Morgan Stanley Sees Growing Risk of 20% Drop in S&P 500

- Strategists say they’re turning more bearish on U.S. stocks

- Many Wall Street banks have said the market looks vulnerable

A plunge of more than 20% in U.S. stocks is looking more like a real possibility, according to Morgan Stanley strategists led by Michael Wilson.

While it’s still a worst-case scenario, the bank said that evidence is starting to point to weaker growth and falling consumer confidence.

In a note on Monday, the strategists laid out two directions for U.S. markets, which they dubbed as “fire and ice.” In the fire outcome, the more optimistic view, the Federal Reserve pulls away stimulus to keep the economy from running too hot.

“The typical ‘fire’ outcome would lead to a modest and healthy 10% correction in the S&P 500,” they wrote.

But it’s the more bearish “ice” scenario that’s gaining traction, the strategists said, laying out a picture in which the economy sharply decelerates and earnings get squeezed.

Among Wall Street strategists, Morgan Stanley is more bearish than most, but their views echo other banks that have come out with ominous predictions recently. Strategists at Goldman Sachs Group Inc. and Citigroup Inc. have also written about the potential for negative shocks to end the U.S. market’s relentless rise.

“Will it be fire or ice? We don’t know, but the ice scenario would be worse for markets and we are leaning in that direction,” Morgan Stanley’s strategists wrote. “We think the mid-cycle transition will end with the rolling correction finally hitting the S&P 500.”

The bank recommended investors stick to defensive, quality companies to protect themselves and keep some exposure to financial stocks, which will benefit from rising interest rates.

JPMorgan’s Kolanovic Sees Stock Rout Overdone, Urges Dip Buying

- Says selloff driven by technical factors amid poor liquidity

- Economic momentum seen picking up amid easing virus risk

The S&P 500’s worst drop in six months on Monday is an opportunity to buy stocks as the global economic recovery is poised to pick up momentum, according to JPMorgan Chase & Co. strategists led by Marko Kolanovic.

“The market sell-off that escalated overnight we believe is primarily driven by technical selling flows (CTAs and option hedgers) in an environment of poor liquidity, and overreaction of discretionary traders to perceived risks,” the strategists wrote in a client note. “Our fundamental thesis remains unchanged, and we see the sell-off as an opportunity to buy the dip.”

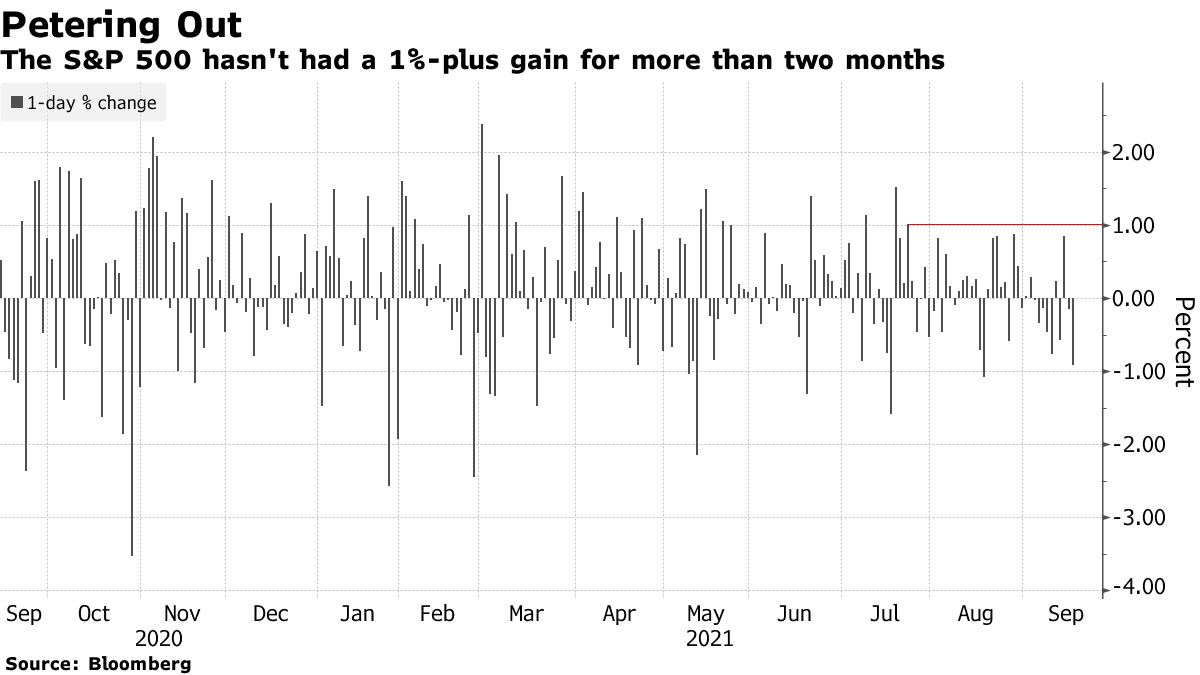

Stocks sold off Monday as angst grew over China’s real-estate sector and Federal Reserve tapering. The S&P 500 dropped as much as 2.5% for the biggest decline since March, extending its loss from a Sept. 2 peak to almost 5%.

As the benchmark undercut its 50-day average for a second day in a row, failing to rebound from a reliable support that had been in place for the whole year, computer-driven traders like commodity trading advisers, or CTAs, stepped up selling. Volatility-targeted funds that allocate assets depending on price swings may be forced to sell as much as $40 billion of assets,warned Nomura Securities strategist Charlie McElligott.

Kolanovic reiterated the firm’s bullish stance on equities, noting the team last week upgraded the S&P 500’s year-end target by 100 points to 4,700 amid a subsiding wave of delta virus cases and better-than-expected earnings.

“Risks are well-flagged and priced in, with stock multiples back at post-pandemic lows for many reopening/recovery exposures,” the strategists wrote. “We look for cyclicals to resume leadership as delta inflects.”

The upbeat view contrasts with Morgan Stanley’s Mike Wilson, whose worst case called for the S&P 500 to plunge more than 20% from its peak, a scenario that the strategist says looks more possible.