(Update: Sept 9, 2021 at 09:44 a.m. ET)

Sea says some of the proceeds would help expand its business, while funds could also be deployed on investments and acquisitions.

Southeast Asia’s most valuable listed company, Sea Ltd., plans to raise about $6 billion or more in new funds, capitalizing on investor enthusiasm for the region’s fast-growing technology industry.

TheTencent HoldingsLtd.TCEHY-2.95%-backed gaming, e-commerce and digital-finance company said in a filing late Wednesday that it would raise the capital by selling new shares and convertible bonds. Sea said some of the proceeds would help expand its business, while funds could also be deployed on “potential strategic investments and acquisitions.”

The company says its Shopee unit, which competes with rivals including Alibaba Group Holding Ltd.’s Lazada unit, is the largest e-commerce platform in Southeast Asia and Taiwan.

Sea, which is listed on the New York Stock Exchange, plans to sell 11 million American depositary shares and $2.5 billion of five-year convertible bonds.

Based on Wednesday’s closing price for Sea shares, of $343.80, the stock sale would be worth close to $3.8 billion, although deals like this are typically sold at a discount to the market price. Sea and its banks expect the final price to be set Thursday, according to a term sheet seen by The Wall Street Journal. The deal’s underwriters have the option to increase the size of both offerings by 15%, via a green shoe.

Like other e-commerce and gaming groups, Sea has enjoyed rapid growth, with the Covid-19 pandemic spurring customers to live more of their lives online.

Compared with the same period a year earlier, Sea’s revenue in the three months to June more than doubled to nearly $2.3 billion, while paying users for its digital-entertainment business and gross merchandise value for its e-commerce unit both leapt by more than 80% year-over-year.

The business remains unprofitable however, reporting a net loss of $434 million for the quarter, or $321 million excluding share-based pay to staff. It generated cumulative annual net losses of more than $4 billion in 2018 through 2020.

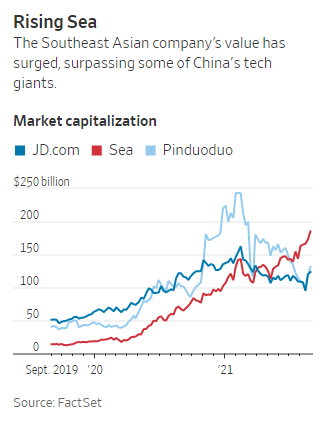

Sea’s shares have surged in recent years, giving it a market capitalization of roughly $185 billion. That makes it the region’s biggest listed company, according to S&P Global Market Intelligence data, and has allowed it to pull ahead of some of China’s big tech companies, such asJD.comInc.andPinduoduoInc.,as the Chinese tech industry confronts a series of government crackdowns.

Sea itself isone of many tech groups backedby China’s Tencent, and it publishes Tencent games such as League of Legends and Arena of Valor in the region. Tencent held a 22.9% stake as of March 5, according to Sea’s annual report.

The planned issuance is the latest in a series of fundraising deals by big tech groups in Asia. In April, Meituan, one of China’s most valuable technology companies,raised roughly $10 billionby selling stock and convertible bonds. Meituan, which competes with Alibaba and others, said it would spend some of the proceeds on researching and developing autonomous delivery vehicles, drone deliveries and other technology.

Southeast Asian tech is also drawingmore interest from investors, with some seeing the planned U.S. listing of Grab Holdings Inc., operator of a superapp that offers services including ride-hailing and delivery, as a watershed moment.

In May, Singapore-headquartered Grab said it planned to raise about $4.5 billion in a tie-up with a special-purpose acquisition company, or SPAC, and go public in the U.S. at a valuation of nearly $40 billion. Grab expects the deal to close in the fourth quarter.

Units ofGoldman Sachs GroupInc.,JPMorgan Chase & Co. andBank of AmericaCorp.are handling Sea’s offerings.

Sea fell over 7% in early trading.