Like a pinball stuck in a machine, markets have been wedged in. The S&P 500 hasn't seen a move greater than 0.4% in either direction for the last seven consecutive sessions. If the stock market were to close for the entire rest of the year, a 12% rise in the S&P 500 certainly wouldn't be a bad result, but it's worth examining why there's so little movement right now.

It might be worth looking at the benchmark asset for all securities, the 10-year Treasury . After surging from below 1% to as high as 1.78%, the yield on the 10-year Treasury has just kind of drifted. That's despite sensational economic data, including the 70 reading registered on the IHS Markit services purchasing managers index released Thursday.

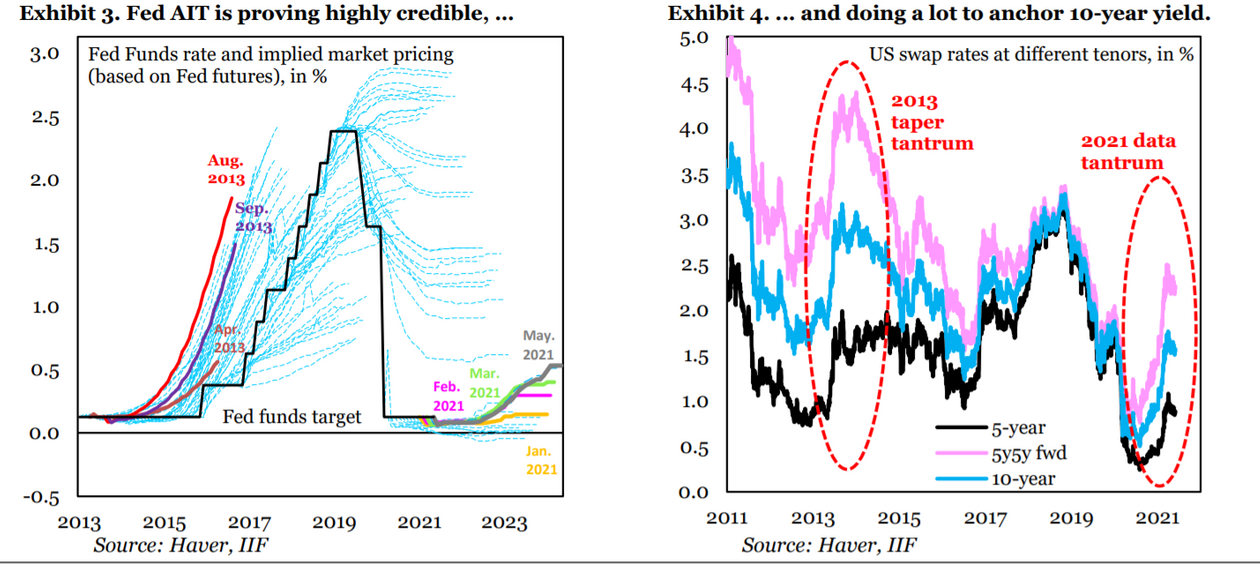

The Institute of International Finance, the trade body for banks, said what's going on is that markets are believing the Federal Reserve. In particular, they think the Fed average inflation targeting program is anchoring longer-term yields.

Compared with the 2013 taper tantrum, IIF's economists led by Robin Brooks say it's notable how few Fed rate hikes are priced in.

The surprisingly weak April payrolls report, they note, was an 8-standard deviation surprise, yet it did little to move bonds in either direction. "To break the stalemate on the 10-year, payrolls will need to show real progress on labor market recovery, which is still outstanding," they said.

The IIF rejects the idea that slowing Chinese credit growth is the real reason markets have hit pause. "That impulse doesn't even correlate with China's GDP, let alone global activity," they say.

精彩评论