Summary

- AMD outperformed in 2021 as business growth accelerated.

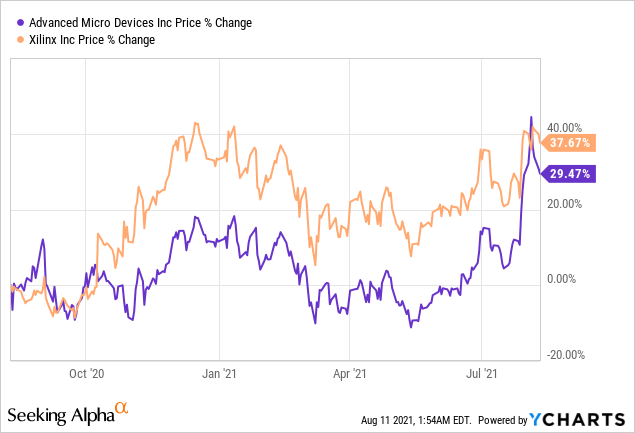

- Most recently, AMD dipped on fears that the Xilinx merger might not get approved.

- AMD is in the strongest position it has ever been in. Even if the deal doesn't go through, AMD will do fine as it launches new GPU products.

- AMD just brought a new high-performance GPU to market which has the potential to boost AMD's revenue growth even without Xilinx.

Shares of semiconductor firm AMD have risen sharply since the company opened up its books for the second quarter at the end of June, but they started to dip last week amid noise that the Xilinx (XLNX) deal may not get through. AMD is launching new GPU products which could accelerate the firm's growth and AMD is set to do well even without Xilinx.

New GPU product launches will add to AMD's revenue growth

It has been just about two weeks since AMD reported for Q2'21 and beat even the most bullish analyst calls. AMD saw its revenues soar 99% Y/Y and 12% Q/Q growth to $3.85B with both Computing/Graphics and Enterprise seeing continual top line momentum. Revenue growth was driven by strong graphic cards sales, especially the Radeon 6000 Series GPUs, and higher EPYC processor revenues. Because of the revenue momentum in both businesses, AMD was able to post a 4 PP Q/Q increase in gross margins to 48%.

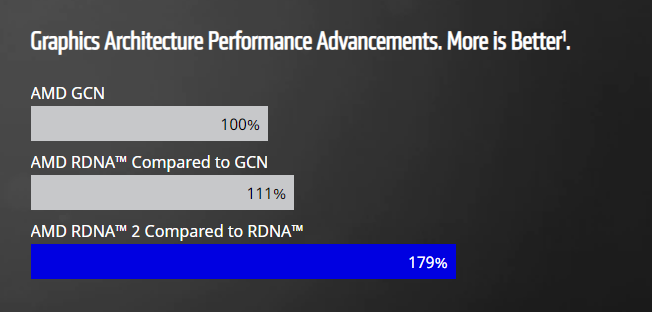

While AMD's business keeps improving and growth is accelerating (and will continue to do so even without the Xilinx merger going through), the semiconductor firm is not resting on the laurels. AMD announced the roll-out of its newest high-performance graphic card for the Mac Pro last week, called the Radeon PRO W6000X series GPU. The Radeon PRO W6000X series graphic processing unit is based on AMD's winning RDNA 2 Architecture which has also been used in the prior-gen AMD Radeon RX 5000 series as well as AMD's RX 6000M Mobile Graphics series. AMD's RDNA 2 architecture provides a 79% performance boost compared to its prior-gen RDNA architecture. Since gamers and professionals often require the highest-performance GPUs available in the market to run the newest applications and workloads smoothly, AMD's new graphics GPU is likely going to meet strong demand.

AMD's new top-of-the-line graphics card has the potential to further accelerate AMD's revenue growth in the Computing/Graphics business. AMD is already benefiting from a shift to higher-price, higher-performance GPUs, and the new Radeon PRO W6000X series GPU could accelerate this trend in the next quarters and add volume as well as GPU ASP growth.

Deal risks are growing, but AMD will be fine either way

While AMD is getting ready to bring new high-performance GPUs to market to make the life of developers, designers and gamers more easy, the market has been obsessing lately about growing risks to the AMD-Xilinx merger. AMD has offered 1.7234 shares of AMD for every Xilinx share in a $35B deal which was proposed in October of last year. The acquisition of Xilinx is meant to strengthen and add more growth to AMD's data center segment, increase the total addressable market for its processor business and realize synergies. The transaction would also provide a stronger base for AMD to attack Intel (INTC), although AMD is already doing a good job on its own of taking market share away from Intel in the processor business.

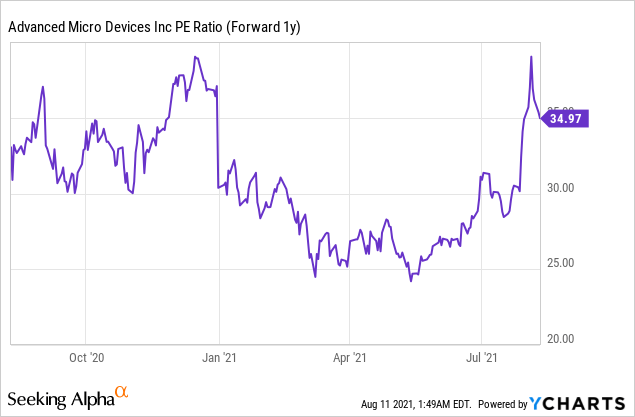

The AMD-Xilinx deal was widely lauded for the strategic sense it made, but the market now appears to be more pessimistic about the deal getting approved. While the closing of the transaction remains a risk for the stock short term, AMD can do well even without Xilinx. AMD is set to grow revenues 60% this year and, possibly, around 50% next year (if revenues don't accelerate in FY 2022), which is an impressive rate to grow at for a firm with a $130B market value. With AMD trading at $106 and at a 2022 P-E ratio of 35, AMD's revenue and profit growth are still very cheap.

If the AMD-Xilinx deal gets through - which chiefly depends on regulators in China with a decision being expected by year-end - then each Xilinx share is worth 1.7234 shares of AMD. Since each share of AMD costs $106, one could buy one share of Xilinx for $146 and receive, potentially, a higher total dollar value in return when the transaction is completed successfully. I expect the merger spread to increase as regulatory risks grow, which could potentially reward buyers of Xilinx stock if the transaction gets finally approved. Concerns over the deal falling through are related to a rising share price for Xilinx - XLNX trades above the $143 deal value - and Nvidia's (NVDA) problems closing the Arm acquisition in the UK.

The risk that the Xilinx merger will be held up or not go through at all has increased, but this should not be a reason to sell or avoid AMD, largely because AMD is already growing very fast on its own and the stock is not overvalued. The rising price of shares of Xilinx may indicate that the market at least views a successful closing to be less likely than a month ago. Xilinx also reported strong revenue results for Q2'21 so there may be some speculation that AMD might have to put more on the table to close the deal, but this is not plausible since both companies already agreed to the deal. What is more likely, however, is that growing regulatory risk was not priced into the calculation before and the market is updating its assessment about the merger. A failing Xilinx acquisition is a risk for AMD's stock, for sure, but the semiconductor firm's business is in the best shape it has ever been in… in part because it is rolling out new GPU products that should see strong customer uptake. The much bigger risk for AMD is that processor ASPs start to decline which would indicate slowing revenue growth. A deal falling through would also likely hurt Xilinx more than AMD since the deal premium would disappear.

Final thoughts

Don't trade the merger news, but invest in AMD's long-term revenue potential.

Whether the AMD-Xilinx merger will be approved or not, AMD's business continues to gain momentum and the new Radeon W6000X GPU could accelerate the shift to higher-priced graphic cards, which already drive AMD's revenue growth in Computing/Graphics. Look for rising GPU ASPs next quarter that also contribute positively to AMD's top line segment growth.

Although the market has lost some of its enthusiasm about the Xilinx merger, AMD's business represents great value and the firm's growth is undervalued at just 36x projected earnings.