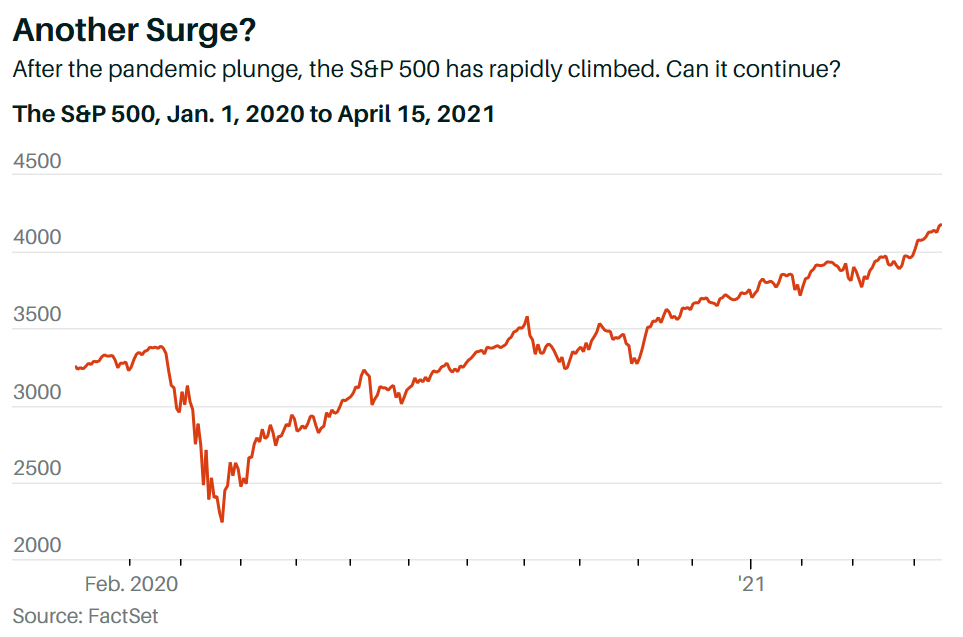

Another rapid surge by stocks might seem unlikely, given that the S&P 500 is up just over 11% to 4185 this year, leaving it 8.6% above the 3,800 Citigroup global equity predicted for the year end. Investors have bid up stocks on a giddy mix of vaccines, stimulus, and pent-up demand. Is it possible, as one analyst suggests, that another 9% leap lies ahead?

Maybe, if everything goes right. President Biden’s $4 trillion infrastructure bill would have to pass without big hikes to corporate and capital-gains taxes to finance it. The pandemic would have to be a nonissue by summer. Inflation would have to be minimal, limiting pressure on the Federal Reserve to keep interest rates low. Earnings estimates would have to rise, and valuations remain high.

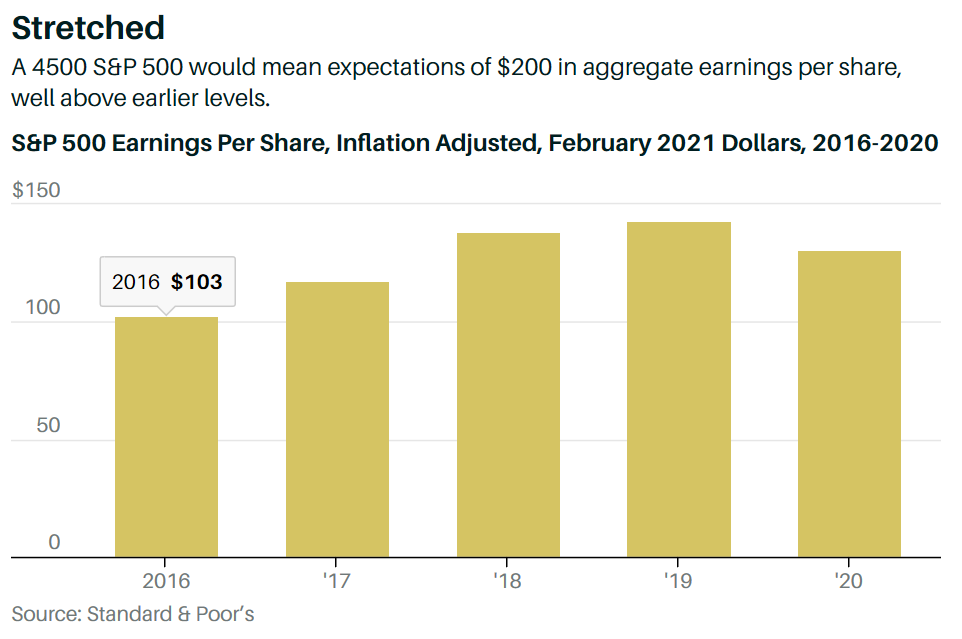

Tom Essaye, founder of Sevens Report Research, is a believer. “That scenario is entirely possible, and if it comes to fruition, then we should expect the S&P 500 to trade into the mid-4,000s, or maybe higher,” he wrote in a note predicting a 4,500 S&P by year end. At that level, the index would reflect expectations for aggregate earnings per share of $200 for S&P 500 companies, assuming valuations don’t change relative to anticipated profits. Aggregate EPS of $200 is Wall Street’s consensus for 2022.

Of course, lots could go awry. Centrist Democrats in Congress could curb the infrastructure bill. Interest rates could keep rising even without higher inflation because 10-year Treasury yields remain below expected inflation rates. Bigger yields on Treasury debt would make bonds more appealing relative to stocks, weighing on valuations. That doesn’t mean investors shouldn’t buy stocks, but it might make sense to do it later, rather than sooner.

精彩评论