The U.S. Fed is caught in a difficult place that will require tremendous communication efforts for the market to understand. So far down the road during the pandemic, the Fed came to the rescue. It eased monetary conditions and also urged Congress to deliver fiscal stimulus.

Its words were heard, and the Fed’s actions eased the world’s desperate need for dollars seen in the spring of 2020. Fast forward to March 2021; the Fed is in a tough spot.

On the one hand, with every stock market decline, the market participants expect the Fed to intervene. However, the stock market is still close to all-time highs, and it is unlikely that the Fed will keep intervening verbally, especially because easing is still ongoing and about to increase.

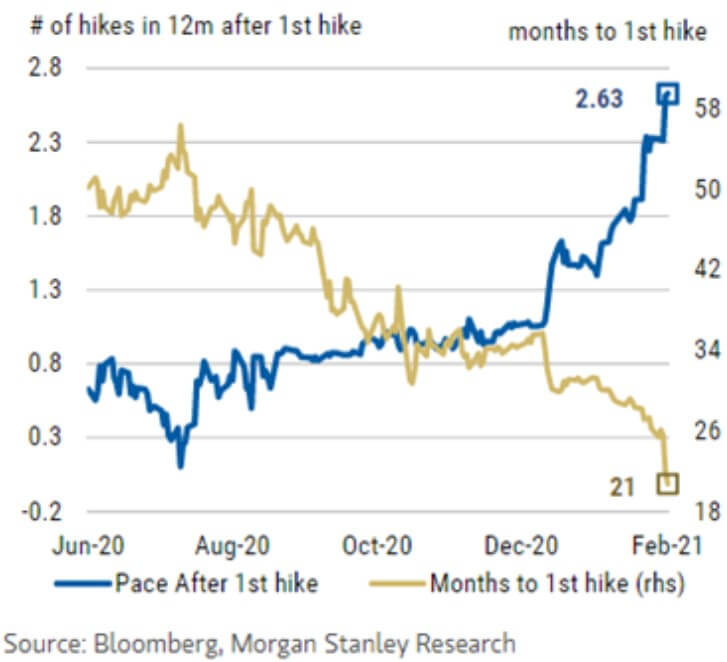

On the other hand, the market starts pricing in a stronger economic recovery. Such a recovery should bring tightening from the Fed, and the market already implies that we will see a first rate hike in 2022. More precisely, the market priced in over 80% odds for a twenty-five basis points rate hike in 2022.

On the same note as in the previous paragraph, the same market prices in another two rate hikes in 2023 and, by the end of 2025, a tightening of monetary conditions of over 125 basis points. This translates into the federal funds rate rising from close to zero currently to 1.25% three years from now.

For example, the fiscal easing will continue. The months ahead will bring a renewed round of fiscal stimulus, as $1.9 trillion in fiscal aid is about to be unleashed. This is easing, but at the same time, the money will further fuel the economic recovery, and, in turn, more jobs will be created, and so on.

More easing comes from the U.S. Treasury as well, forced to unwind its general account at the Fed in the months ahead. Finally, more easing comes even from the Fed, as it keeps purchasing $120 billion a month.

Yet, traders and investors must understand these actions reflect current conditions. Also, all are priced in already.

As such, the rise in long-term yields is the one thing that matters. It points to sharp economic recovery, and more easing will not deter but fuel it.