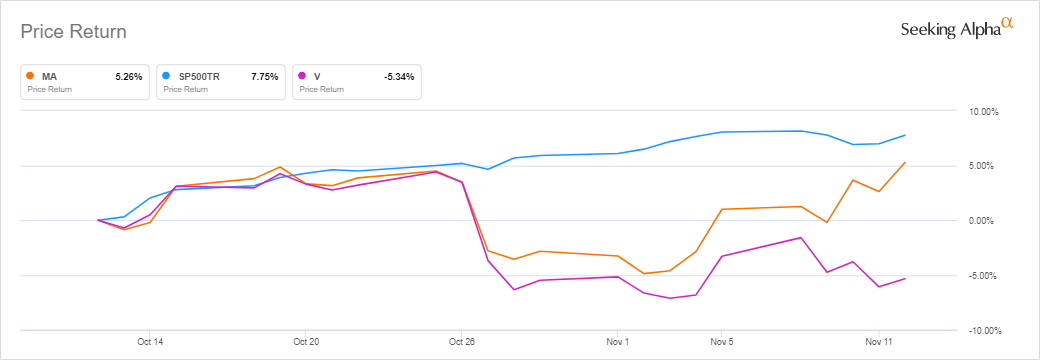

In the past couple of weeks Mastercard (NYSE:MA) stock pulls away from rival Visa (NYSE:V), as Mastercard announces a spate of crypto and BNPL announcements while Visa's shares appear to be weighed down by a Department of Justice investigation.

Both stocks, though, are lagging the S&P 500's 6.7% increase. MA gained 5.3% over the past month while Visa fell 5.3%.

Note that the divergence coincides at about the time Visa issued disappointing guidance, then the Wall Street Journal reported a U.S. Justice Department investigation into Visa's arrangements with fintechs Square (NYSE:SQ), Stripe (STRIP), and PayPal (NASDAQ:PYPL).

Both Mastercard and Visa stocks dropped, but Visa fell further. Then Mastercard reported better-than-expected Q3 earnings as cross-border spending rebounds.

Mastercard (MA) has recently made a number of announcements highlighting its embrace of crypto and Buy Now Pay Later features. It has teamed up with Bakkt and a number of partners in Asia on crypto services and acquired crypto intelligence platform CipherTrace. The card also expanded its installment payments program to include American Airlines, Fiserv, and Global Payments, among others.

Just this past week, Mastercard introduced long-term performance goals at an investor conference last and its CEO appeared on CNBC's "Mad Money" program.

Don't count Visa (V) out, though. Interest in the stock may be rising, as more Seeking Alpha users are adding the ticker to their portfolios. The ratio of adds to removals is 1.67, according to SA data.

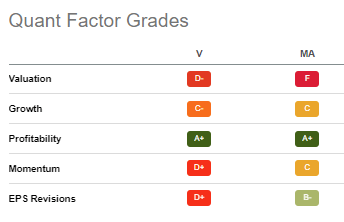

SA's Quant rating ranks the two card network rivals as nearly identical :

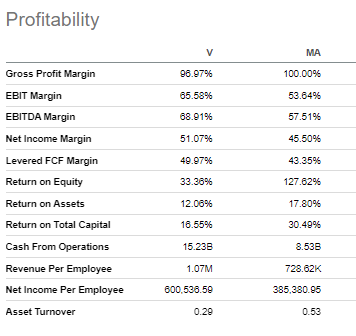

Comparing the two companies' profitability metrics, Visa (V) surpasses Mastercard (MA) on revenue and net income per employee as well as cash from operations, while Mastercard excels at return on equity and return on total capital:

Over a 10-year time horizon, Mastercard and Visa have closely tracked together as seen in the graph below.

SA contributor Librarian Capital digs into Mastercard's Q3 results and sees Visa's (V) 7% share price correction as unjustified.

精彩评论