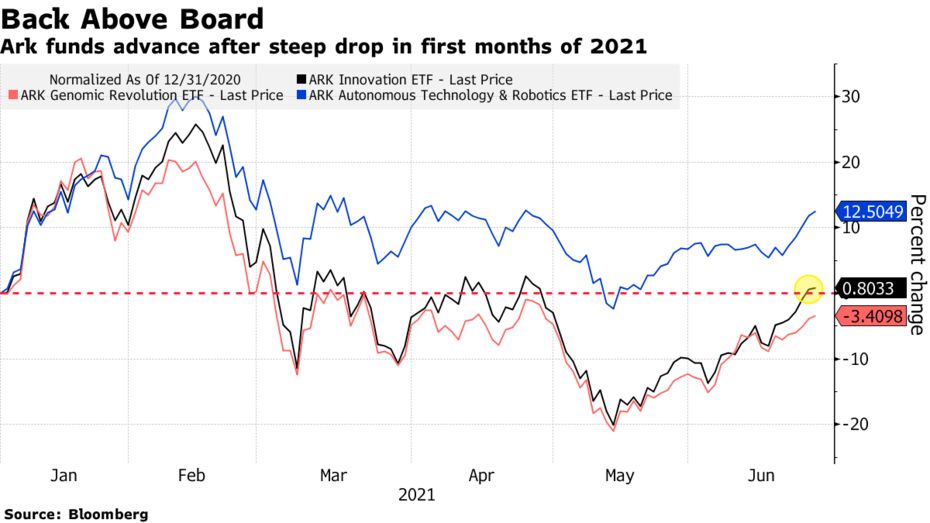

Inflows are picking up, the firm’s pile of assets under management is growing once again, and her flagship fund has gained 26% since its May low. Now the question is, can she keep it going?

The stock picker turnedcult figure, who seemingly got every call right as the coronavirus outbreak reshaped the U.S. economy in 2020, earlier this year suffered her first major blow since emerging into the mainstream. At one point her Ark Innovation exchange-traded fund (ARKK) was down almost 40% from its peak as concerns about higher inflation hammered the high-flying tech names she famously backs.

Yet over the past month and a half, Wood has managed to claw her way back. Her main fund has erased its losses for the year, a welcome milestone for her legions of loyal followers, most of whom stood by her even during the downturn. Of course, inflation jitters could return at any time, which would once again cause growth shares to fall and drag down Wood’s picks.

“ARKK’s holdings are such long duration assets that the biggest risk is interest-rate expectations,” said James Pillow, a managing director at Moors & Cabot Inc. “As long as interest rates remain on the back burner, long-duration assets like tech can remain well bid.”

A representative for Ark Investment Management didn’t respond to a request seeking comment.

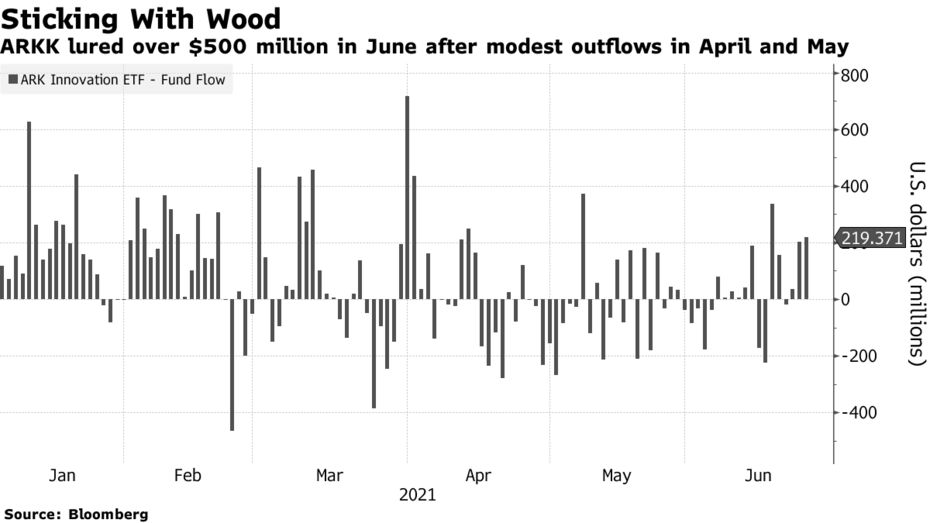

ARKK rallied for a seventh day Friday, the longest winning streak since last July. Over the span investors have plowed more than $900 million into the fund, far exceeding the roughly $250 million they withdrew in April and May, the first monthly outflows since 2019.

Amid the rebound, some of her lesser known ETFs have done even better. The ARK Autonomous Technology & Robotics ETF (ARKQ) is up 12.5% year-to-date, while the ARK Fintech Innovation ETF (ARKF) has climbed 8%.

“People are creating emotional ties to her,” said Mike Bailey, director of research at FBB Capital Partners. “Some of them have probably made money over the past few months, so that strengthens the ties. It would take meaningful month-after-month of underperforming results to break that.”

The rebound comes even as some of Wood’s highest-profile wagers continue to underperform.

Bitcoin plunged below $30,000 this week amid China’scrackdownon cryptocurrencies, andCoinbase Global Inc.-- which Wood bought for her funds in May -- is down 10% since its April listing. Her bet onDraftKings Inc.has also been a drag, tumbling almost 30% from its March high.

Still, ARKK managed to advance 5.5% last week, with top stocksTesla Inc.andRoku Inc.adding 7.8% and 17%, respectively.

“A lot of ARKK’s biggest investments have been fueled by central bank liquidity,” said Matt Maley, chief market strategist for Miller Tabak + Co. “If that liquidity is going to stay plentiful, ARKK should continue to make a come-back.”

That’s helped boost Ark’s total ETF assets under management back to about $47.8 billion, up from a 2021 low of $42.6 billion at the end of last month, according to data compiled by Bloomberg. In total, her firm has taken in $15.8 billion in fresh cash this year.

Bets against her funds are on the decline as well, with short interest as a percentage of shares outstanding down to 2.9% for ARKK, compared to 4.6% in early May.

Still, Wood might want avoid taking a victory lap.

“It could be just a bit of a breather in this battle between a spike in inflation, ‘is the Fed going to hike rates,’ ‘is that going to hurt growth,’” FBB’s Bailey said. “We’ve seen a pause in that battle, and that’s given Cathie Wood and some of the hyper-growth stocks some room to run.

精彩评论