Government bond yields gained.

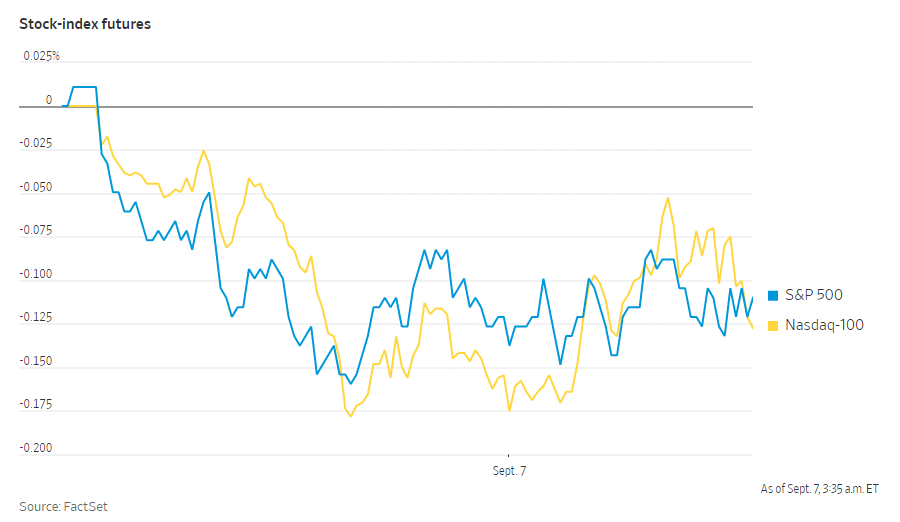

S&P 500 futures gained 0.1% and futures on the Dow Jones Industrial Average also added 0.1%. Changes in equity futures don’t necessarily predict market moves after the markets open.

In Europe, the Stoxx Europe 600 shed 0.1% in morning trade as gains in communication services and materials sectors were balanced by losses in consumer discretionary and energy sectors.

DS SmithPLC jumped 2.8% for a two-day winning streak and Marks and Spencer Group added 2.6%.

The U.K.’s FTSE 100, which is dominated by large international businesses, was lower 0.2%. Other stock in Europe were mixed as France’s CAC 40 edged up 0.1% and Germany’s DAX declined 0.1%.

The Swiss franc was up 0.1% against the U.S. dollar, with 1 franc buying $1.09. The euro was mostly flat against the dollar, with 1 euro buying $1.19. The British pound slipped 0.1% against the dollar, with 1 pound buying $1.38.

In commodities, Brent crude rose 0.1% to $72.28 a barrel. Gold fell 0.7% to $1,821.20 a troy ounce.

German 10-year bund yields were up to minus 0.343% and the yield on U.K. 10-year gilts gained to 0.621%. The yield on 10-year U.S. Treasury rose to 1.353% from 1.322% on Friday. Bond yields and prices move inversely.

Stocks in Asia mostly climbed as Hong Kong’s Hang Seng rose 1%, Japan’s Nikkei 225 index added 0.9% and China’s benchmark Shanghai Composite gained 1.5%.