Summary

- Gilead Sciences is a solidly profitable enterprise with high margins and strong free cash flow.

- While it does have patent cliffs to deal with, the promising pipeline could make up for that.

- GILD appears to be cheaply valued. I also highlight the dividend, balance sheet, and other points worth considering.

Some investors may shy away from battleground stocks for various reasons. It’s important to keep in mind, however, that there are two sides to every coin, and where some investors see risk, others see opportunity. This brings me to Gilead Sciences (GILD) which appears to be one such stock.

In this article, I highlight the positives and negatives around the stock, and examine what makes it a buy at present for dividends and growth, so let’s get started.

What Makes Gilead A Buy

Gilead Sciences is a large-cap biopharmaceutical company that’s been around for more than three decades, and operates in more than 35 countries worldwide. It’s best known for producing medicines that treat life-threatening diseases, including HIV, viral hepatitis, and cancer. In the trailing 12 months, Gilead generated $25.6B in total revenue.

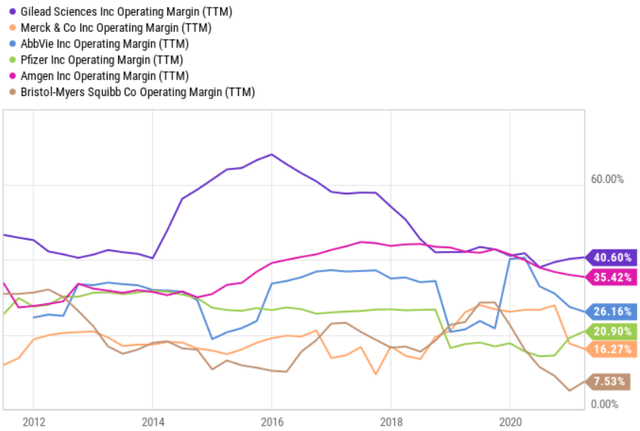

One of the reasons for why I’m bullish around GILD is that the enterprise remains a cash cow, as supported by its high margins. Over the past decade, GILD’s operating margin has stayed above the 40% mark for virtually the entire time. This speaks to the mission-critical nature of its treatments and the pricing power that GILD has held over this time period. As seen below, GILD’s op margin sits above that of its U.S. peers Merck (MRK), AbbVie (ABBV), Pfizer (PFE), Amgen (AMGN), and Bristol-Myers Squibb (BMY).

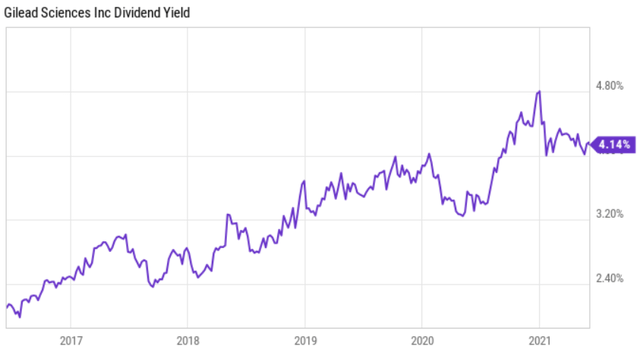

Secondly, at the same time, GILD currently sports one of the highest dividend yields in the pharmaceutical sector. At the forward yield of 4.3%, GILD’s dividend sits only below that of ABBV’s 4.7% yield in the aforementioned peer group. It also comes with plenty of safety and growth, as it has a payout ratio of 40%, with a 5-year CAGR of 16.4%. The low payout ratio leaves GILD with plenty of financial flexibility for repayment of debt and share buybacks, and this includes $1.3B of debt repayments and $309M of share repurchases during Q1’21.

As seen below, GILD’s dividend yield is now nearly at the highest level over the past 10 years, as a result of both relative undervaluation and robust dividend growth over this time frame. Note: the following chart shows the dividend yield based on the trailing 12 months’ dividends.

Thirdly, GILD has a promising pipeline in the novel cancer drug, Trodelvy, with new indications. This includes applications for breast cancer, bladder cancer, and advanced urothelial cancer, which was recently grantedaccelerated approvalby the FDA in April. Trodelvy has the potential to become the next blockbuster drug for GILD, as Morningstar estimates it to generate probability-weighted sales of $5B annually by 2030. This is rather significant, as it represents 20% of GILD’s current annual run rate revenue.

Meanwhile, GILD continues to post strong results, while other big pharma companies have seen declines. This is reflected by a strong Q1’21, during which GILD’s revenue increased by16%YoY to $6.4B, driven by Veklury (also known as Remdesivir, the anti-viral treatment for COVID-19), and Yescarta & Tecartus, which are cancer treatments that came from the Kite Pharma acquisition. I’m also encouraged by adjusted EPS improving by 24% YoY driven by operating efficiencies and a lower tax rate.

Balance Sheet and Valuation

Turning to the balance sheet, GILD’s net debt balance has increased in recent years as a result of an aggressive acquisition strategy. This includes the acquisition of Galapagos in 2019 for nearly $4B, and the acquisition of Immunomedics last year for $21B, which brought in the drug, Trodelvy. I’m encouraged by the $1.3B of debt repayments made during the first quarter, and the net debt to EBITDA ratio of 1.7x sits well below the 3.0x level that I prefer to see.

Plus, GILD generated levered free cash flow (after interest payments) of $8.7B over the trailing 12 months. After dividends, this leaves $5.2B in remaining cash flow to repay debt. As such, GILD could hypothetically reduce its net debt balance to $0 after just 4.5 years, should it maintain at least the same level of FCF.

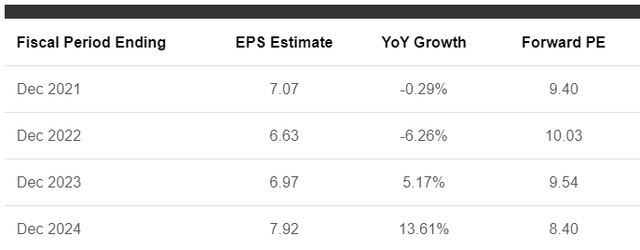

Valuation-wise, I find GILD to be attractive at the current price of $66.48, with a forward PE of just 9.4. At this valuation, GILD is essentially being priced for a no growth future, which I don’t believe to be the case. While analysts expect a mid single-digit decline in earnings next year, bottom-line profitability is expected to pick up in the 2023-2024 timeframe, with 5-14% annual EPS growth. This brings GILD’s forward PE to just 8.4 based on 2024 analyst estimates. Analysts have a consensus Buy rating on GILD, with a $75 price target, and Morningstar rates GILD as a 4-Star Buy, with an $80 target.

Of course, no investment is risk-free, and the following points are worth considering:

- Like all pharmaceutical companies, GILD has to deal with patent cliffs. This includes patent expirations on its HIV drugs this year. As such, GILD will need to convert its HIV patients to newer products like Biktarvy.

- There’s no guarantee that newer drugs and ones in the pipeline will live up to their expectations.

- Price competition from peers may give PBMs (pharmacy benefit managers) more leverage to negotiate aggressively with GILD.

- Investors should always maintain appropriate risk caps and diversification.

Investor Takeaway

Gilead Sciences is a battleground pharmaceutical stock that appears to be cheap by all measures. While there are some legitimate concerns around patent cliffs, GILD remains a solidly profitable enterprise with strong margins and free cash flow, and has a promising pipeline. Meanwhile, GILD pays a well-covered 4.3% dividend yield with a low payout ratio.

This leaves plenty of room for share repurchases and debt paydown, which management executed on during the first quarter. At the current valuation, GILD is priced for a no-growth future, which I do not believe to be the case. As such, I view GILD as being an attractive buy for long-term income and growth.

精彩评论