During the 2020 pandemic, people around the world were forced to stay at home. Remote working became the norm, and, when not possible, the state intervened and supplemented the households’ income via fiscal support.

The support took various forms. From cutting the VAT (e.g., in Germany) to direct help from the state towards the employees (i.e., Spain), to direct checks sent to the population – you name it. In the end, the income gap was filled – in some countries faster than in others.

In the United States, most people earned even more during the pandemic than they did on their regular job. Because they had plenty of time to spend online, investing part of the stimulus came as a logical response to the lockdown. What started small transformed into a huge market-moving trend, as the retail trader now is responsible for wild market swings.

Over 20% of Stimulus Checks Will Be Invested in the U.S. Stock Market

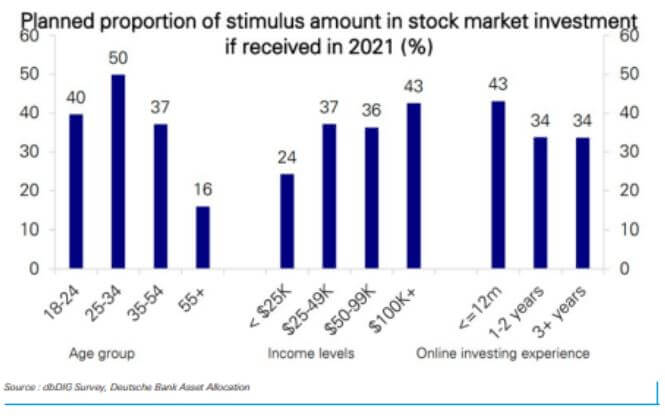

A survey run by Deutsche Bank recently reveals that over 20% of the new $1.9 trillion “stimmy,” as retail traders call the fiscal stimulus, will find its way to the stock market. That is a nice push for the stock market, and the percentage is bigger among the age group 25-34. It shows that the new class of retail investors is here to stay, especially if we look at the younger group’s 40% planned stock market investment.

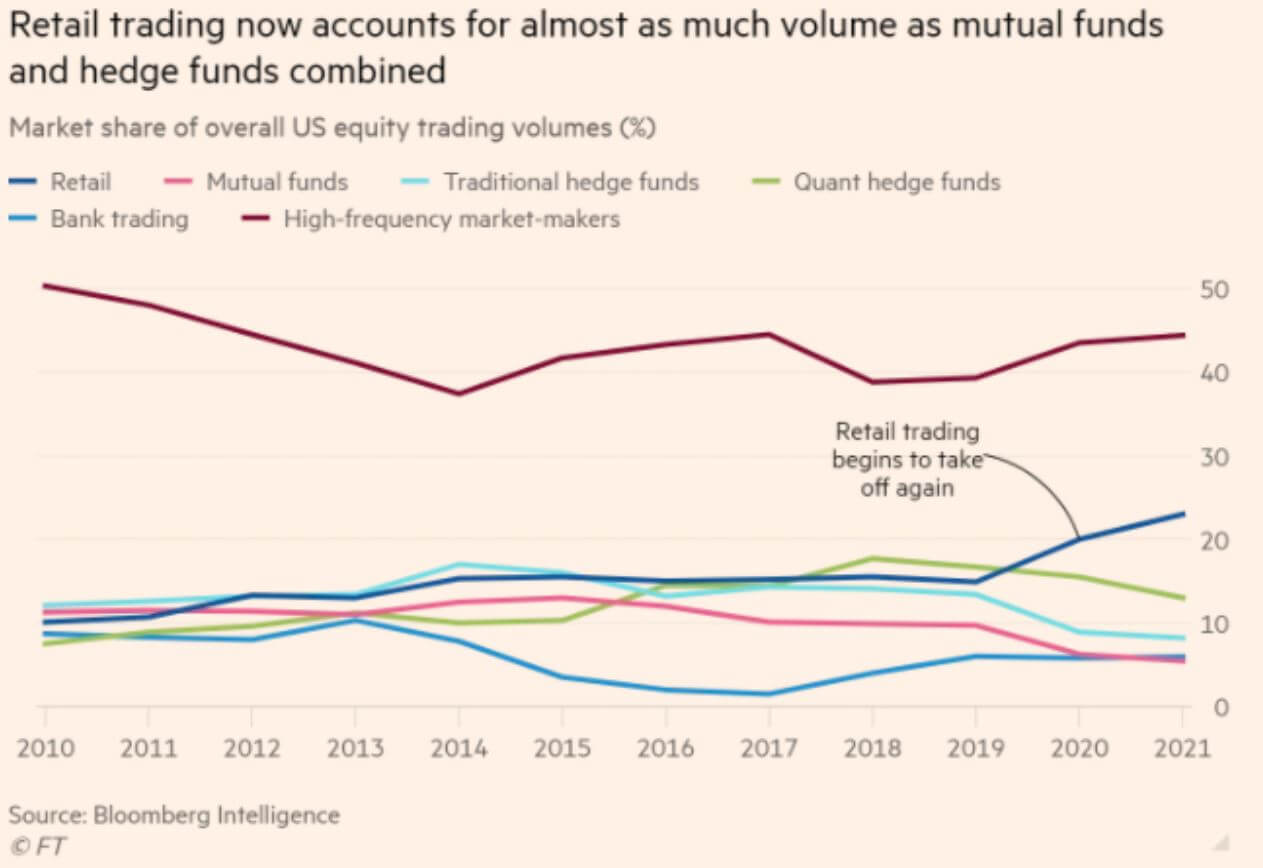

Indeed, since the second half of the last year, interest in stocktradinghas exploded in the United States. Retail trading literally took off, exceeding the volume of mutual funds and hedge funds combined.

Moreover, retail traders suddenly realized the power of trading in unison. Wild market swings in some names (e.g., GameStop) in January of this year turned out to be driven by a group of millions of traders organized on a Reddit’s subgroup.

Furthermore, their trading revealed deep knowledge of market mechanisms. They used a combination of direct common shares purchasing and call options to put pressure on hedge funds heavily exposed on the short side. The outcome? Short-sellers reported losses of hundreds of millions of dollars. Therefore, the retail trader is not represented by the baby boomer anymore, the passive investor interested in a buy and hold strategy.

Instead, the new retail trader is young, knowledgeable, sophisticated, and with a desire to learn. When you put some free money in the hands of such a trader, coordinating trading may result in wild stock market fluctuations.

精彩评论