Hertz Global Holdings is set to emerge from bankruptcy this week at a perfect time. And shareholders stand to gain.

The rental-car industry is capitalizing on both a domestic travel surge and a vehicle shortage this summer to raise prices. Vacationers are paying $275 a day or more for midsize sport utility vehicles from Hertz in popular locations and $100-a-day rentals are common, double what Hertz was getting in the first quarter. Used-car prices, meanwhile, have surged, benefiting the industry when they sell their fleets.

“The rental-car market is on fire, and the companies have found pricing discipline,” says Hamzah Mazari, an analyst at Jefferies. “What used to be a dysfunctional oligopoly is now functional.” Hertz (ticker: HTZGQ),Avis Budget Group(CAR), and privately owned Enterprise control about 95% of the domestic market.

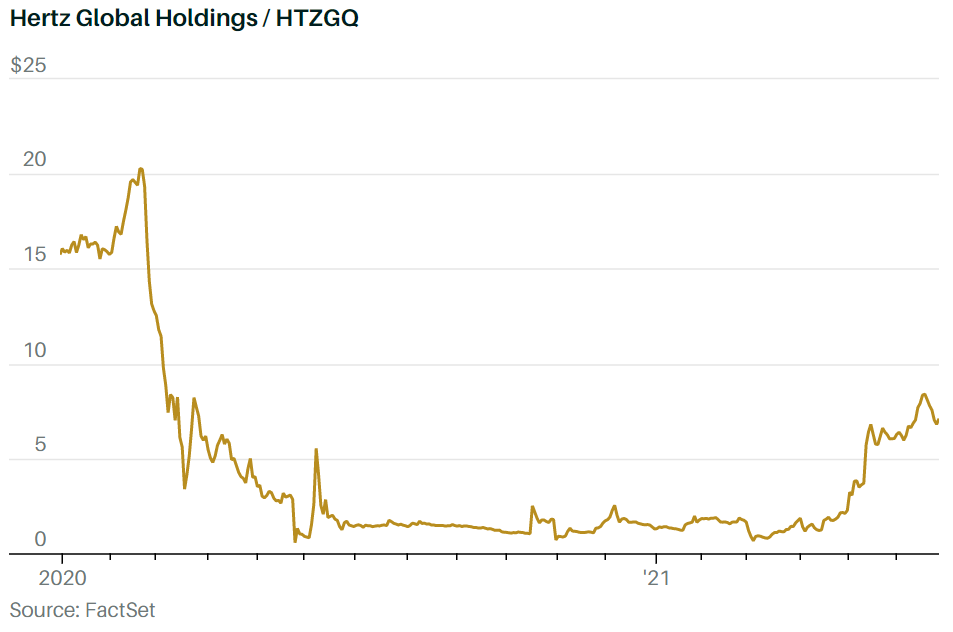

The way to play Hertz is through its current stock, which has nearly doubled, to $7.15, since mid-May. That’s when a group led by Knighthead Capital Management, Certares Management, and Apollo Global Management(APO) won a bidding contest in bankruptcy court for the company. More upside is likely after Hertz exits bankruptcy—expected on June 30, with the new stock trading the next day. Hertz will emerge with little or no net corporate debt, while Avis has about $3.5 billion.

Hertz so Good

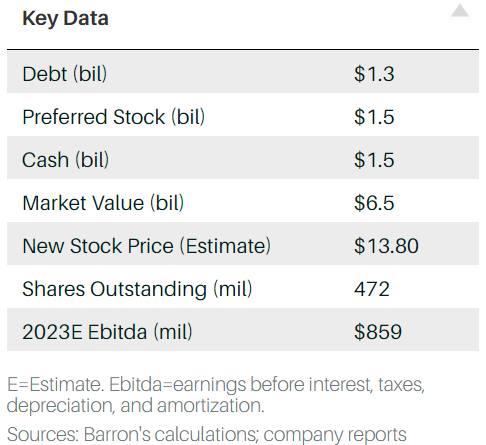

Here are the financials projected for Hertz after bankruptcy and what holders of the current shares can expect to receive.

“Our plan for Hertz is to invest heavily in modernizing the company’s technology and improving the customer experience,” Greg O’Hara, senior managing director and founder of Certares, tellsBarron’s. “Along with a right-sized capital structure and favorable economic tailwinds, we can turn Hertz—which has always had a strong brand—into a stronger company, as well.”

Andy Taylor, managing director at Carronade Capital Management, another firm involved in the restructuring, says, “It’s hard to overstate how well positioned Hertz is coming out of this restructuring. Hertz will emerge with the healthiest balance sheet in the rental-car sector into an unprecedented demand and pricing environment, which should persist through the second half of 2022, given that the industry can’t increase supply due to a 50-year low in auto inventory.”

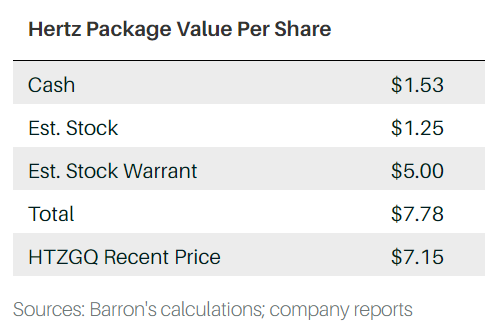

Current Hertz shares are due to be exchanged for a package consisting of $1.53 a share in cash, 3% of the stock in the reorganized company, and warrants—a long-term call option—for 18% of the new, postbankruptcy company. Holders of the current Hertz shares could realize $10 to $12 a share, Taylor says.

The initial trading in new Hertz stock could begin at $13.80, valuing it at $6.5 billion based on about 472 million shares outstanding. There is also $1.5 billion of preferred stock held by Apollo.

Assume no net debt and Hertz is valued at about nine times projected 2023 earnings before interest, taxes, depreciation, and amortization, or Ebitda, of $859 million. This projection was made by Hertz management in April and could prove conservative given the strong industry trends.

Many investors are confused by the package of securities that Hertz holders will get. As noted, holders will get $1.53 a share in cash, new stock, and warrants for each current Hertz share. The stock portion could be worth about $1.25 for a current Hertz share, based on the estimated issuance to Hertz holders of 14 million new shares, or nearly one-10th of a new share for each current Hertz share.

Current Hertz holders are expected to get nearly two-thirds of a warrant for each share with a strike price of $6.5 billion of new equity value, or $13.80 a share based on the new stock. The warrant is expected to account for the bulk of the package value.

The warrants are tricky to value. Their maturity of 30 years—most warrants mature in less than 10 years—makes them valuable. Based on option pricing models, each could trade around $8, assuming a stock price of $14, meaning that holders would get roughly $5 in warrant value.

Using these assumptions, the package of cash, stock, and warrants could be worth about $8 per current Hertz share: $1.53 a share in cash, $1.25 in stock, and $5 of warrants—a premium to the current stock price. If new Hertz gains, there would be additional upside. The risk is a lower price on the new stock and warrants.

The biggest risk that investors face is if the industry’s discipline crumbles when the car shortage eases. Yet Hertz and Avis cut their fleets in the pandemic and have been slow to rebuild them as auto makers prioritize sales of vehicles to dealers. Hertz’s U.S. fleet stood at 292,000 on March 31, down from 519,000 a year earlier.

One potential spark for Hertz would be a deal to sell cars to a large used-car retailer. There has been talk about a possible deal between Hertz and Carvana(CVNA), which would help Hertz on used-car sales and give Carvana a regular supply of vehicles. Carvana and Hertz did not respond to requests for comment.

Like its old ad slogan, Hertz puts investors “in the driver’s seat” in a rapidly improving industry.