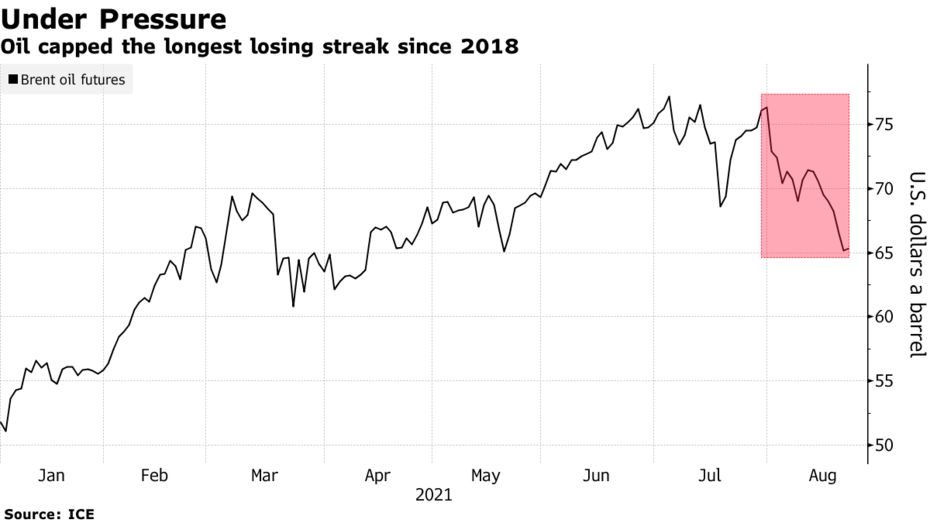

Brent oil edged higher after capping the longest run of declines in more than three years amid economic strains from the latest Covid-19 comeback and U.S. dollar strength.

Futures in London rose 0.5% after falling for a seventh session Friday, the worst streak since February 2018. The spread of the delta variant of the virus has led totightening restrictionson mobility in some regions, most notably in China, clouding the outlook. The dollar strengthened last week on haven demand, making raw materials such as oil priced in the currency more expensive.

Oil’s scorching rally over the first half of the year has run into stiff headwinds recently as the rapid spread of delta across the globe raised questions about the outlook for fuel demand. The resurgence may prompt OPEC+ to reassess its pledge to keep boosting output each month as renewed lockdowns and curbs on travel crimp fuel consumption. The group next meets on Sept. 1.

| PRICES |

|---|

|

The Covid-19 flare-up has also weakened the oil futures curve. The prompt times pread for Brent was 44 cents a barrel in backwardation -- where near-dated contracts are more expensive than later-dated ones. That compares with 92 cents at the end of July.

Daily average fatalities have climbed in the U.S., while average weekly cases now surpass 1 million as delta continues to spread, according to data compiled by Johns Hopkins University and Bloomberg. The spread has forced Australia and New Zealand toreviewtheir strategies of eliminating infections.