Opportunity seen in outsourcing trend similar to chip industry

TOKYO -- Fujifilm Holdings is staking its future on becoming a provider of drug development and manufacturing services to other pharmaceutical companies.

The Japanese company is spending 600 billion yen ($5.25 billion) to gain a foothold in a market that is expected to grow rapidly in the coming years. It decided at the end of June to increase its investment by 90 billion yen, betting that it can become the pharmaceutical industry's answer to Taiwan Semiconductor Manufacturing Co., which specializes in making computer chips designed by others.

As in the chip industry, there is a growing trend among big drugmakers to farm out some or all of their development and manufacturing to specialists. One factor driving the trend is the growing diversity of treatments and drugmaking technologies.

As new treatments such as antibody drugs, cell therapies and gene therapies have become widely available, pharmaceutical companies face much tougher challenges developing and marketing drugs.

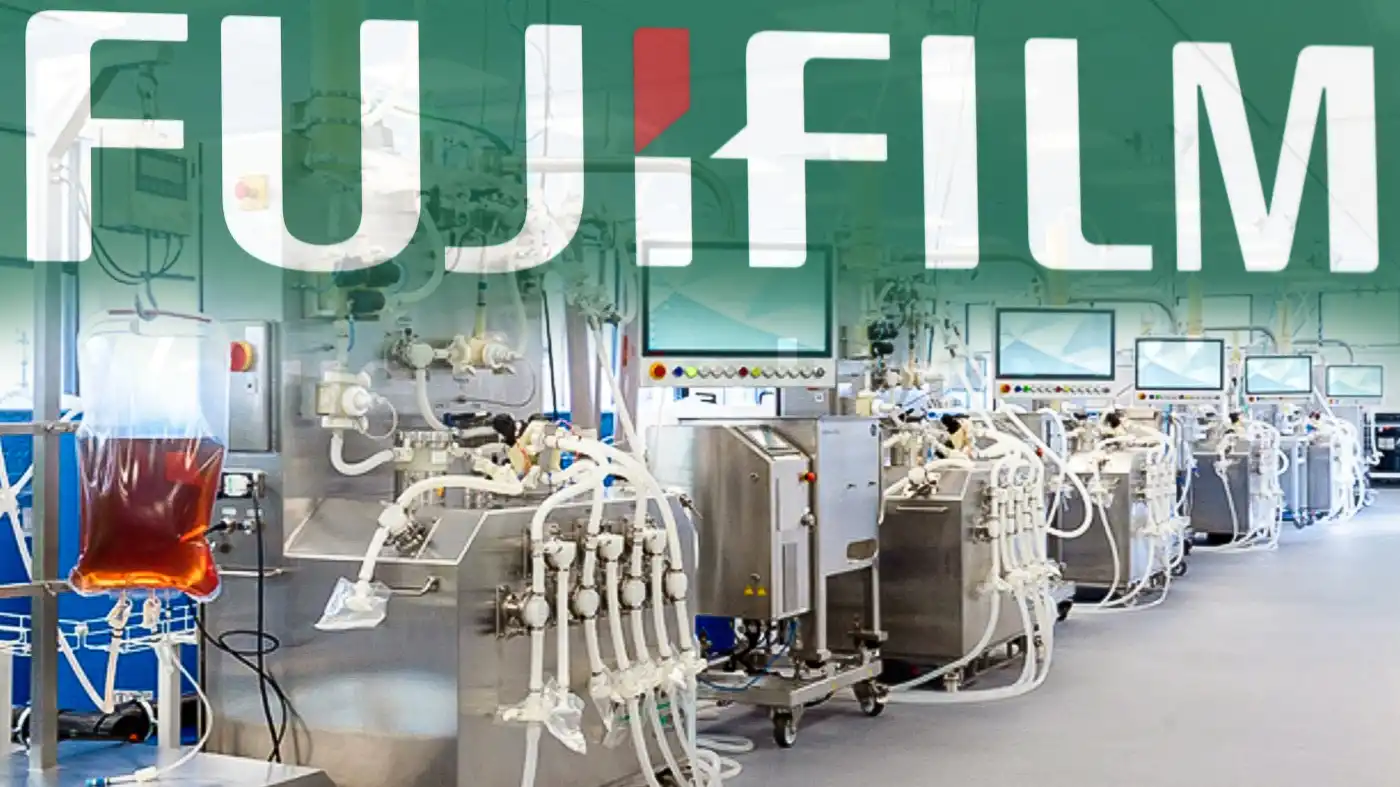

Another factor is the huge investment needed to develop and manufacture biopharmaceuticals -- drugs derived from biological processes, such as blood products. This has opened the door for contract development and manufacturing organizations (CDMOs) of the sort Fujifilm hopes to become.

Developing a new drug and bringing it to the market typically takes around 10 years and carries with it a huge risk of failure. The economics of the business argue for outsourcing: It makes sense for pharmaceutical companies to focus on lab operations drug discovery, and leaving steps such as cell line development, clinical trials and commercial manufacturing to service providers like CDMOs. "We want to focus our management resources on drug discovery and marketing," says an executive at a major Japanese drugmaker.

Takahiro Mori, a senior analyst at Mizuho Securities, predicts steady growth for outsourcing in the biopharmaceutical industry. "Major pharmaceutical companies are putting less priority on investment in complex and sophisticated production technology for such drugs," he points out.

In fact, more big drugmakers are selling off their manufacturing operations these days. Swiss pharmaceutical giant Novartis sold its U.S. production facility for gene therapies to AGC in August. AstraZeneca of Britain sold its U.S. plant to AGC in June 2020.

Research and Markets has forecast the CDMO market will grow by 50% to $241 billion by 2024, compared with 2020. The market is currently dominated by Lonza Group, a Swiss company, Boehringer Ingelheim of Germany and Samsung Biologics of South Korea. Together, they control around 70% of the global market in terms of production capacity.

In particular, Samsung Biologics is using its financial muscle to expand, spending around $1.4 billion on a new plant that will raise its capacity by 70% next year. It has further plans for growth

Fujifilm is late to the race but hopes its competitive production technology will help it catch up. The Japanese company plans to introduce a new production system that can more efficiently make antibodies with high purity in its plant in the U.K. Fujifilm describes the system as a "fully integrated continuous processing facility."

Fujifilm's continuous processing approach offers a cost-effective alternative to traditional batch cell culturing, allowing higher efficiency, along with better, more consistent product quality, the company says. Because it allows continuous production, the system does not require large tanks, reducing the required investment by 70% and overall production costs by around 30%, according to Fujifilm. The company says the amount of antibodies that can be harvested is three times higher with its continuous production method, compared with conventional batch production.

Continuous production, however, requires highly precise control of the entire cell culturing process, as well as sophisticated refining technology and equipment. It also demands an enormous amount of culture media -- 30 to 40 times more than is used in batch production. These technological and cost challenges have hindered widespread use of continuous production for biopharmaceuticals. Fujifilm has taken advantage of its design capabilities in film production and other businesses to develop new equipment for its continuous production system.

Takatoshi Ishikawa, a senior executive vice president in charge of the company's Bio CDMO division, calls Fujifilm's new production system "a game-changer" that will put it in a strong position to become the market leader. The company is already in talks with more than one major pharmaceutical company over the new technology.

Fujifilm aims to raise the sales in its CDMO business to 200 billion yen by the year through March 2025, double the figure for the year that ended in March 2021, and achieve annual sales growth of 20% in subsequent years.