In the past, the sell-in-May strategy shakes out better in Europe than in the U.S.

Stocks have been on a tear this year, leaving investors to question whether to "sell in May and go away."

"With stocks at record highs, some investors may be tempted to follow the old adage," a team of strategists at UBS Group's global wealth management division, wrote in a note Friday.

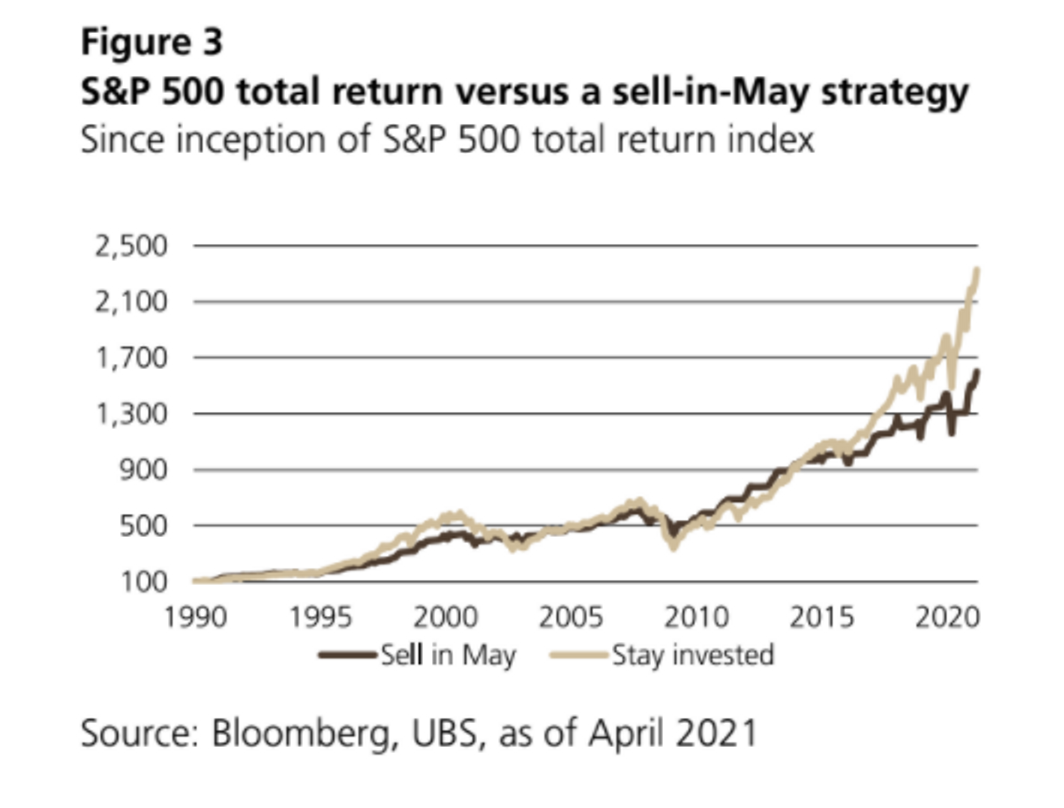

The hypothesis is that equities tend to underperform in the six months through October, so investors should sell stocks at the start of May, invest in cash and then re-enter the market in late autumn, the strategists said. Historically, the approach has worked for Europe, but not as well in the U.S., according to their note.

"In the U.S., a stay invested strategy has tended to outperform, particularly in recent years," the strategists said. "Market composition, with the U.S. market more tilted towards growth stocks, partly explains the outperformance."

The technology sector now accounts for 27% of the S&P 500, or much higher than the 8% weighting for the MSCI Europe index, according to UBS. For that reason, investors who tried timing the U.S. equity benchmark for "seasonal reasons" would have missed the outperformance of growth stocks in the bull market since the global financial crisis of 2008-09.

Using the past as a guide, the UBS team recommends staying invested, even through they also point to historical evidence in Europe that supported a sell-in-May strategy.

Over the past 15 years, returns in Europe have been negative in June 80% of the time, according to the report. "This has contributed to a sell-in-May strategy outperforming a stay invested strategy during those years," the strategists said.

Meanwhile, the U.S. stock market has risen to all-time records this year, including as recently as this week, as measured by the S&P 500 and Dow Jones Industrial Average benchmarks. The S&P 500 rose to a record 4,211.47 finish on April 29, for example, and was up 11.3% this year as of Friday's close.

"We are now entering a time of year when stocks have historically found it more challenging to advance," according to the UBS report. "With many equity indexes making new highs, some measures of sentiment looking extended, and ongoing concerns about the spread of new COVID-19 variants," some investors may be contemplating selling.

Billionaire investor Leon Cooperman, a self-described "fully invested bear," told CNBC on Friday that he has "an eye on the exit" given a coming expected rise in taxes, inflation and a "reasonably richly appraised market."

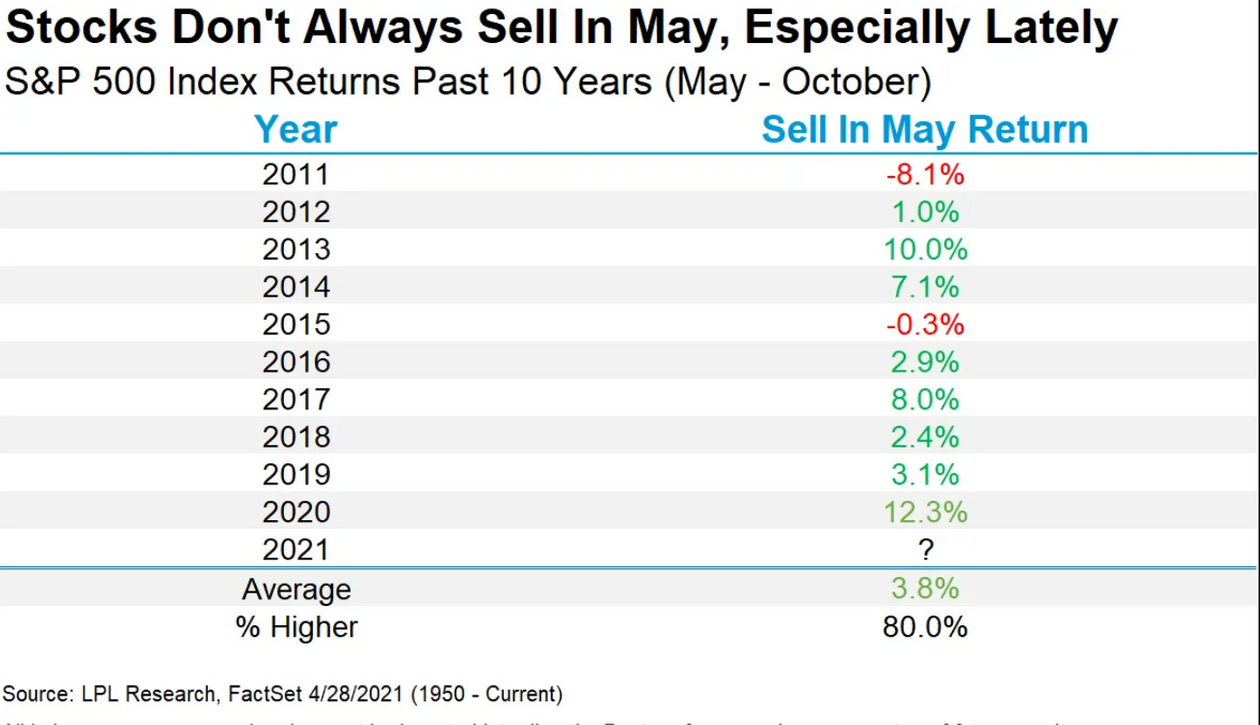

Ryan Detrick, chief market strategist for LPL Financial, said in a blog Friday that the six months from May through October have been "some of the weakest months of the year for stocks" in the past 10 years. "But with an accommodative Fed, fiscal and monetary policy, along with an economy that is opening faster than nearly anyone expected, we'd use any weakness as an opportunity to add to positions," he said.

"Here's the catch," Detrick said. "Stocks have actually been higher during these worst months of the year eight of the past ten years."

精彩评论