Summary

- NIO’s June deliveries grew at an impressive rate.

- The Chinese EV maker returned to triple-digit delivery growth last month, helped by strong Y/Y growth in NIO’s flagship model ES6.

- NIO is set to overcome production setbacks and ramp up production in the second half of 2021.

Chinese electric vehicle maker NIO (NIO) is rebounding fast from the pandemic-driven chip supply shortage and the proof is in surging EV deliveries. Impressive delivery rates for the month of June show that the market may underestimate NIO's growth potential.

Shipping volumes are accelerating

NIO guided for lower production volumes in the second quarter due to the global chip and battery supply shortage. The shortage was set to reduce NIO's factory output from 10,000 vehicles to 7,500 vehicles a month.

The global semiconductor supply shortage has its roots in the COVID-19 pandemic. As more people started to work from home, a sharp increase in demand for semiconductors from the consumer electronics industry coincided with a faster than anticipated rebound in chip demand from the auto industry, leading to a global shortage in semiconductors that is throttling auto production from the US to China. NIO's guidance for lower factory output has lowered delivery expectations but a return to triple-digit growth rates may now push NIO's stock higher again.

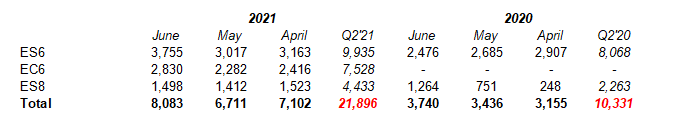

While the temporary production drop was a setback for NIO, it seems that the electric vehicle maker is ready to bounce back.NIO's June deliveries were nothing short of impressive and the market may underestimate NIO's ability to grow EV deliveries at triple digits this year. The Chinese EV maker delivered a total 8,083 vehicles in June, bringing the Q2'21 total to 21,896 EVs consisting of all models… NIO's 5-seater electric SUV ES6, the 5-seater electric coupe SUV EC6 and the 6-seater or 7-seater electric SUV ES8. NIO's monthly and quarterly delivery totals hit records in the second quarter and the EV maker is set to reach new records for the rest of the year. Total June deliveries saw 116% growth Y/Y with the largest growth coming from the ES6 model. The ES6 category saw 52% growth Y/Y. Total deliveries for Q2'21 were 21,896, most of which were ES6s, showing growth of 112% Y/Y… and that's despite production problems in the second quarter. Comparable figures for the EC6 are not available since deliveries for this model only began after the second quarter last year. What stands out from NIO's June delivery report is that shipping growth is speeding up compared to the previous month, which may be seen as a sign that NIO's delivery capabilities are undervalued. In May, NIO delivered 6,711 vehicles which is equivalent to a Y/Y growth rate of 95%. Strong delivery numbers for the month of June may be a cue that NIO's production problems are easing and that NIO is ready to return to full production capacity.

NIO has an annual production capacity of 150,000 vehicles which the EV maker is not fully utilizing due to the semiconductor shortage. As soon as the chip shortage eases, which can be expected to be the case in the second half of the year, we should see a steady ramp up in NIO's factory output and deliveries. The speed of the ramp up will depend less on demand but rather on the severity of the supply shortage. The semiconductor shortage is a primary risk factor that will impact NIO's delivery success in the remaining two quarters.

The market for electric vehicles is very resilient in China and demand for zero-emission passenger vehicles is not going away due to delays in production, which may be a sort of luxury problem for Chinese EV makers. NIO's EV sales in China have surged this year, but the second half of the year may see even faster growth as the industry works through the supply problem.

XPeng (XPEV), another Chinese electric vehicle maker,delivered 6,565 Smart EVs in June 2021, representing growth of 617% Y/Y. XPeng sold 4,730 electric sport sedans and 1,835 compact SUVs last month, more than ever before. In Q2'21, XPeng delivered 17,398 deliveries, representing 439% growth Y/Y.

XPeng's EV sales in China are also soaring showing strong demand and customer uptake of EV vehicles.

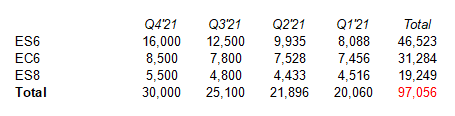

NIO FY 2021 delivery projections

My estimates for Q3'21 and Q4'21 deliveries are shown in the graph below and assume a ramp up especially in NIO's ES6 delivery capability and a continual escalation to a quarterly output of 30,000 vehicles by year-end. A quarterly output volume of around 30,000 cars by year-end is realistic to achieve and NIO would still be operating 20% below full production capacity. Calculating the delivery totals for Q1 and Q2 together with my estimates for Q3 and Q4 results in a total delivery potential of 97,056 vehicles (across all three models) in FY 2021 and NIO may even be able to crack the 100,000 barrier if shipment volumes continue to accelerate at a strong rate in the last two quarters of the year. NIO delivered 43,728 vehicles in 2020 in total, so a 97,056 delivery estimate for 2021 implies 122% Y/Y growth. In the first six months of 2021, NIO already delivered 41,956 or 43% of my FY 2021 delivery estimate. As production returns to normal in the second half of the year, NIO should be able to create triple-digit delivery growth on a Y/Y basis.

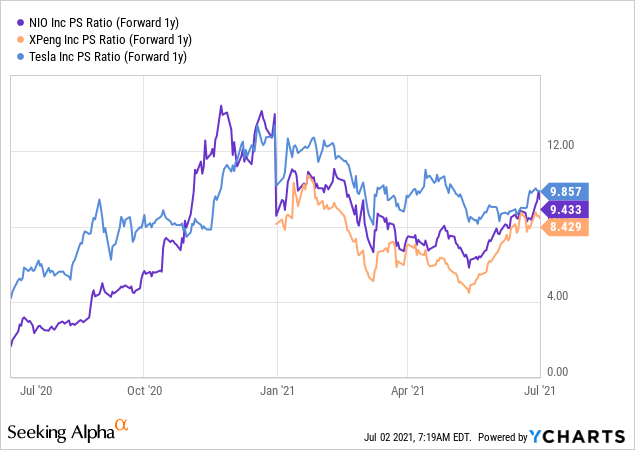

NIO's sales growth is cheap

EV makers are not cheap and that is because the market values sales and delivery growth more than anything. NIO trades at a P-S ratio of 9.4 and the valuation multiplier factor is not that much different from other EV makers. Compared against Tesla (TSLA), which trades at a P-S ratio of 9.9, NIO has more revaluation potential because it operates in a larger market and has a lower revenue base.

Risks

The chip supply shortage is still a major risk factor for NIO and it will have an impact on NIO's Q3 and Q4 production output... which will be below potential. As conditions normalize slowly in the second half, NIO should be able to ramp up factory output and deliveries. While delivery growth rates are influenced by factors outside of NIO's operations, they also represent a big opportunity for NIO to surprise the market. Better than expected growth rates and a fast return to full production could create fertile ground for stock price appreciation.

Final thoughts

NIO may be growing faster than expected in 2021 as the chip supply shortage eases and a strong rebound in the second half of the year could push NIO to hit the critical 100,000 annual delivery milestone. Demand for EVs remained strong in 2021 and Chinese EV makers are killing it. I believe 120% Y/Y growth in annual deliveries is possible in 2021 as factory output normalizes in the second half of the year.