- Private home values climbed 0.9% in the second quarter

- Lower growth was due to tightened lockdown restrictions in May

Singapore’s housing boom took a breather last quarter, after a return to lockdown conditions eased price growth.

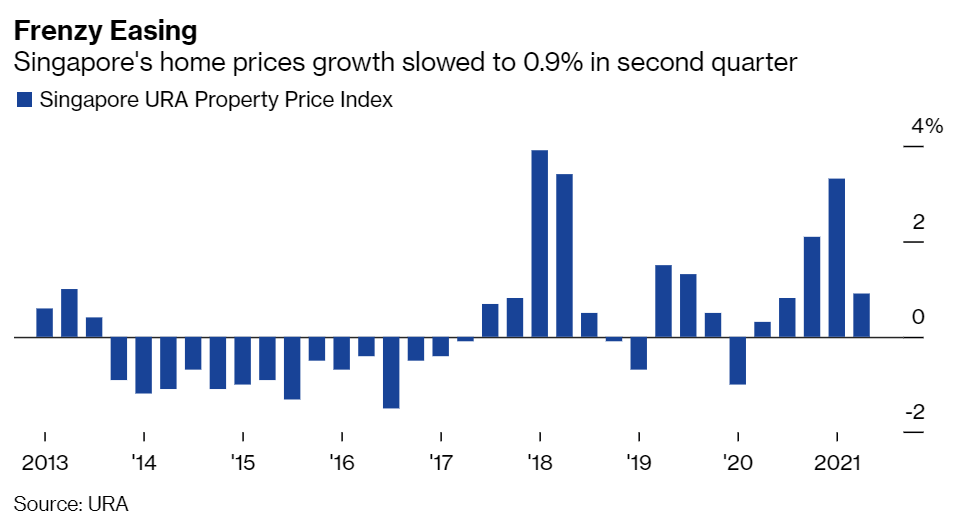

Private property values increased 0.9% in the three months through June from the previous quarter, when they rose 3.3%, preliminary estimates from the Urban Redevelopment Authority showed on Thursday. It was the first time price growth slowed in five quarters.

The respite for buyers may be short-lived given that it was driven by stricter social-distancing measures imposed temporarily in May to curb a Covid-19 outbreak, said Nicholas Mak, the Singapore-based head of research and consultancy at APAC Realty Ltd. unit ERA.

“Feedback from agents on the ground was that potential buyers had stayed away from showflats when the government tightened social restrictions,” Mak said. “But now, people are coming back and demand may go up again.”

Singapore’s property market has been heating up in the past year as buyers capitalize on low interest rates and expectations that prices will climb further after the economy recovers from the pandemic. Values of public housing apartments and luxury homes have jumped, with some breaking records.

Soaring prices in the city-state have been in line with aworldwide boomthat’s seen home values climb the most since before the global financial crisis, triggering concerns of a bubble. Australia’s housing market just wrapped up its best fiscal year since 2004,figures showed Thursday.

While there has been intense speculation that Singapore authorities may impose cooling measures for the first time since 2018, the central bank said this week that the market isn’t overheated. However, it remains “highly vigilant” about the rising prices given the risks to affordability and market stability if they’re left unchecked.

Fewer property launches last quarter also caused prices to slow, said Christine Sun, senior vice president of research and analytics at OrangeTee & Tie. She expects demand to pick up, driven in part by home buyers looking to upgrade from public to private apartments.

“Local and foreign investors will similarly purchase homes for long-term rental income,” she added.

Home sales tumbled 30% in May, after the government tightened limits on the number of people to view apartments and model rooms to groups of two, down from five previously.

Slower price growth coupled with the central bank’s remarks that the market isn’t overheated may quell concerns of property curbs being introduced, Mak said. “This certainly reduces the need for cooling measures. But the government may surprise the industry,” he added.