Summary

- Shares go into report near all-time high.

- Estimates surge after two massive beats.

- Timing of product launches will shift revenue picture.

After the bell on Tuesday, we'll receive fiscal third quarter results from technology giant Apple (AAPL) for its June ending period. With the company's previous two quarterly earnings reports smashing street estimates, it's not really a surprise that expectations have continued to rise. With shares rallying in recent weeks to new all-time highs, another strong report will likely be needed to keep things going.

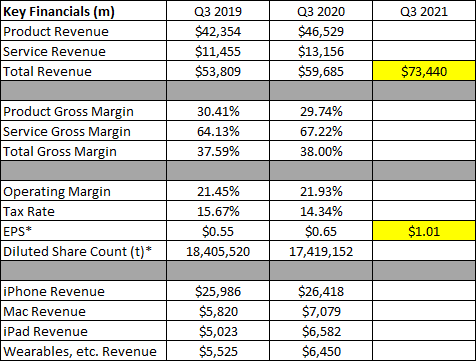

For the first half of fiscal 2021, Apple's revenues have beaten street estimates by an average of $10.25 billion per quarter. The fiscal Q3 current average estimate is $73.44 billion, which would represent growth of more than 23% from the year-ago period. It's quite impressive that the current average is up more than $13 billion over the past year. On the bottom line, the street is looking for $1.01, growth of more than 56%. In the table below, you can see some Q3 key financial items for the past two years, with the current estimates for this year's period in yellow. Dollar values are millions except per share amounts.

Apple is comingoff arguably its best quarter ever. Revenues for the iPhone were up more than 65.5% over the prior-year period, with the Mac up more than 70% and iPad up nearly 79%. Fiscal Q2 overall revenue growth was nearly 54%, so this time around we're looking for about 40% of that figure. Don't forget, on the Q2 conference call, management talked about a $3 billion to $4 billion revenue hit in the June period from supply constraints.

I'm most curious to see how the iPhone does this time around, as it appears that the 5G supercycle seems to be going pretty well. This year, however, most expectations are that the smartphone will return to its usual September launch period, meaning new phone revenues would be generated in fiscal Q4 again. Last year's coronavirus delayed launch meant sales didn't start until well into October and even November for some models, completely changing the sales trajectory for Apple's current fiscal year. This year's launch isn't expected to see a major upgrade to the phone line itself, so demand trends will probably be more dependent on how many consumers are upgrading to 5G rather than switching to iPhones.

I'm sure analysts will also be looking to see how Apple has navigated the chip shortage as well as soaring commodity prices. I don't think we will see a repeat of the 575 basis point increase in product gross margins that Q2 saw this time around, but the iPhone 12 line should still provide a nice year-over-year boost. In the long run, investors will look at growing services margins helping the gross margin percentage overall, but don't forget that the services side of the business has a lot of its expenses on the operating line.

For the stock to stay elevated, management is going to need to show that work from home and stimulus money tailwinds are still ongoing. As I discussed in a previous article, estimates call for Apple to see quarterly revenues decline for its March 2022 fiscal period, as the company laps very high previous year bars. While that might bring out some of the bears again, the long-term trajectory still seems positive. Current estimates call for $355 billion in total revenue during this fiscal year with Apple adding another $50 billion to that total over the next three years.

I hope that management took advantage of the weakness in Apple shares during the quarter for its buyback. Even though the company is spending $20 billion or so every three months, that money doesn't go as far as $145 as it does at $125, obviously. Less shares repurchased means less of an earnings per share benefit, and lower long-term dividend raises. The good news is that Apple is on its way towards $100 billion a year in free cash flow, so investors don't need to worry about capital returns slowing down anytime soon.

The major issue for Apple right now is valuation. Shares finished last week trading at 33.4 times their trailing twelve-month earnings. That's basically double the mid-teens numbers from a couple of years ago, helped a lot by easy-money policies around the globe. My current price target of $162 is based on a 30X multiple of $5.40 in EPS for the September 2022 period. That number, however, assumes that the Fed and other central banks will remain fairly accommodative through most of next year. If we start to get a lot of tapering and or rate hikes earlier than expected, the overall market is likely to feel some pain, and I don't see how Apple would be immune from that.

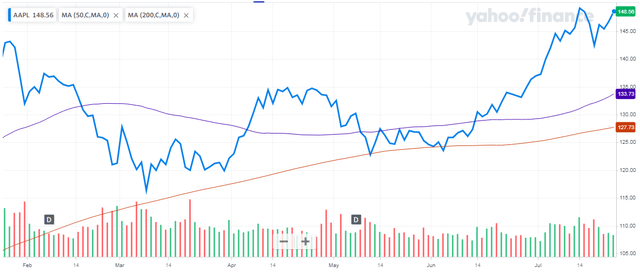

A strong report from Apple could easily help shares to rise to a new all-time high. But just to play devil's advocate for a minute, what if there is a disappointment or a "buy the rumor, sell the news" reaction? Well, shares are quite a bit above their key moving averages as seen in the chart below (50-day in purple, 200-day in orange). As long as Apple can hold the shorter-term trend line, that rising technical level should be one of support. The stock has been able to hold the long-term trend line for quite a while, so I don't see any more than about 14% downside in the near term unless we get a major market pullback.

In the end, expectations for Apple are very high as earnings approach this week. Two massive quarterly beats have sent estimates through the roof, and the stock has recently run to a new all-time high. The market will be looking for signs that the iPhone supercycle has continued while work from home tailwinds have not subsided just yet. Investors hoping that this rally can continue will need to see a strong report, with management hopefully painting a bright sales picture for upcoming fall product launches.