Hershey(NYSE:HSY)shareholders are in for a treat. The confectioner is set to announce earnings results for the second quarter on Thursday, July 29. And if its recent momentum is any guide, that report might include strong sales and earnings growth, along with another upgrade to management's 2021 forecast.

Let's take a closer look.

More mobility

There's every reason to expect big sales numbers in Thursday's announcement. Hershey said back in April that its portfolio was resonating with consumers, especially as they increased mobility following the lifting of COVID-19 social distancing efforts. Its baking products continued to sell well through early April, but on-the-go purchases like candies, mints, and gums started booming. Overall organic sales were up 13% last quarter.

Look for slower, but still impressive, gains on Thursday. Most investors who follow the stock are expecting sales to rise about 5% to $1.8 billion. That performance would keep Hershey near the top of the snack food niche.PepsiCo, for context, just announced a6% boostin its U.S. snack segment through mid-June.

Beyond that headline sales figure, watch for Hershey's comments on market share and on the balance between rising sales volumes and prices. Ideally, volume will lead the way higher even as prices increase.

Profit check-in

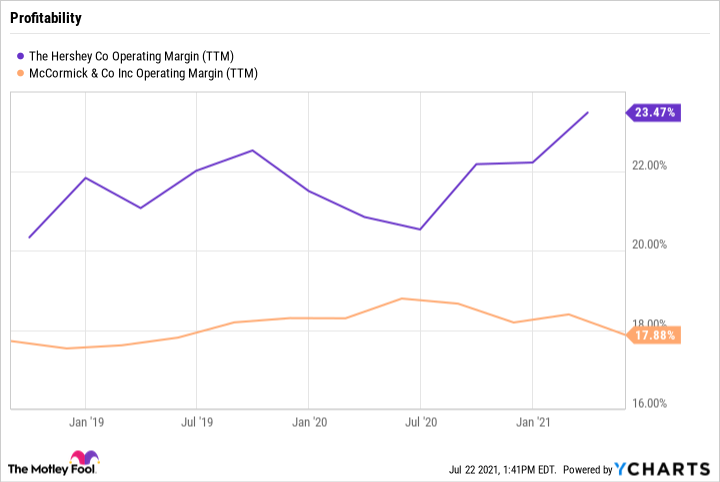

Most globalconsumer staplespeers, including PepsiCo, are posting higher margins right now, but Hershey hasn't yet cashed in on that trend. Gross profit dipped slightly in the second quarter, in fact, which held bottom-line profitability in check.

That situation likely improved in recent months thanks to rising prices and a demand tilt toward higher-margin, on-the-go candies and snacks. Most packaged food peers, fromCoca-Cola, toMcCormick, are seeing a lift from these shifts. Hershey won't be left out of the party.

Most investors are looking for earnings to jump to $1.44 per share from $1.31 per share a year ago. But the bigger question is whether Hershey can return to setting record operating margins by late 2021.

The new outlook

Heading into this report, CEO Michele Buck and her team's outlook is calling for sales to rise by between 4% and 6% this year, up from their prior forecast of a 2% to 4% uptick. A strong Q2 outing for the business might spur another modest increase to that prediction on Thursday.

The earnings outlook was also lifted in April and might get another boost this week, especially if consumers don't balk at Hershey's latest round of price increases.

Looking further out, the company can reasonably target accelerating sales and earnings growth this year following modest increases during the COVID-19 pandemic. Hershey isn't the cheapest or fastest-growing stock in its niche with those kinds of prospects. McCormick and PepsiCo have lower valuations even though they're expanding sales and earnings at a faster clip.

But investors still might want to follow Hershey's report this week for signs that the business is on a sustainably stronger path. That's the surest way the company can earn the stock price rally that's seen it outperform most of its rivals over the past year.