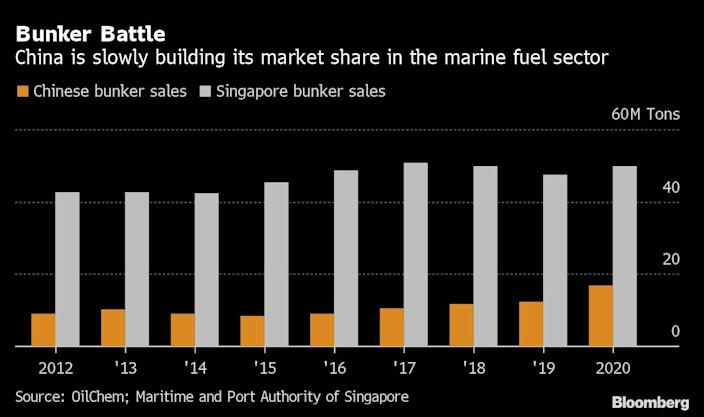

China’s marine fuel sales -- known in the industry as bunkering -- have almost doubled over the past five years and the nation is banking on attracting ships that travel to nearby ports in major economies such as South Korea and Japan. Singapore still has a commanding position as the top supplier to a sector valued at over $30 billion in Asia, but Chinese growth is accelerating.

The epicenter of China’s bunkering is Zhoushan, an archipelago to the south of Shanghai on the east coast. Some of the nation’s newest and biggest crude oil refineries are being built in the area, while the government has introduced tax incentives that make Chinese fuels more competitive.

“Singapore has had an edge over other Asian ports on all parameters,” said Jayendu Krishna, director at Drewry Maritime Advisors. “It continues to be so today, however, slowly other ports have been trying to catch up. Zhoushan will certainly capture a share of the vessels from other north east Asian ports.”

Singapore -- also the world’s biggest ship refueling hub -- sold about 50 million tons of bunker fuels last year, or a fifth of the global total. Industry consultant OilChem estimates China’s sales rose for a fifth straight year to 16.9 million tons. SeaCred, a marine intelligence agency, valued the Asian bunker fuel market at $31 billion to $32 billion in 2020.

The world’s busiest ports are in China thanks to its massive manufacturing industry, and boosting its bunkering capabilities adds clout to supportive businesses. The local government is spending 520 million yuan ($80 million) to expand the anchorage and build new shipping channels at Zhoushan, while refiners are pumping out higher volumes of low-sulfur fuel oil, now essential under new global rules that mandates ships use cleaner fuels.

See also: Singapore Prepares to Swap Oil Hub Status for Greener Future

China’s bunkering business is closely catching up with that of Singapore, a former official with the customs authority in Zhejiang province, which includes Zhoushan, said at an industry conference last month. They predicted the nation’s marine fuel sales would be 40% of Singapore’s this year -- or about 20 million tons based on 2020 data.

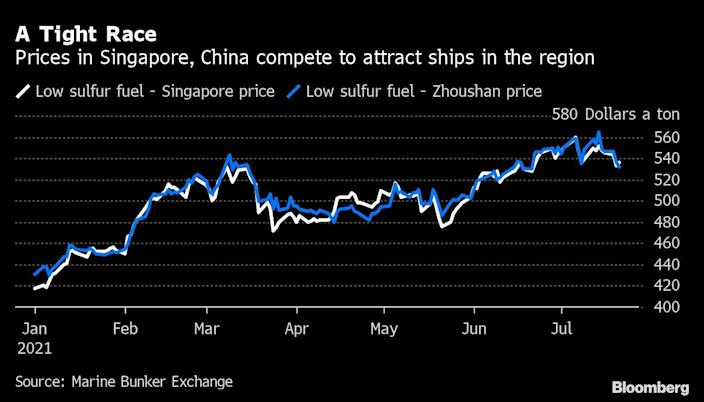

China has issued more than 10 bunkering licenses to companies operating in the free-trade zone of Zhoushan, and has also introduced a low-sulfur fuel oil futures contract to the Shanghai International Energy Exchange to improve transparency on pricing. The actual LSFO fuel being sold at the port was at $536 a ton on Tuesday, $3 higher than Singapore, after being cheaper than the city-state in April, according to data from the Marine Bunker Exchange.

Zhoushan has been more competitive with its prices this year and Stena Bulk vessels traveling to China will likely utilize the port for refueling more often, said Yvonne Rittfeldt, head of bunker procurement at the shipping company, which transports crude and refined products. However, Singapore is more reliable with its efficient and timely delivery of fuel, she added.

Singapore has geographical superiority where it counts. It sits at the crossroads of a centuries-old trade route that links the region to Europe, the Middle East and the U.S. Gulf Coast. The construction of Southeast Asia’s first container port in 1972 helped the city-state map a path to the top marine fuel supplier spot, and it’s planning for the world’s biggest automated terminal.

Additionally, the country has a vast refining and storage network to keep the steady stream of vessels refueled, and it’s also bolstered its credentials around transparency recently. Strict measures for monitoring bunker fuel deliveries were introduced last year, following on from the addition of flow meters in 2017, which gives shippers assurance the quantity of fuel they purchased will be delivered.

“The regional bunker fuel pie is big enough to support growth for key ports, but Singapore will remain the main bunkering hub in the foreseeable future,” said Victor Shum, vice president of energy consulting at IHS Markit.

(Adds new chart, updates attribution of quote in 7th paragraph.)