AMC CEO Adam Aron has shown sympathy for the Ape cause. However, he still has a business to run. Should the chief executive be trying to raise more money for AMC?

Some background first

AMC Entertainment’s (AMC) - CEO Adam Aron probably had no idea what was in store for him and his company in 2021. With the start of the COVID-19 crisis, AMC and much of the entertainment industry were in tatters, scrambling for resources to weather the storm and come out of it alive.

Growing bearishness led hedge funds and other traders to pile up on AMC, as they looked to profit from its misfortunes. The bear thesis gained strength as some believed that the movie theater operator was heading towards bankruptcy.

But no short seller could have imagined what would happen next. Driven by the “meme mania” that first struck GameStop (GME) , a community of retail investors poured their capital into other heavily shorted stocks, and AMC took center stage.

After the ape army witnessed a short squeeze in January 2021, AMC saw its market cap jump from $250 million to almost $8 billion. Later in June, the valuation stretched even further to nearly $32 billion – surpassing the market cap of airline companies like Delta Airlines (DAL) and retailers like Best Buy (BBY) .

Not bad for a company that some had left for dead only a few months earlier.

How apes could help AMC

There are a few ways for a publicly traded company to benefit from an increase in its stock price: (1) more firepower for acquisitions and other deals, (2) less vulnerable to takeovers, and (3) new shares issued to generate capital and improve the company's balance sheet.

CEO Adam Aron benefited from the stock's strength when the company issued new shares in early June. AMC raised $587 million in equity, just after the second short squeeze of the year. According to him, the capitalraisedwas invested in the company's balance sheet and saved for “a rainy day”.

Stock tanks after share issuance

With the issuance of the 11.5 million new shares, AMC price topped and dropped quickly. The dilution of the company’s equity may have helped to deflate June’s short squeeze, giving bears the opportunity to regroup and reload their positions.

Recently, Adam Aron put to vote a plan to issue another 25 million shares, but shareholders rejected the idea. The CEO did not hide his opposition to the results of the vote, but made it clear that he listens and values the ape community.

Staying liquid seemed like a top priority for AMC through 2020 and the early part of 2021. Therefore, the June share issuance was likely the best move. But recently, AMC locations started to reopen, and the movie theater company has alreadywitnessedrecord-breaking audiences.

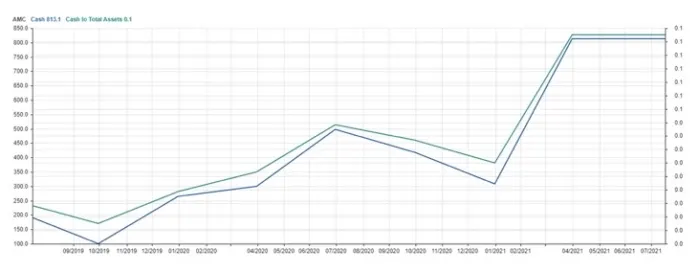

So, is CEO Adam Aron doing the right thing by following the ape community and refraining from raising more capital? Wall Street Memes believes so. The worst for AMC has probably been left behind, and the company currently holds $800 million in cash and equivalents (8% of total assets vs. only 3% at the start of the year, see chart below).

精彩评论