- JPMorgan, TD Securities strategists said short 10-year bonds

- Morgan Stanley sees risk of hawkish FOMC surprise this week

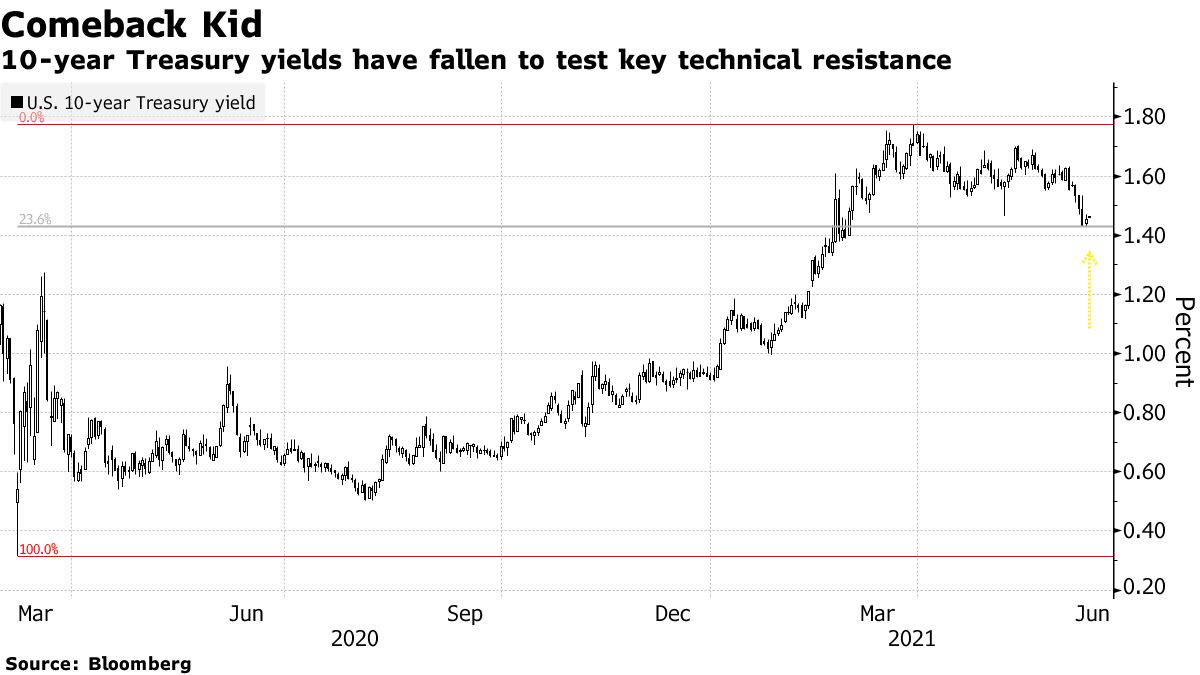

Despite a short squeeze that pushed benchmark Treasury yields to a three-month low last week, Wall Street is urging bond bears to stick to their guns.

Strategists at JPMorgan Chase & Co. said Friday they turned bearish on 10-year Treasuries ahead of the Federal Reserve meeting on Wednesday as markets are now pricing in a too shallow rate hike outlook, while their peers at Morgan Stanley are bracing for a hawkish surprise. A team at TD Securities called for a “tactical short” in the benchmark securities on Thursday.

“Given rich valuations and a benign implied tightening pace, we turn bearish in 10-year Treasuries,” wrote a JPMorgan team including Jay Barry. “The pendulum has swung over the current quarter as Treasuries have moved from extremely cheap to extremely rich.”

Bond investors have been abandoning short bets in recent weeks on an expectation Fed officials will reaffirm that an ultra-loose policy remains appropriate, and that it’s too soon to start even considering tapering purchases of Treasuries and mortgage-backed securities. Still, officials could project interest-rate liftoff in 2023 amid faster economic growth and inflation, according to economists surveyed by Bloomberg -- something the swap-market is pricing for April that year.

Ten-year yields inchedup toaround 1.46% Monday after hitting the lowest since March on Friday. That coincided with a key Fibonacci technical support level, stemming from the rise in yields from last year’s pandemic lows.

Fed Catalyst

While market expectations for the Fed to hike rates are more hawkish than the central bank’s own guidance, swaps are pricing in less than 100 basis points of tightening over the next four years, according to the JPMorgan strategists. That suggests markets see a relatively low pace of normalization, they said.

TD Securities see the potential for the central bank’s median “dot” for 2023 -- a gauge of its expectations for rates that year -- to move higher, according to a note from strategists including Priya Misra. That would likely surprise the market, which is priced for a dovish Fed, they said, calling for benchmark yields to bounce back to the 1.70% level.

The slump in Treasury yields after last week’s U.S. consumer-price data suggests markets are completely ignoring inflation as transitory, just when a case can be made for its sustainability, wrote Morgan Stanley’s head of U.S. interest rate strategy Guneet Dhingra in a note Friday.

“Given the shift in the mix of inflation from transitorytowardssustainable, the risk of a hawkish tilt within the FOMC has increased, exposing the rates market to a hawkish surprise,” he said.