Corporate profits are set to surge next year in Europe, and along with them a big jump in stock buybacks, according to strategists at Citi.

Strategists led by Beata Manthey expect a 60% jump in European company earnings per share, which will help drive a 30% gain in stock buybacks.

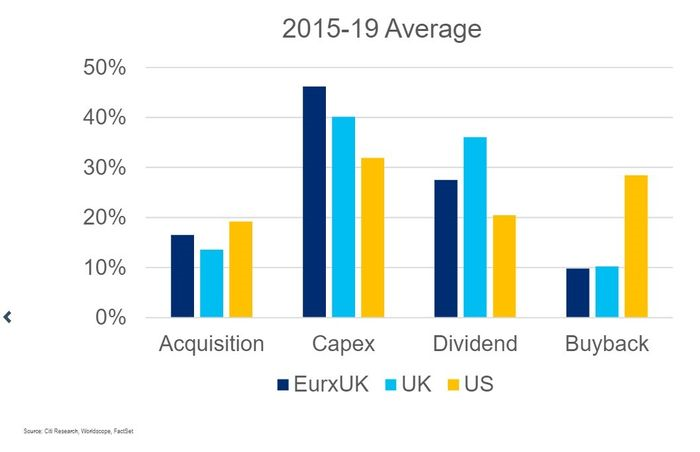

That's not a typical use of cash by European companies, that are more likely than their U.S. peers to return cash in the form of dividends. In 2021, Citi estimates the typical company has spent 39 cents on every euro in dividends and 9 cents on dividends. (About 46% is spent on capital expenditure, and 14% on acquisitions.)

"The overall story is that dividends picked up sharply this year, but buybacks should rise most next. Our forecasts suggest the European dividend:buyback ratio will be 2.6 :1 in 2022, down from 3.3 :1 in 2021. But this is still very different to the US 0.7:1 dividend:buyback ratio," said the analysts.

European stocks traded lower Thursday, as traders priced in the late-session swoon on Wall Street on Wednesday.

The Stoxx Europe 600 fell 1.5% to 463.72.

Of the major regional indexes, the German DAX declined 1.6%, the French CAC 40 declined 1.3% and the U.K. FTSE 100 fell 0.9%.

Vifor Pharma jumped 19% after the Australian newspaper reported CSL is in exclusive talks to buy the Swiss company.

The food delivery sector took a beating, with shares of Deliveroo , Just Eat Takeaway.com and Delivery Hero each retreating.

精彩评论